Buying from overseas—China in particular—has gradually become a normal habit for many international shoppers. Competitive pricing, wide product variety, and easier access to Chinese marketplaces have lowered the barrier to cross-border purchasing.

Yet once an order leaves the seller and enters the international shipping process, an important detail is often pushed aside:

Does adding shipping insurance really make sense for international deliveries, or is it something most buyers can ignore without consequences?

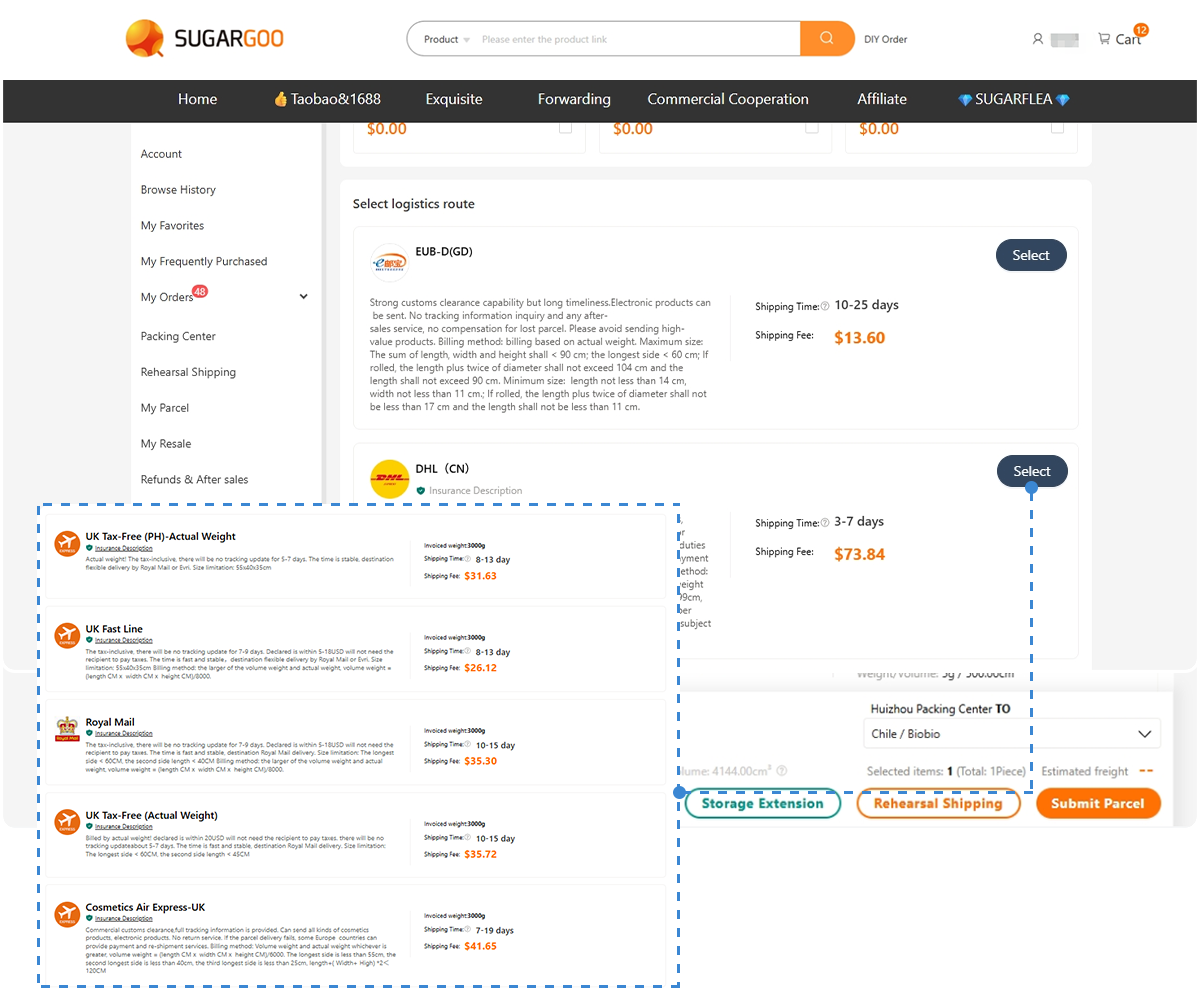

The reality is that there isn’t a single answer that applies to everyone. The value of shipping insurance depends largely on how cross-border logistics actually function and how much uncertainty a buyer is prepared to take on personally.

Why International Shipping Comes With Built-In Uncertainty

Unlike domestic delivery, international shipping is not handled by a single system. A typical cross-border parcel may pass through:

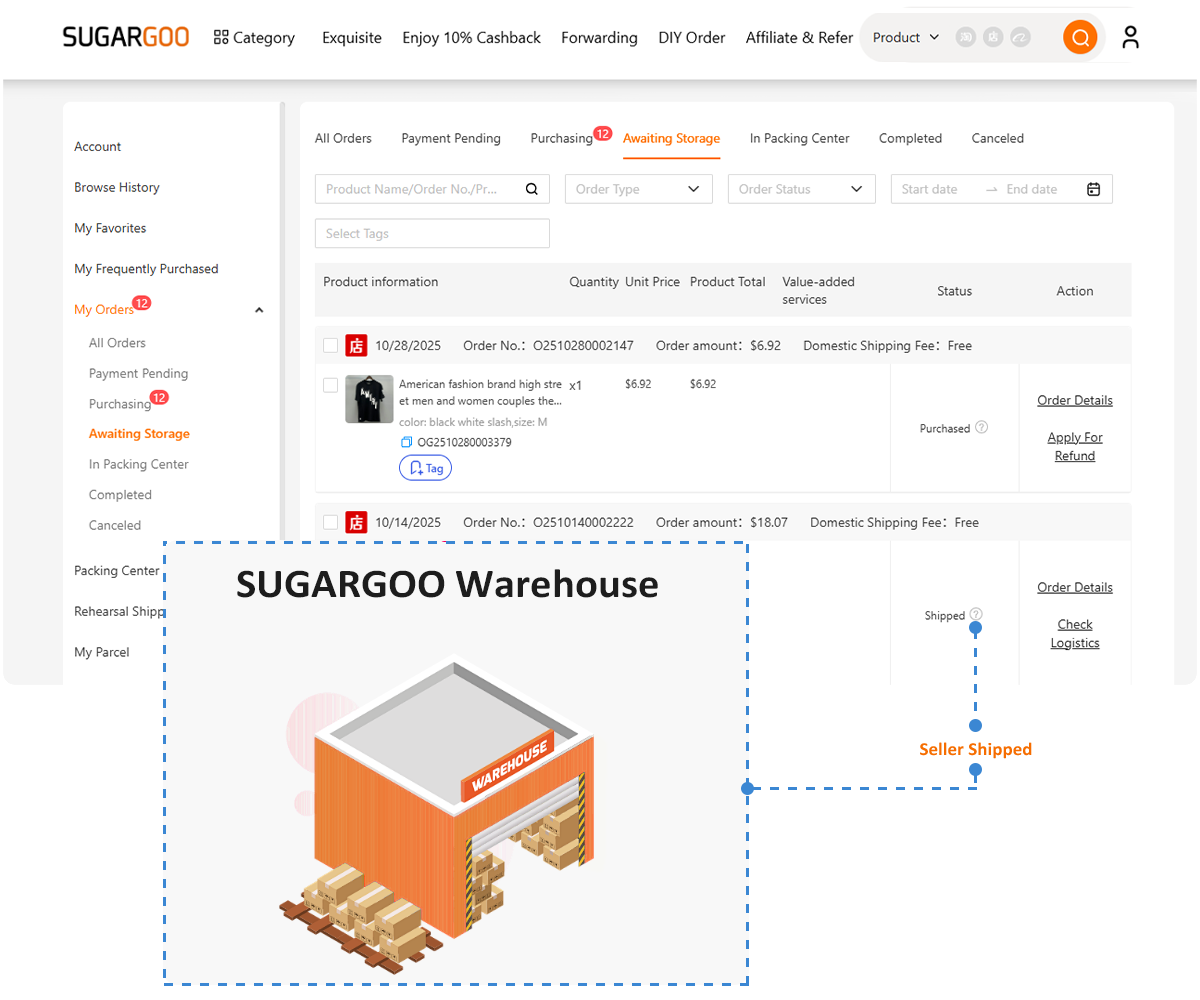

- A seller or warehouse inside China

- Domestic logistics and export processing

- International air or sea transport

- Customs clearance

- Local courier networks in the destination country

Each transfer increases uncertainty. Even when every party involved operates correctly, delays, damage, or misrouting can still happen due to congestion, inspections, or handling issues.

Shipping insurance exists because no buyer controls this entire chain.

What Shipping Insurance Is Designed to Protect

Many buyers assume insurance guarantees delivery. In reality, it serves a narrower purpose.

Insurance generally applies to:

- Parcels that are lost during transit

- Goods that arrive severely damaged

- Partial loss, depending on policy conditions

It usually does not apply to:

- Customs-related issues

- Restricted or prohibited items

- Incorrect declarations or addresses

- Minor cosmetic damage to packaging

In short, insurance does not remove risk—it limits how much of that risk the buyer must absorb financially.

When International Orders Carry Higher Risk

Some shipments are naturally more exposed to problems than others. Insurance tends to be more relevant when orders involve:

- Higher-value products

- Fragile or pressure-sensitive goods

- First-time shipping routes or unfamiliar logistics lines

- Purchases that would be expensive or difficult to replace

For low-cost items that are easy to reorder, skipping insurance may be reasonable. For larger or more complex orders, the equation changes quickly.

Risk Reduction Goes Beyond Insurance Alone

Insurance works best when the chance of problems is already minimized.

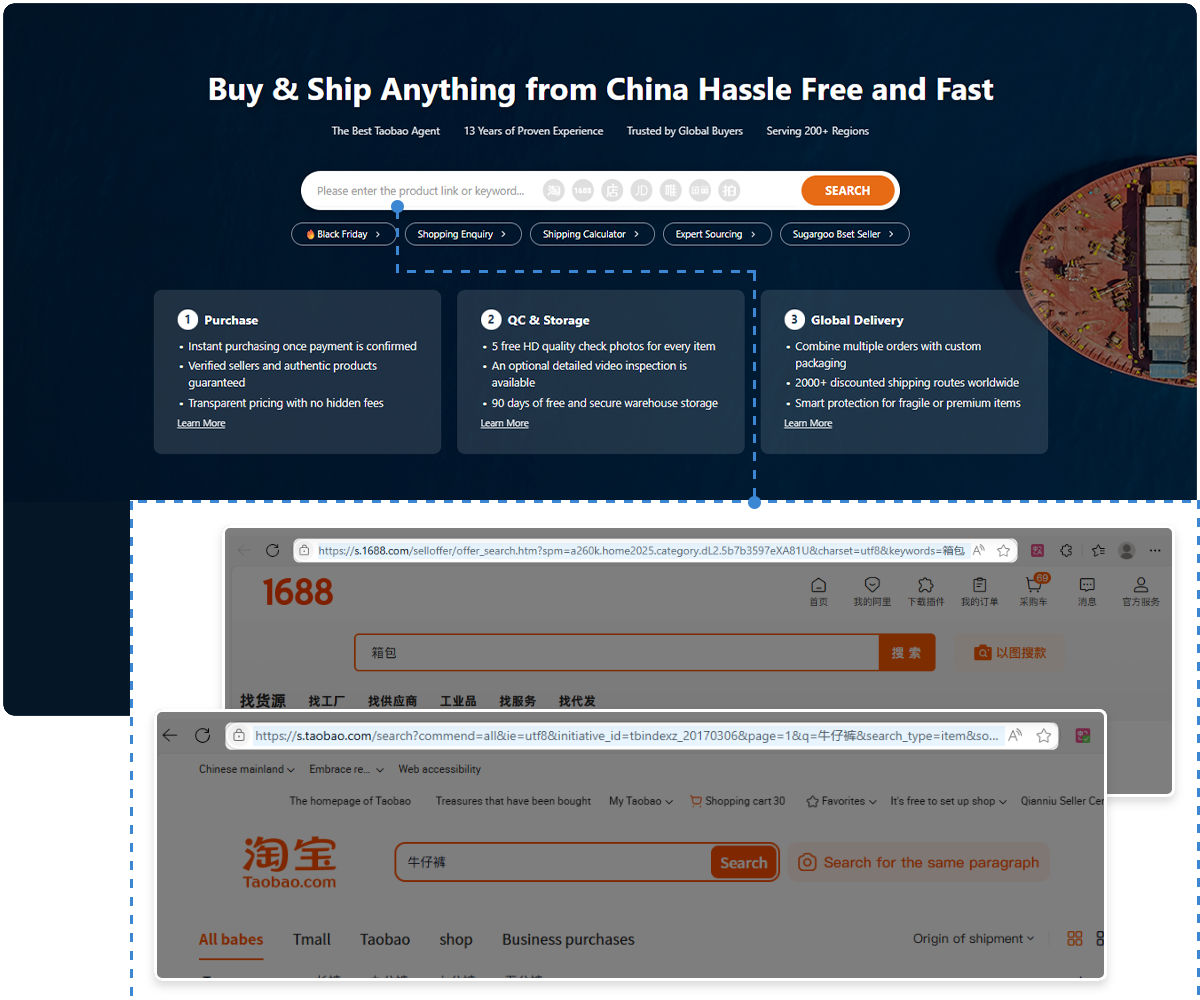

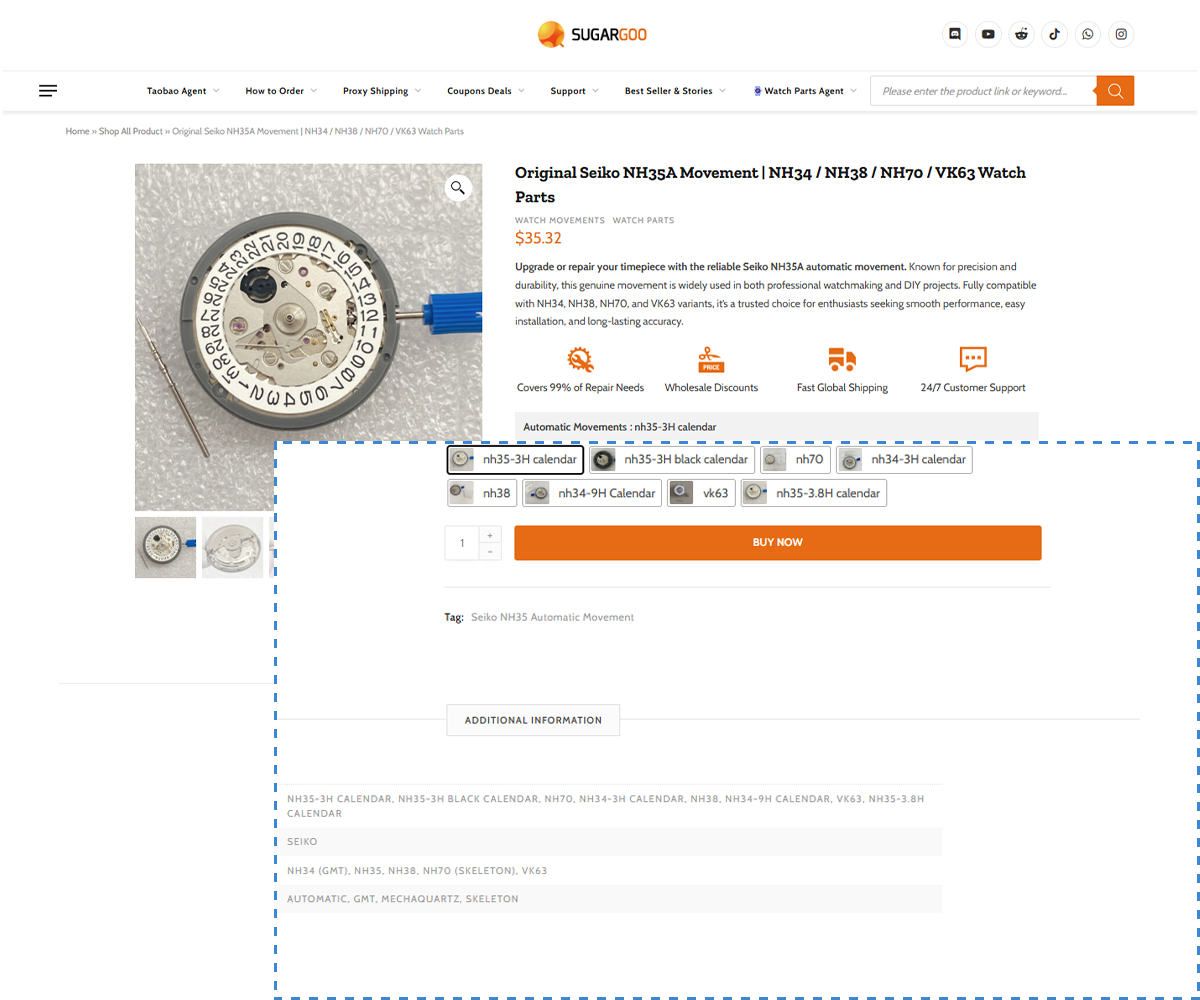

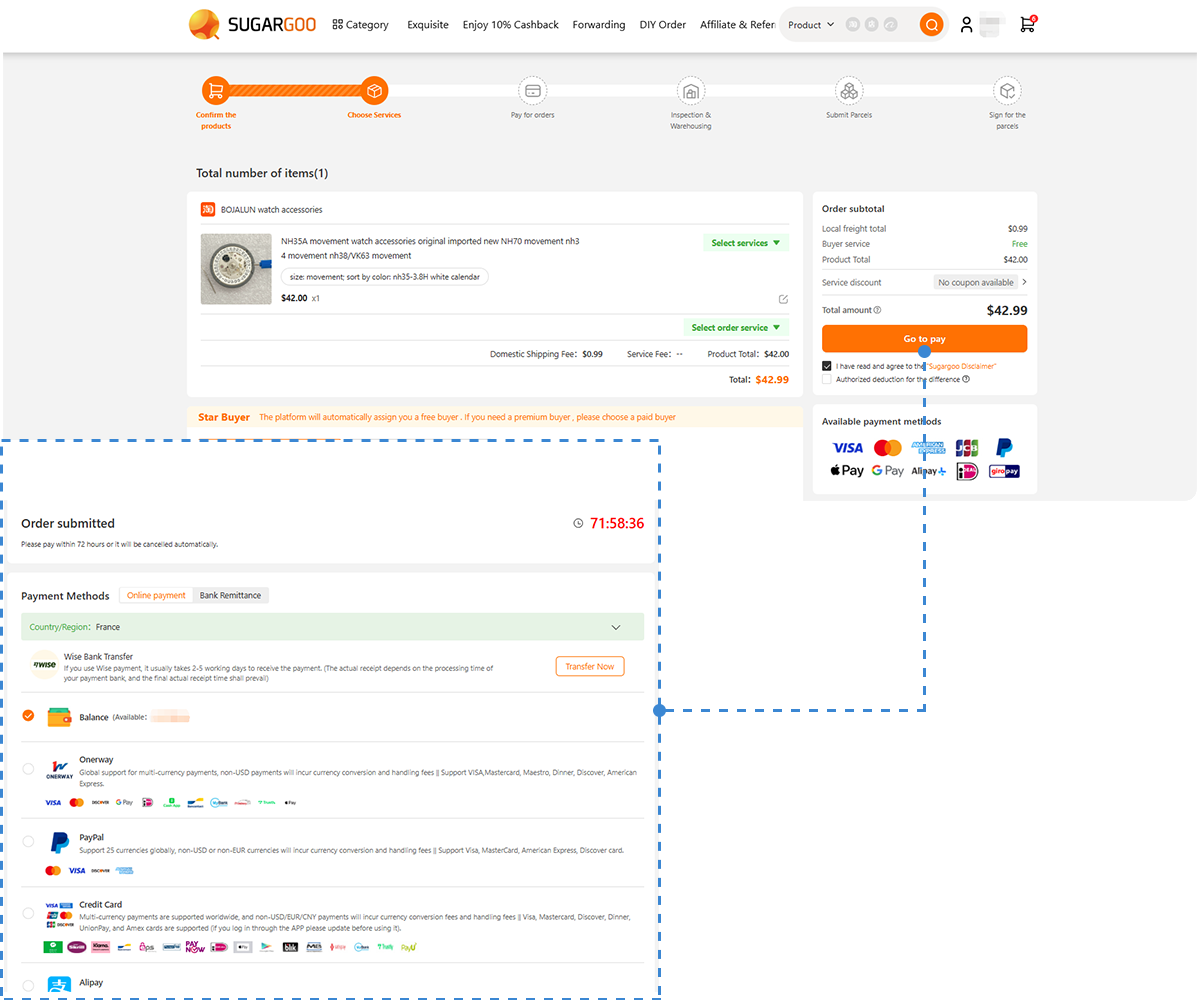

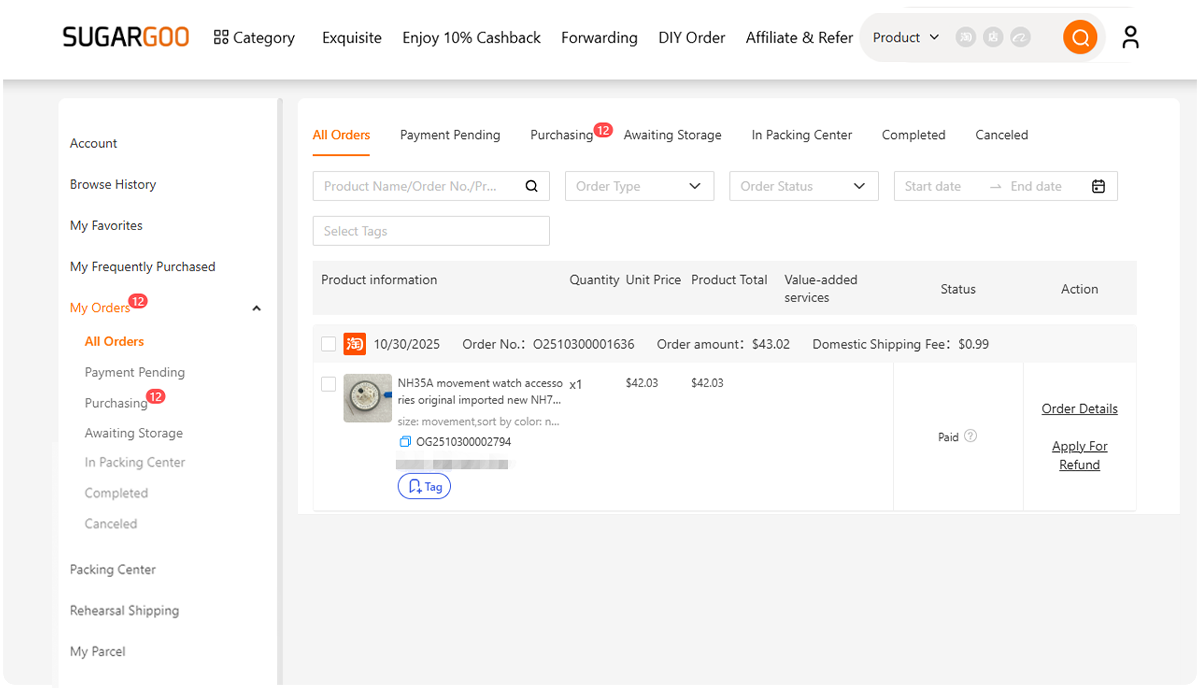

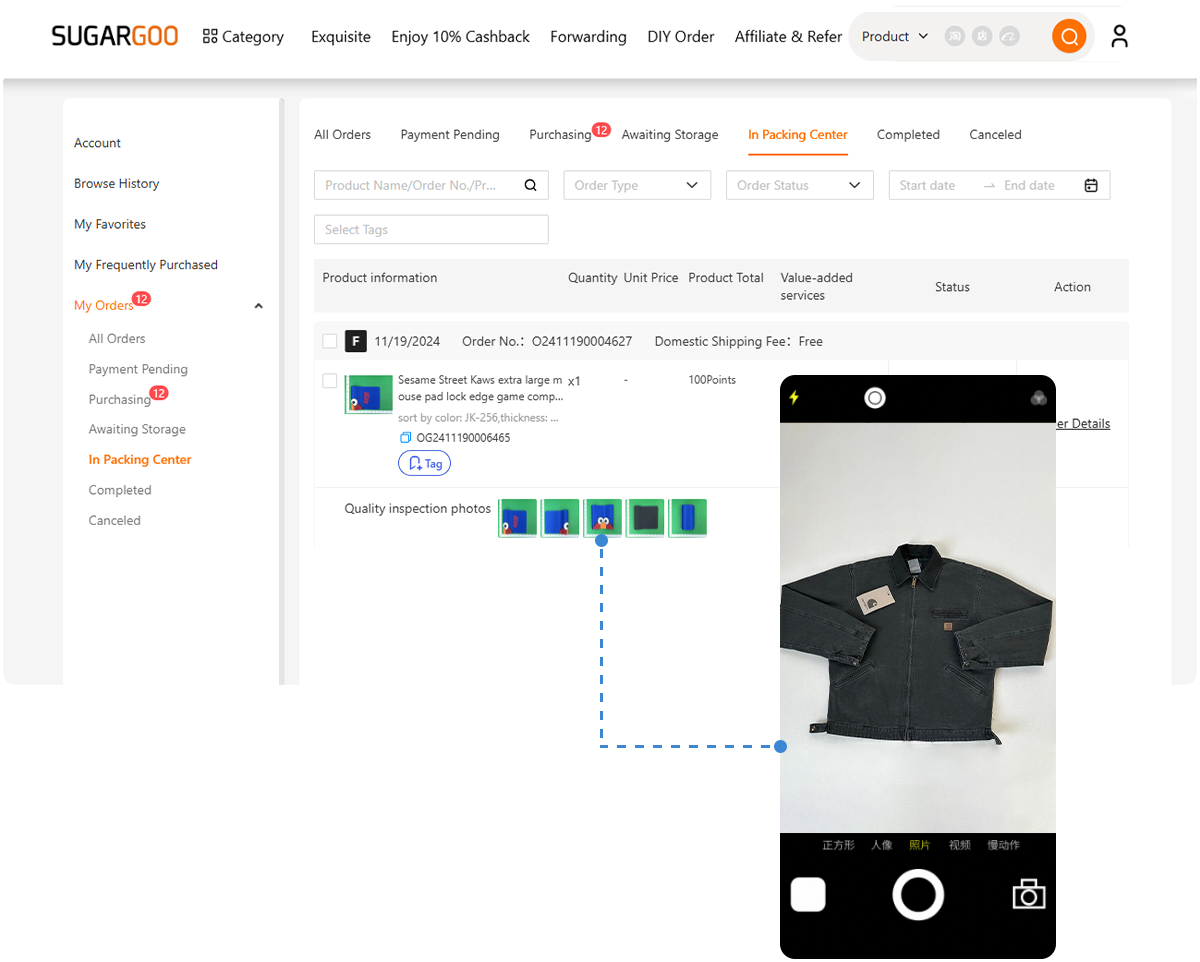

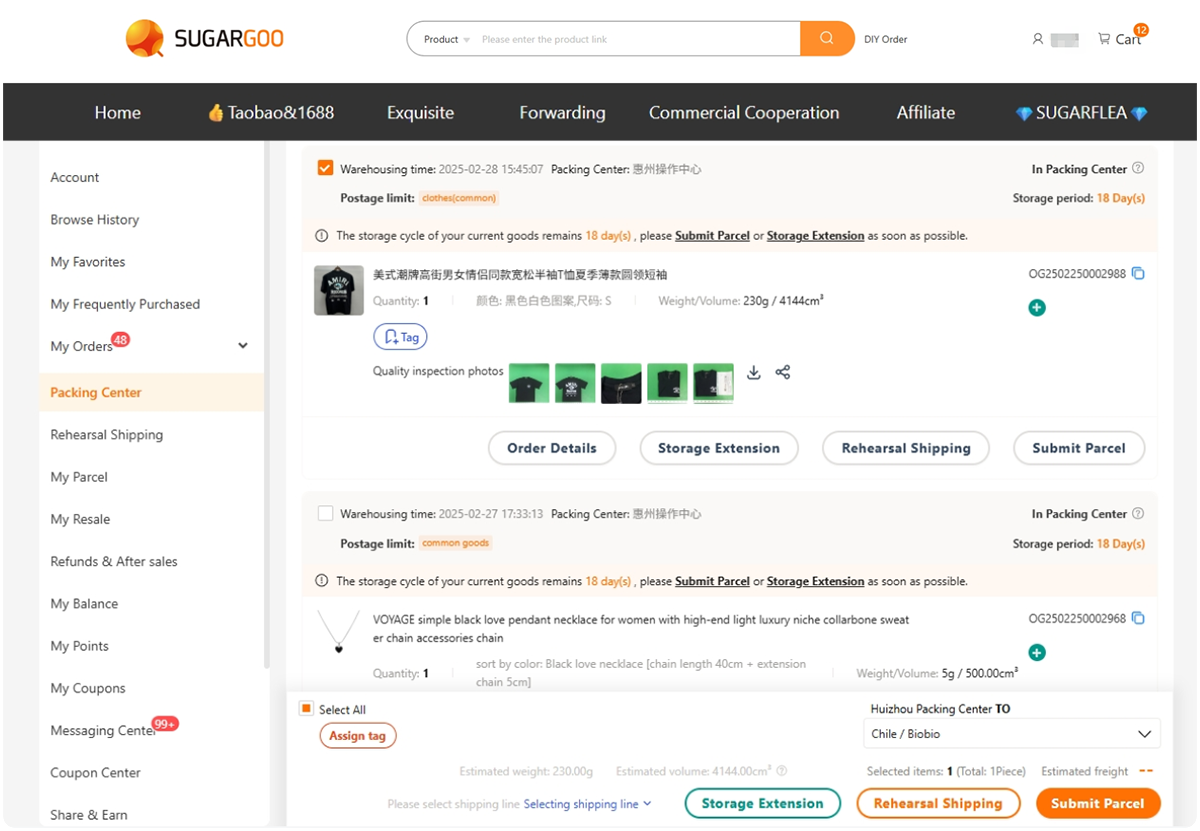

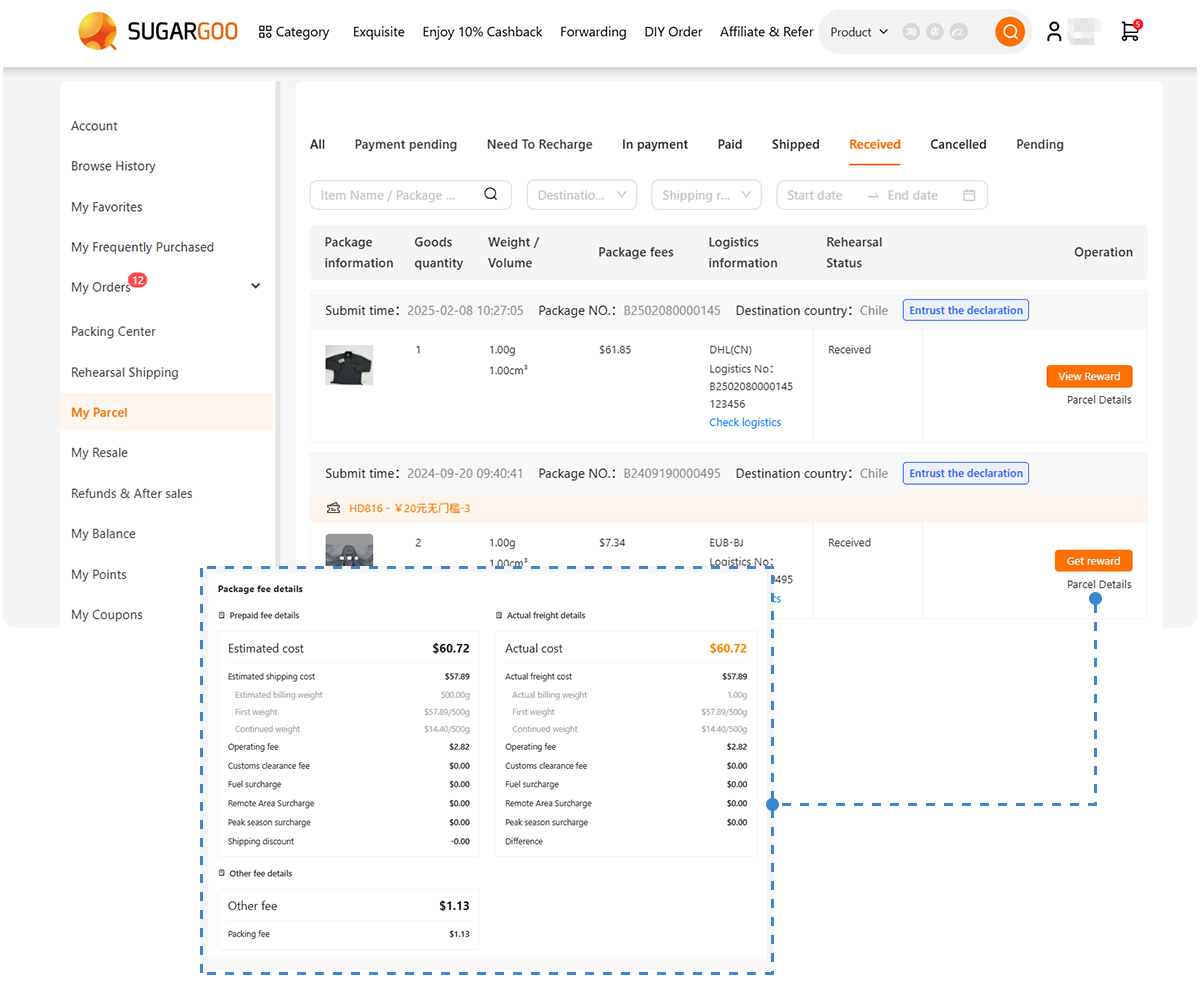

Buying agents like Sugargoo often provide preventive services such as:

- Warehouse inspection and product checks

- Photos taken before international shipment

- Repacking and reinforced packaging

- Shipment consolidation and route optimization

- Optional insurance selected based on parcel value

With Sugargoo, buyers can review items in advance and decide whether insurance makes sense on a case-by-case basis, rather than treating it as a default expense.

Situations Where Insurance May Not Be Necessary

There are cases where skipping insurance is a rational choice:

- The product value is very low

- Replacement would be quick and inexpensive

- The buyer is familiar with the shipping route

- Delivery time is not critical

The key difference between risk-taking and risk-management is awareness. Problems arise only when buyers underestimate what they might lose.

A Practical Way to Decide

Before checking out, consider:

- Would losing this parcel cause real inconvenience or financial loss?

- Is the shipment fragile?

- Is this a new logistics line for me?

If more than one answer is “yes,” insurance is usually worth serious consideration.

Insurance Is a Tool, Not a Requirement

So, do you really need shipping insurance for international orders?

Not always.

But seasoned international buyers understand that insurance is part of a broader risk strategy—not a mandatory purchase.

When combined with inspection services, flexible shipping options, and clear communication, insurance helps turn unpredictable international shipping into something more manageable. For buyers who source from China regularly, using a buying agent like Sugargoo, with optional insurance and value-added services, often results in fewer surprises and more control.

Ultimately, the smartest choice is not blindly adding insurance—or avoiding it—but knowing when the risk becomes yours alone and whether you are prepared for that outcome.