Importing products from China often looks straightforward at first. The product price is low, suppliers respond quickly, and shipping quotes seem reasonable. Yet for many buyers, the final cost turns out to be far higher than expected.

The reason is simple: most import costs are not visible upfront.

Hidden fees don’t usually come from a single source. They appear gradually, at different stages of shipping, customs clearance, and local delivery. By the time they show up, the buyer has little room to react.

This guide breaks down the most common hidden fees when importing from China—and, more importantly, how to reduce them before they happen.

Why the “Cheap China Price” Is Often Misleading

Chinese sellers typically quote ex-factory or domestic prices. Their responsibility often ends once the goods leave the warehouse or arrive at a local forwarder.

What’s missing from that initial price:

- International freight variables

- Customs duties and taxes

- Clearance and handling fees

- Last-mile delivery costs

- Risk-related losses (damage, delays, seizures)

These costs don’t appear because someone is dishonest. They appear because importing is a multi-stage process, and each stage has its own pricing rules.

Hidden Fee Category 1: Shipping Costs Beyond the Quoted Rate

Volumetric Weight Charges

Many buyers calculate shipping based on actual weight, only to be charged by volume instead. Lightweight but bulky items—such as shoes, bags, toys, or jackets—are especially vulnerable.

Fuel Surcharges and Peak Season Fees

Airlines and couriers adjust prices frequently. Fuel surcharges, holiday demand, and peak-season congestion can increase costs without advance notice.

Remote Area Surcharges

Even within the same country, certain postal codes trigger extra delivery fees. These charges are often applied after the parcel arrives.

Key takeaway: shipping is not a fixed price—it’s a moving calculation.

Hidden Fee Category 2: Customs, Duties, and Clearance Costs

Import Duties and VAT/GST

Taxes depend on:

- Product category

- Declared value

- Destination country regulations

Clearance and Brokerage Fees

Commercial couriers frequently charge:

- Customs processing fees

- Advance tax payment service fees

- Documentation handling fees

These are rarely included in the initial shipping quote.

Customs Inspections and Delays

Random inspections can result in:

- Storage charges

- Additional paperwork fees

- Delivery delays that increase downstream costs

Hidden Fee Category 3: Last-Mile and Local Delivery Charges

Once the shipment enters the destination country, new costs may appear:

- Residential delivery surcharges

- Oversize or overweight handling fees

- Re-delivery charges due to address issues

- Temporary storage fees if customs clearance is delayed

These costs are often invisible until the parcel is already in transit.

Hidden Fee Category 4: Packaging, Compliance, and Preparation

Repacking and Reinforcement

Domestic packaging in China is often not designed for international transport. Fragile, liquid, or electronic items may require:

- Reinforced cartons

- Protective materials

- Repacking fees

The Most Overlooked Cost: Risk

Some costs don’t appear as line items—but they still affect profitability.

- Lost or damaged parcels

- Returns or seizures due to incorrect declarations

- Missed selling seasons due to delays

Uncertainty itself becomes a cost when buyers cannot predict outcomes.

How to Reduce Hidden Fees Before You Import

Hidden fees are not random. They are predictable once you understand the full logistics chain.

Instead of focusing on the lowest product price or a single shipping quote, experienced buyers take a different approach.

Think in “Total Delivered Cost”

Evaluate the entire journey:

- Product price

- Domestic shipping in China

- International freight

- Taxes and clearance

- Final delivery

This prevents surprises after payment.

Consolidate Shipments

Shipping multiple small parcels separately increases:

- Repeated clearance fees

- Multiple minimum charges

- Higher per-unit shipping costs

Combining items into one shipment often reduces total cost significantly.

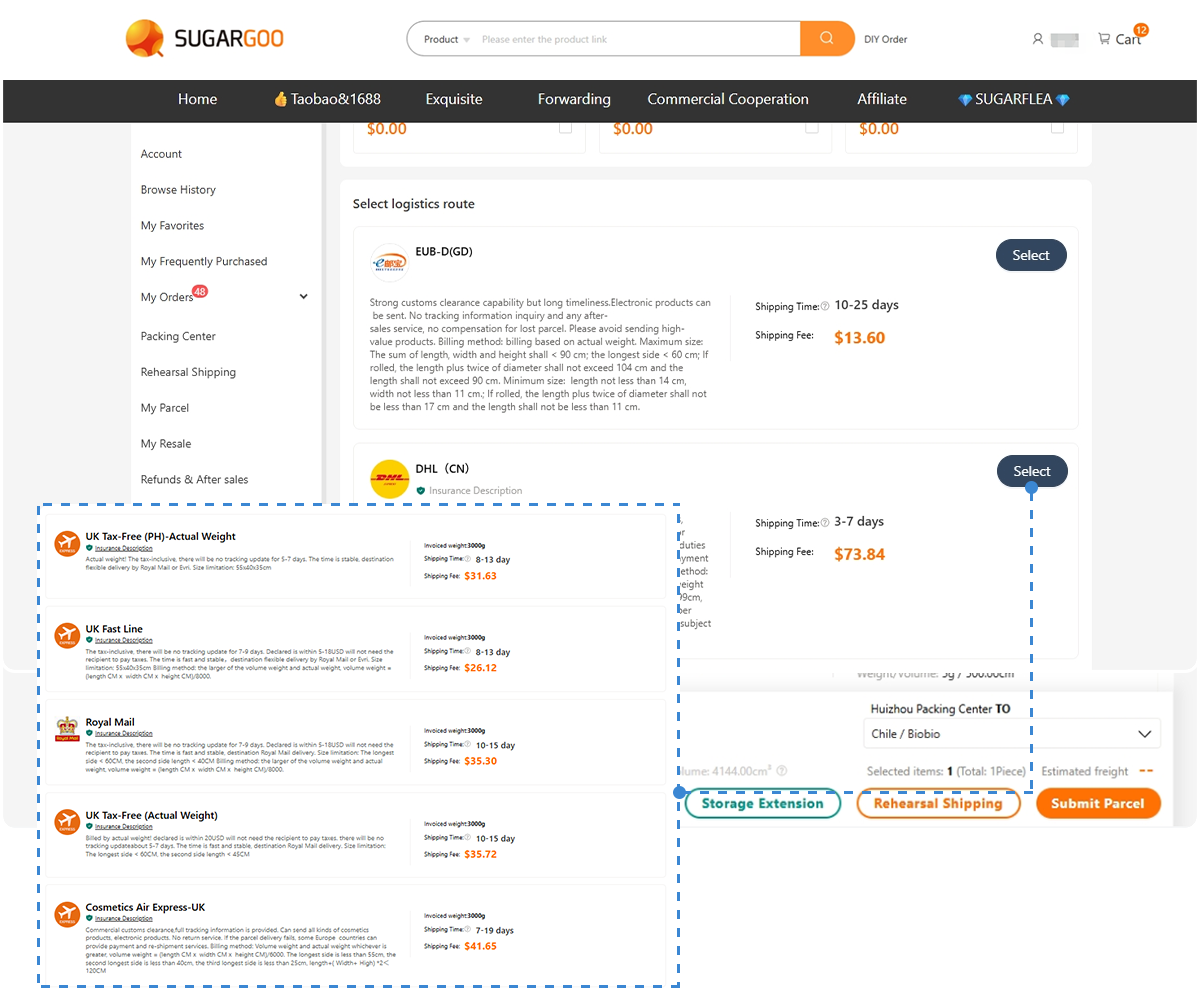

Match Shipping Methods to Product Type

Speed, volume weight, destination, and tax structure all matter more than headline price.

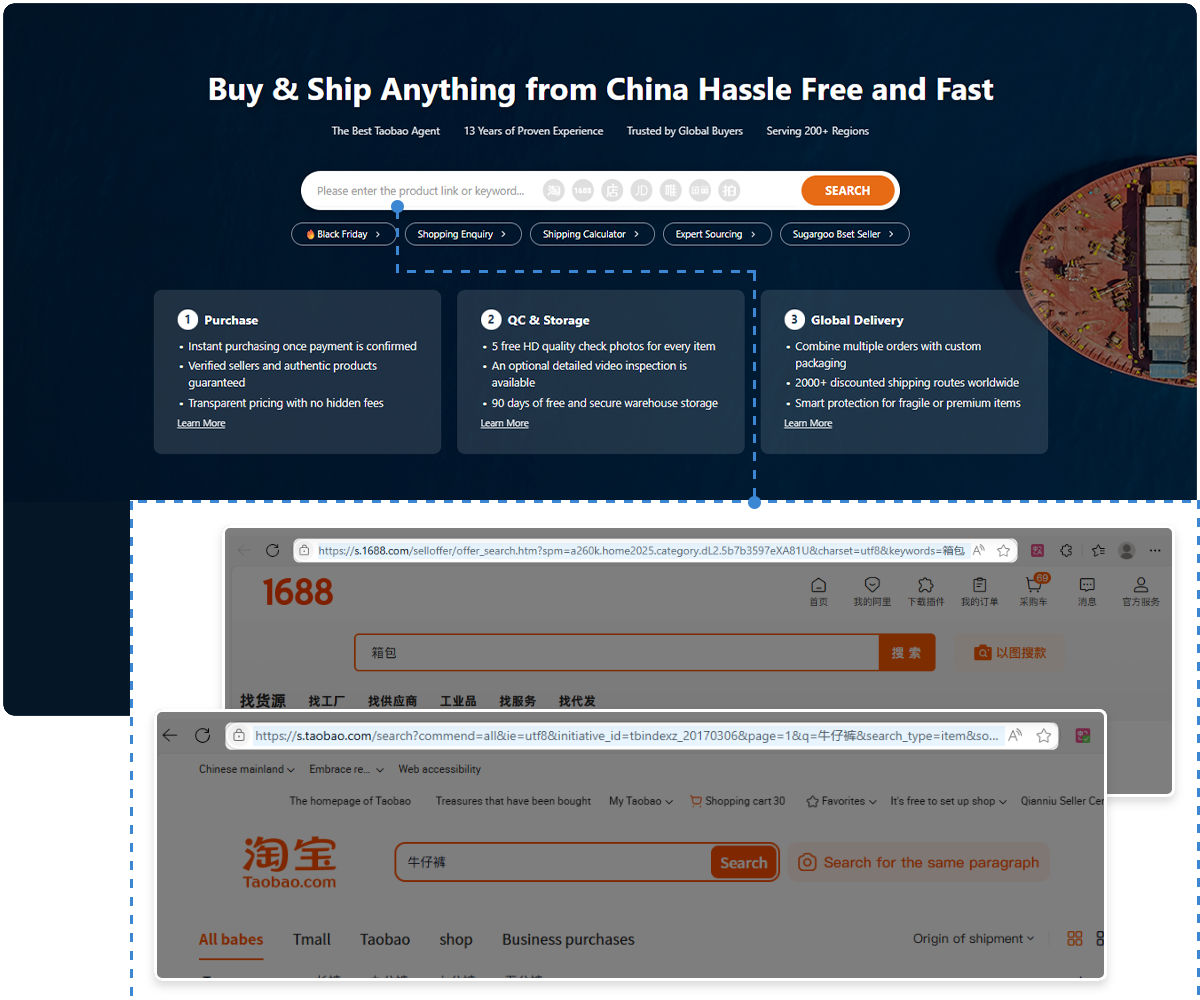

Use Buying Agent That Calculate the Final Price for You

This is where many overseas buyers regain control.

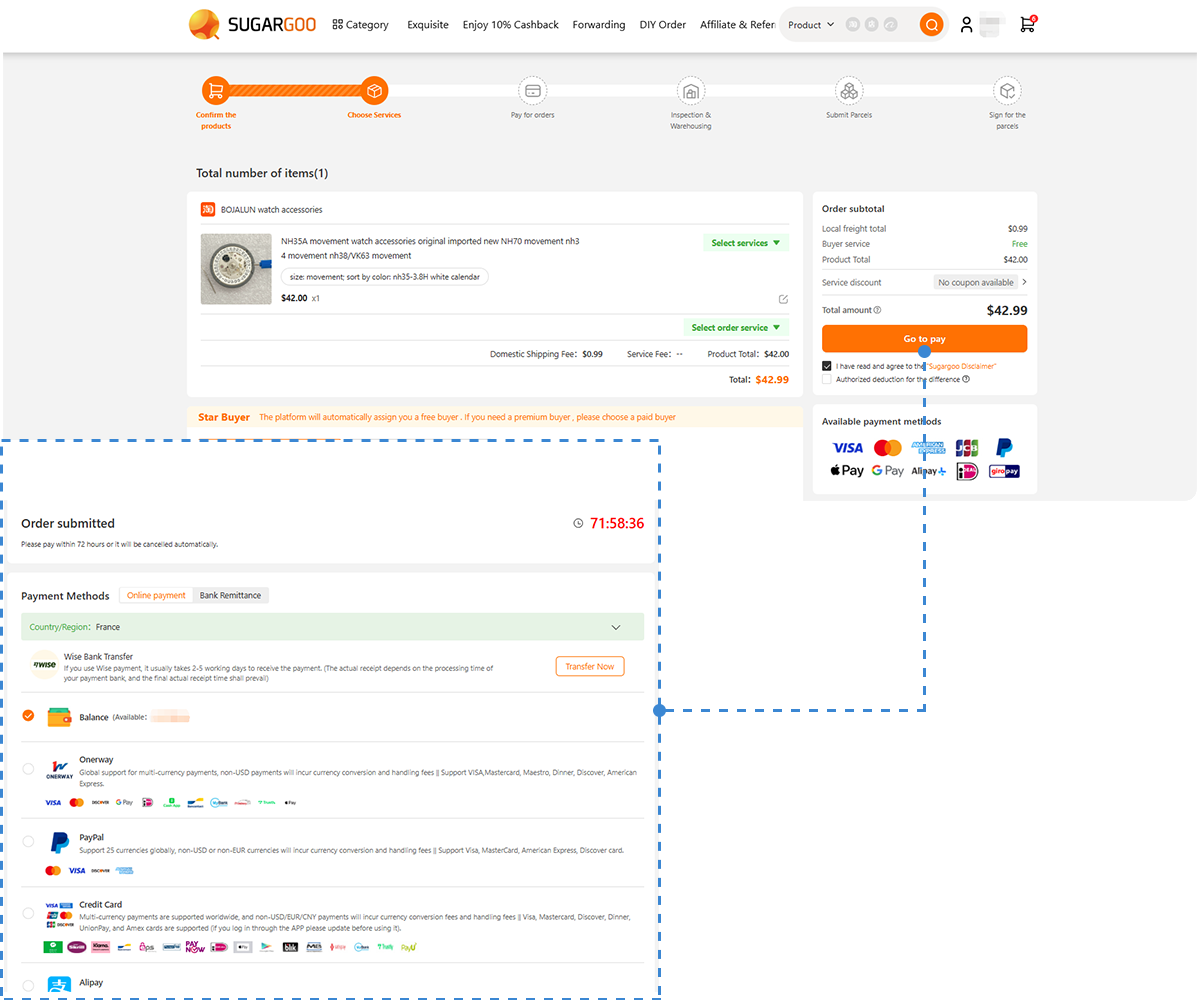

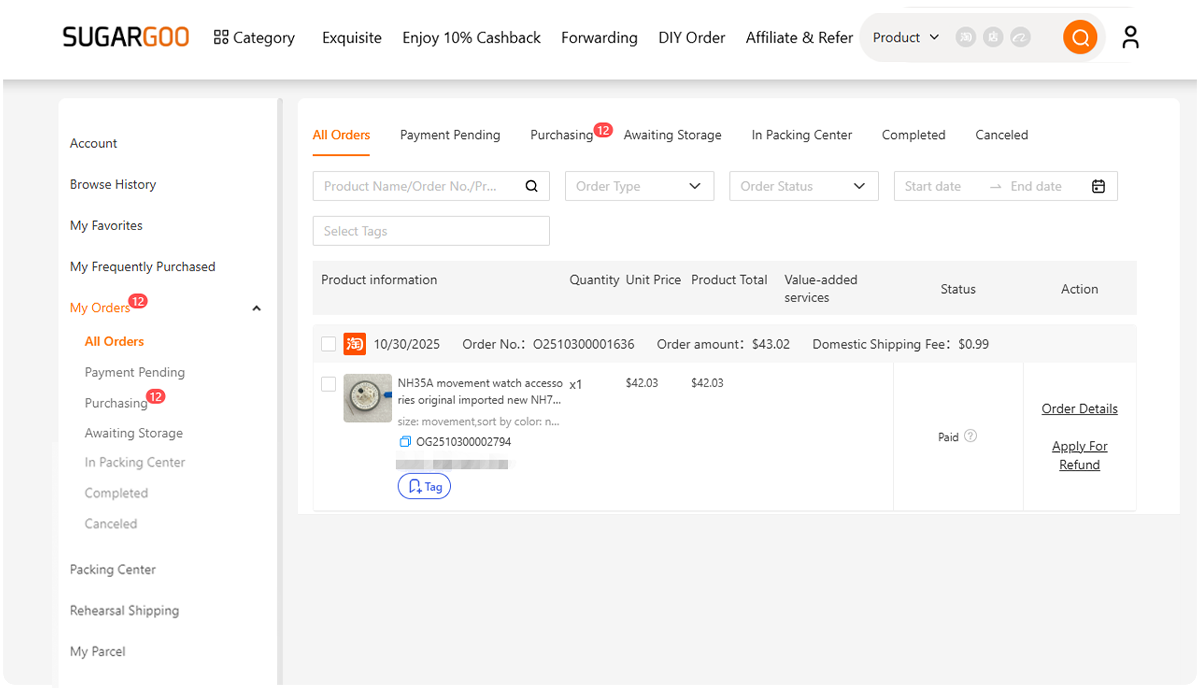

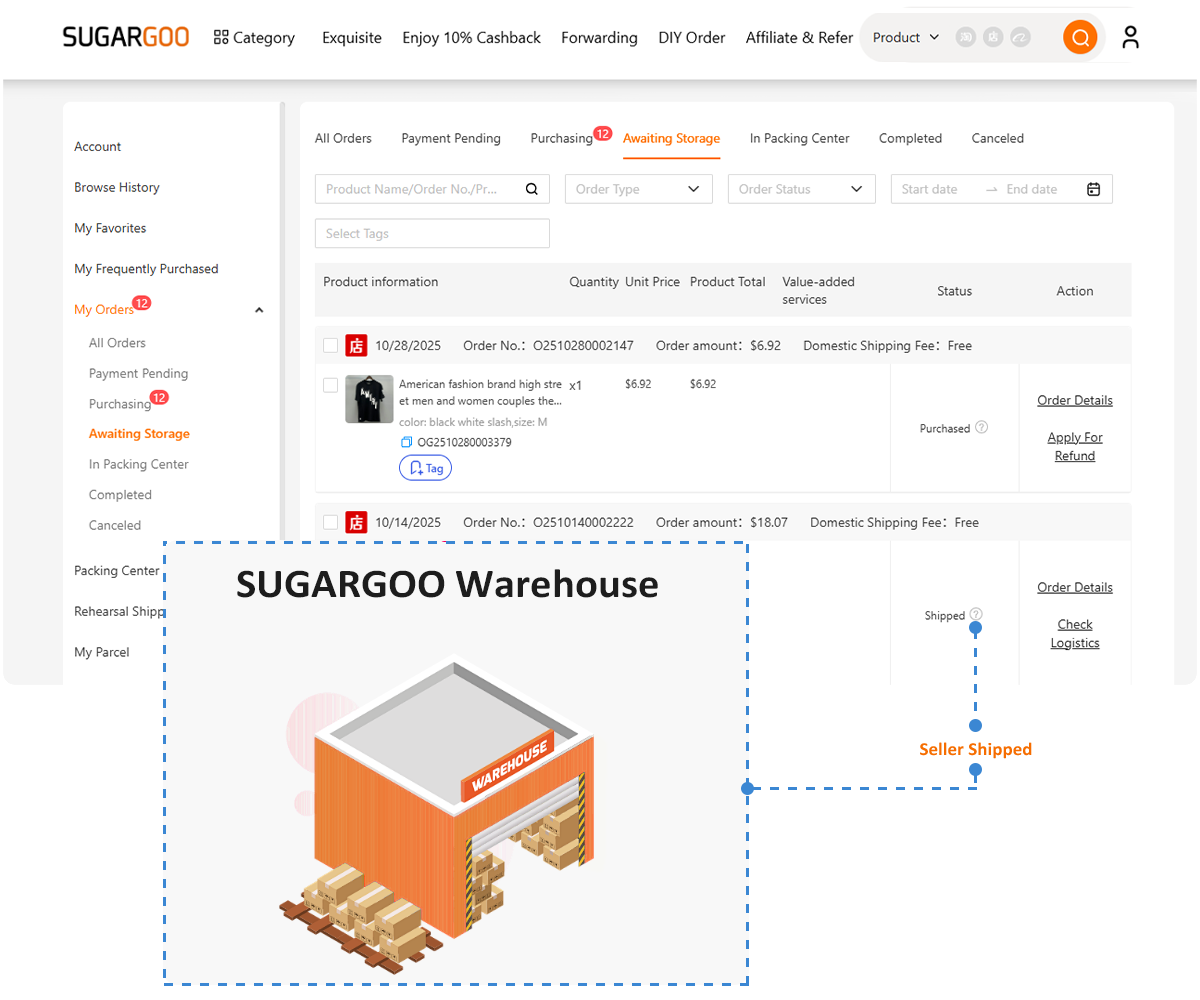

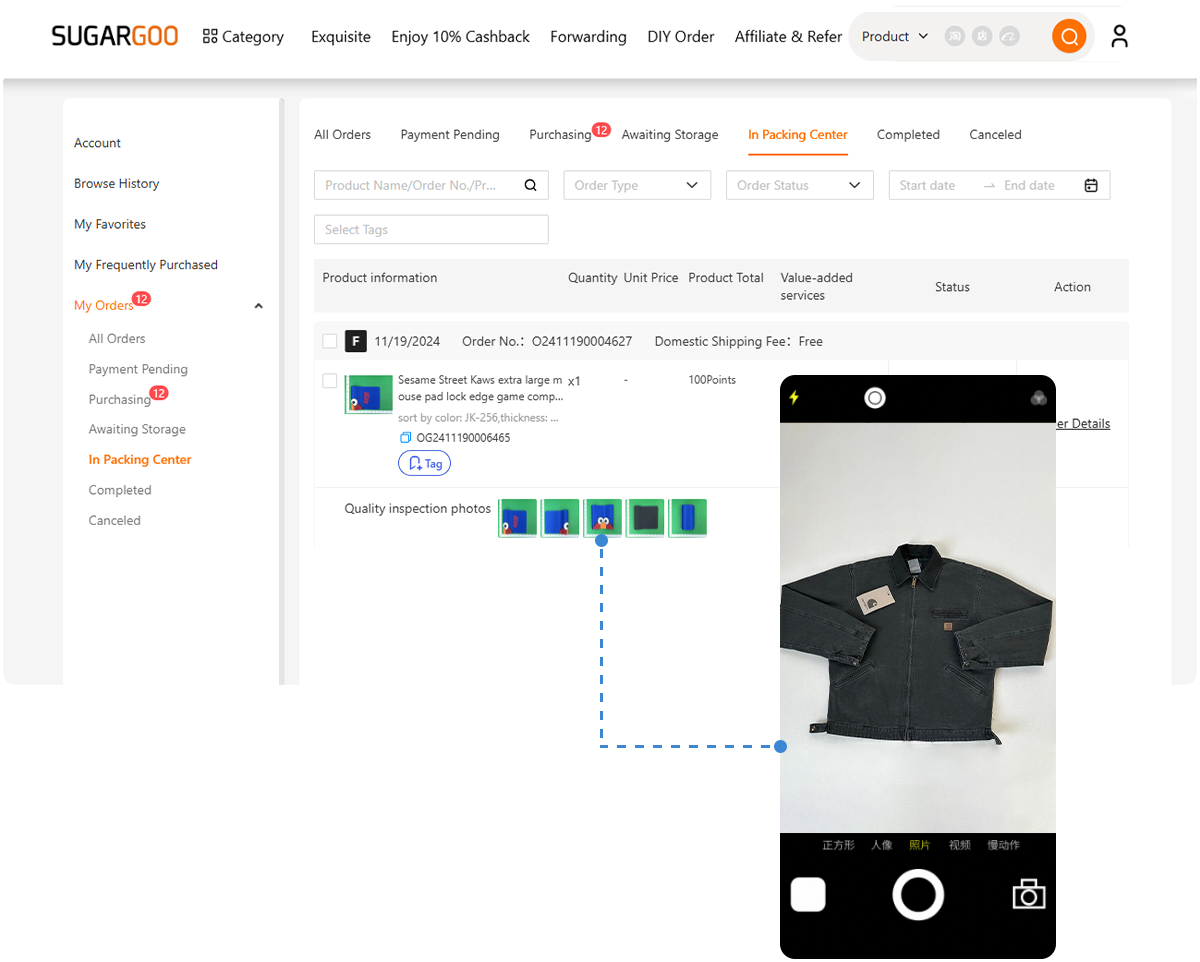

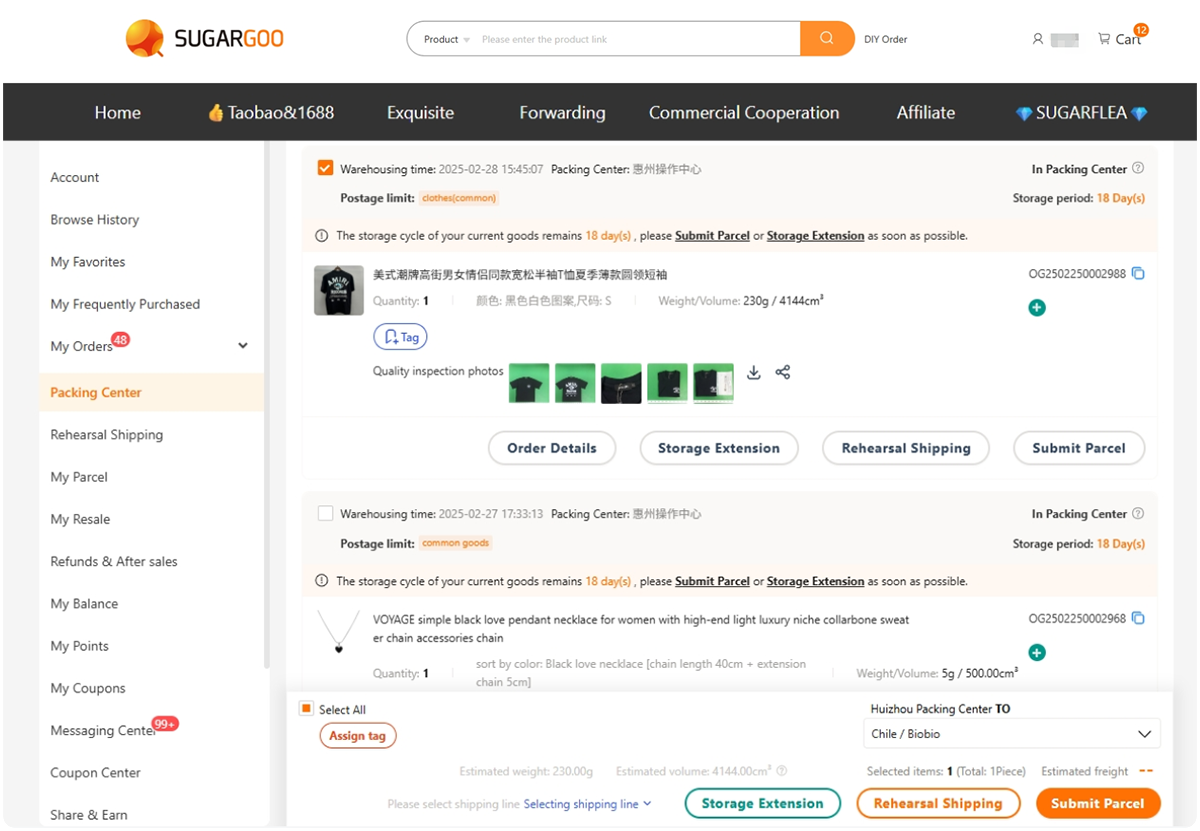

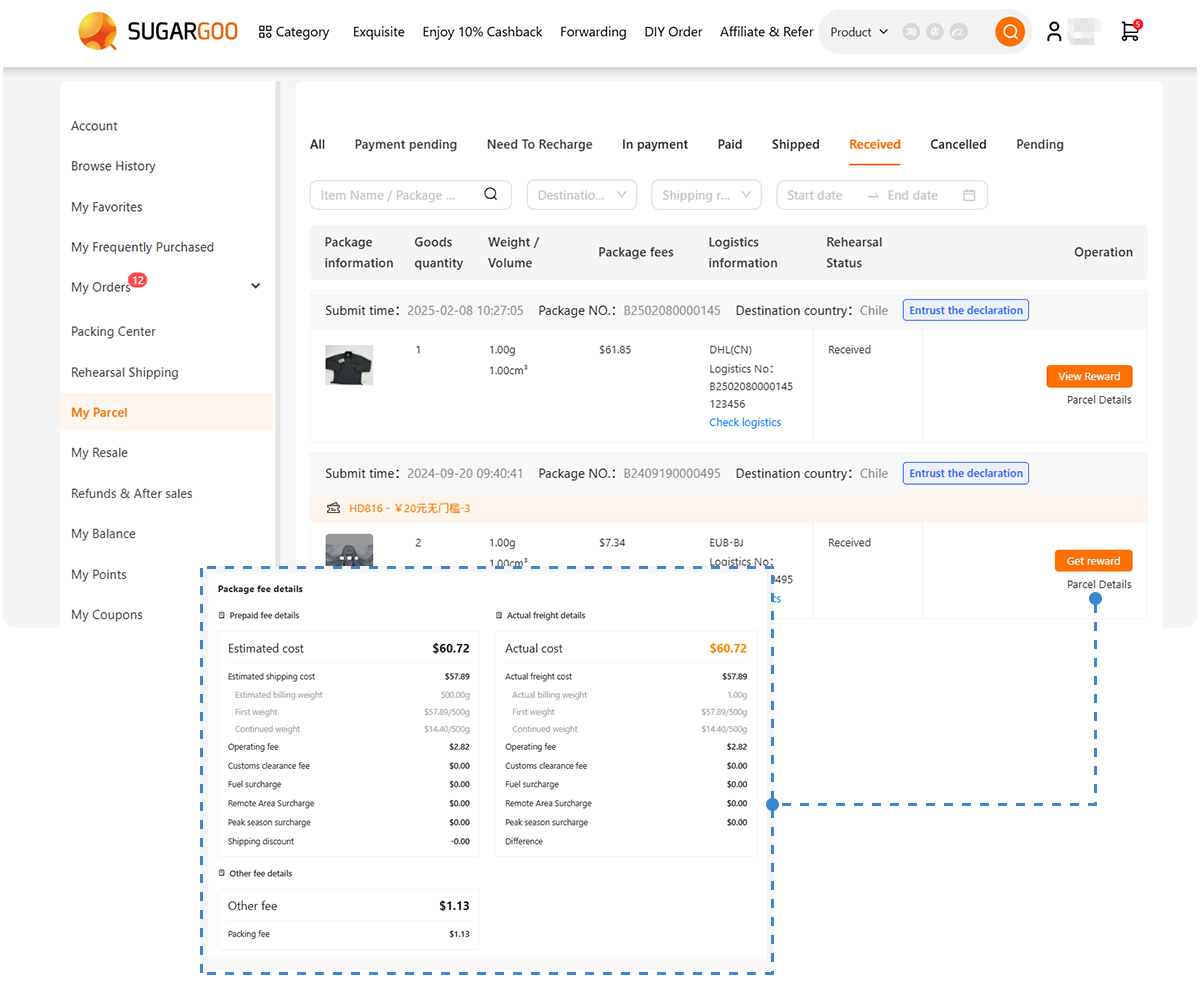

When you purchase from Chinese marketplaces, your items can first be sent to a proxy warehouse. There, the platform:

- Receives and inspects the goods

- Stores items from multiple sellers

- Consolidates them into one parcel

- Calculates one all-in shipping price to your country

Instead of guessing fees step by step, you see a clear total cost upfront—for example, the final price of a tax-free shipping line after consolidation.

At that point, the buyer simply compares available routes, pays the selected price, and waits for delivery at home.

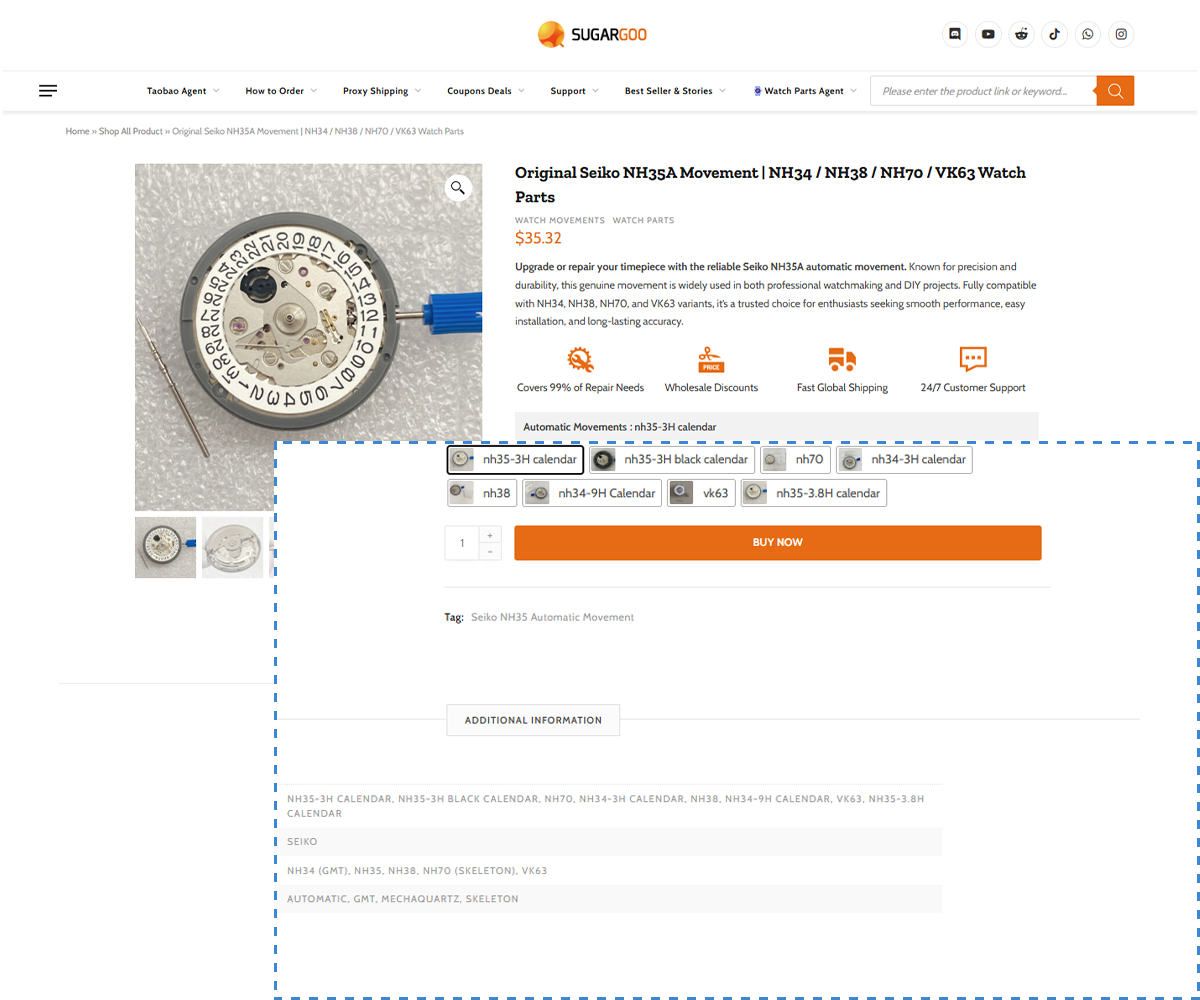

Platforms such as Sugargoo offer this type of service, combining warehousing, quality checks, package consolidation, multiple shipping lines, and optionalinsurance into a single workflow. The result is fewer unknowns and far less post-payment friction.

Hidden Fees Are a Knowledge Problem

Hidden fees when importing from China are rarely traps. They are usually the result of fragmented information and early decisions made without full cost visibility.

Once buyers shift their mindset—from chasing the lowest price to managing the entire delivery process—most “surprises” disappear.

Importing doesn’t become cheaper by accident.

It becomes cheaper when costs are understood, calculated, and controlled from the start.