Sourcing products from China often means better margins, more variety, and access to manufacturers that are difficult to reach elsewhere. However, the moment a shipment is dispatched, buyers step into a system they no longer fully control. International parcels move through layered logistics networks, border inspections, and routing decisions that are largely invisible to the end customer—and each stage carries its own risk.

Because of this, overseas buyers are less concerned with whether problems might happen, and more focused on what happens if they do. That concern naturally raises a practical consideration: does paying for shipping insurance actually provide real value, or is it an optional add-on that most orders can do without?

Rather than approaching the topic from a theoretical standpoint, this article looks at shipping insurance through the lens of real China-based orders—examining how it functions in practice, when it meaningfully reduces risk, and how experienced international buyers decide whether insurance belongs in their shipping strategy.

What Shipping Insurance Really Covers (and What It Doesn’t)

Shipping insurance is not a guarantee that nothing will go wrong. Instead, it is a financial safety net designed to compensate you if a shipment encounters specific problems during transit.

In most cases, the process looks like this:

- You declare the shipment’s value, usually including product cost and shipping fees

- An insurance fee is charged as a percentage of that value

- If a covered issue occurs, you submit proof and receive compensation under the policy terms

Insurance is most commonly used to protect against:

- Parcels that disappear during international transit

- Damage caused by handling or transportation

- Partial loss when items are missing from a consolidated package

- Customs-related losses, depending on policy conditions

Rather than preventing delays or inspections, insurance helps ensure that a bad outcome does not automatically become a financial loss.

When Shipping Insurance Makes Sense for China Orders

Not every shipment requires insurance. Experienced buyers decide based on exposure, not habit.

Scenarios Where Insurance Is Usually Worth It

- Orders with high total value, even if individual items are inexpensive

- Consolidated parcels where multiple products are shipped together

- Goods that are fragile, collectible, or difficult to replace

- Destinations known for stricter or less predictable customs clearance

- Shipments tied to resale, deadlines, or planned use

In these situations, paying a small percentage of the shipment value often provides more benefit than cost.

Situations Where Insurance May Be Optional

- Single-item, low-value purchases

- Orders where loss would be inconvenient but manageable

- Test purchases or samples

A useful rule is to think in reverse: If this package never arrives, would you regret not insuring it? If the answer is yes, insurance is probably justified.

Why Orders from China Carry Higher Transit Risk

International shipping is rarely straightforward, but China-based orders add additional complexity.

Typical China export shipments involve:

- Longer transit routes and more handling points

- Multiple logistics providers working on the same parcel

- Customs procedures that differ widely between countries

- Communication gaps between overseas buyers and domestic sellers

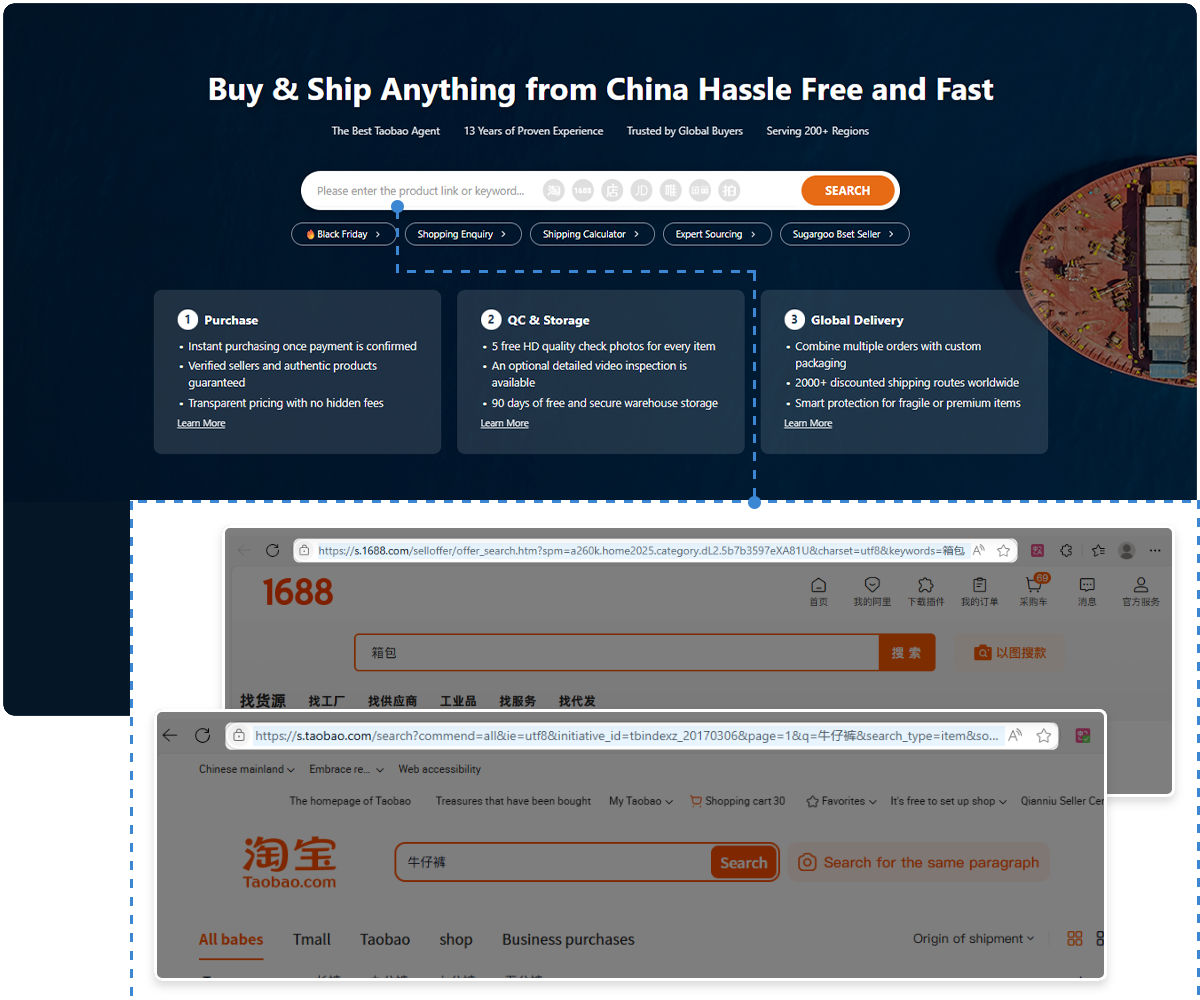

International buyers often face challenges with payments, shipping setup, and after-sales support.

As a result, many overseas shoppers rely on buying agents to manage these steps—while still recognizing that transit risk cannot be eliminated entirely.

Where Buying Agents Help — and Why Insurance Still Matters

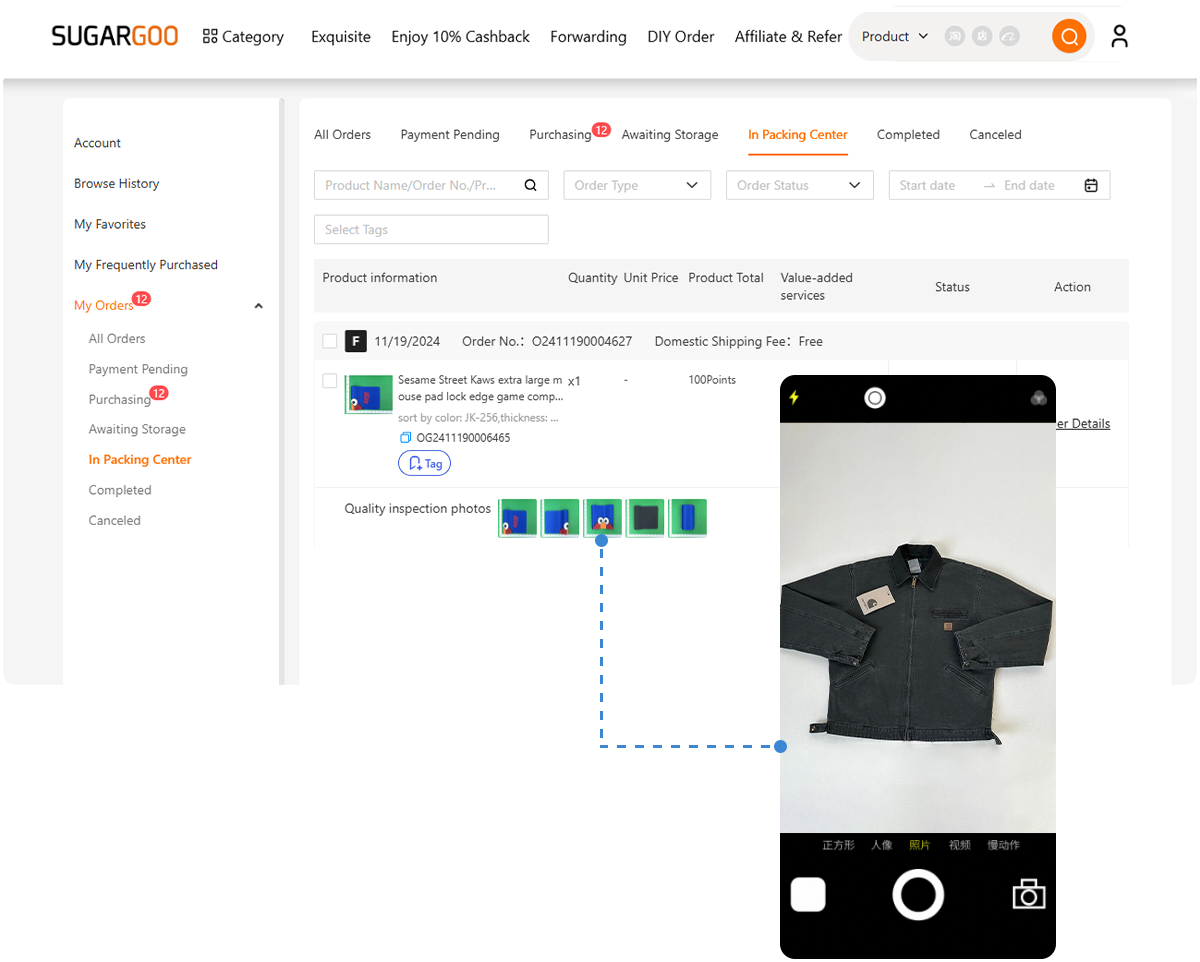

Buying agents reduce risk before shipping by handling seller communication, inspections, and logistics preparation. They help ensure that the correct items are shipped in acceptable condition.

However, once a parcel enters international transit, risk shifts to external factors: carriers, customs authorities, weather, and routing decisions. Insurance becomes relevant at this stage—not as a replacement for good logistics, but as a fallback when logistics fail.

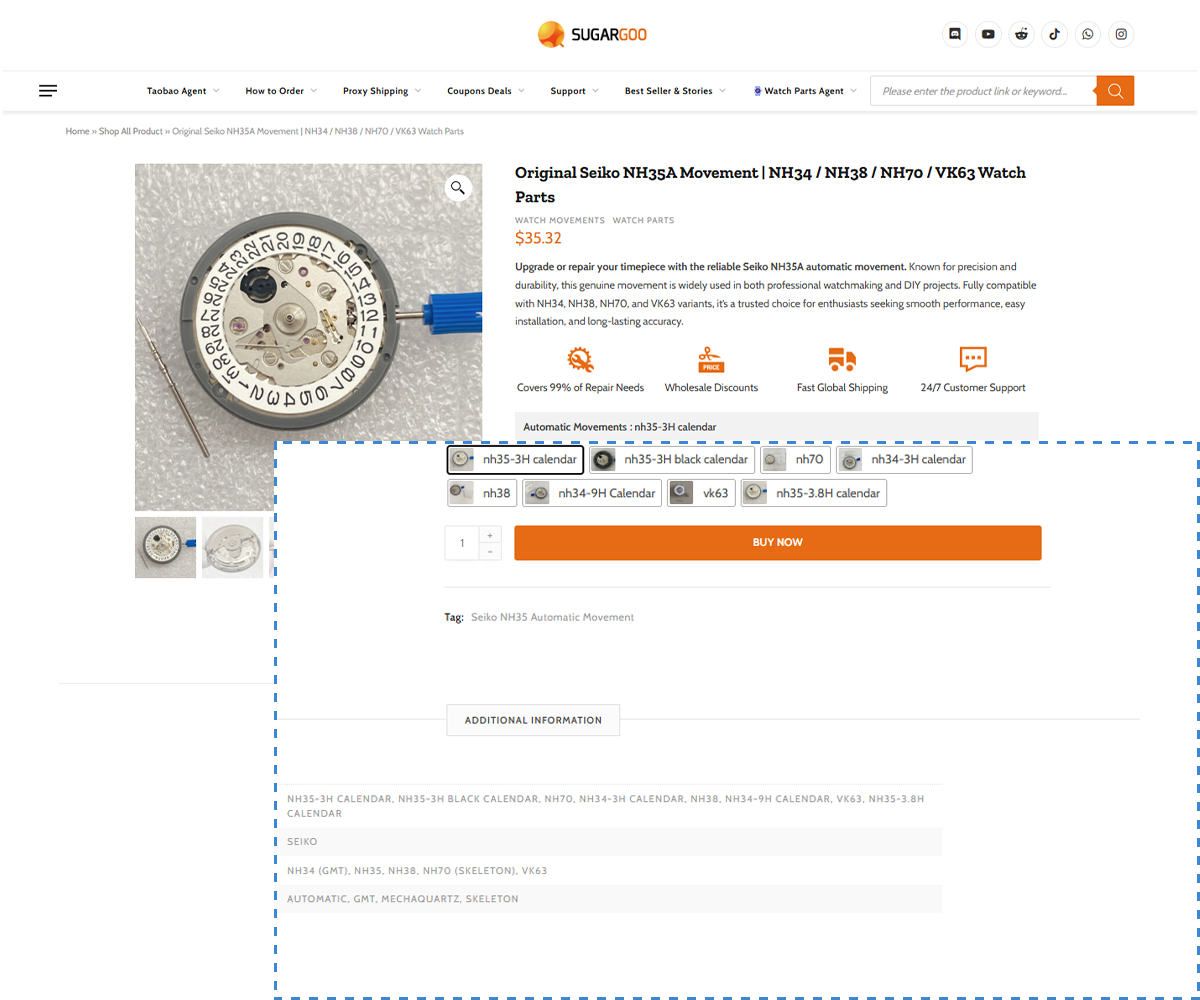

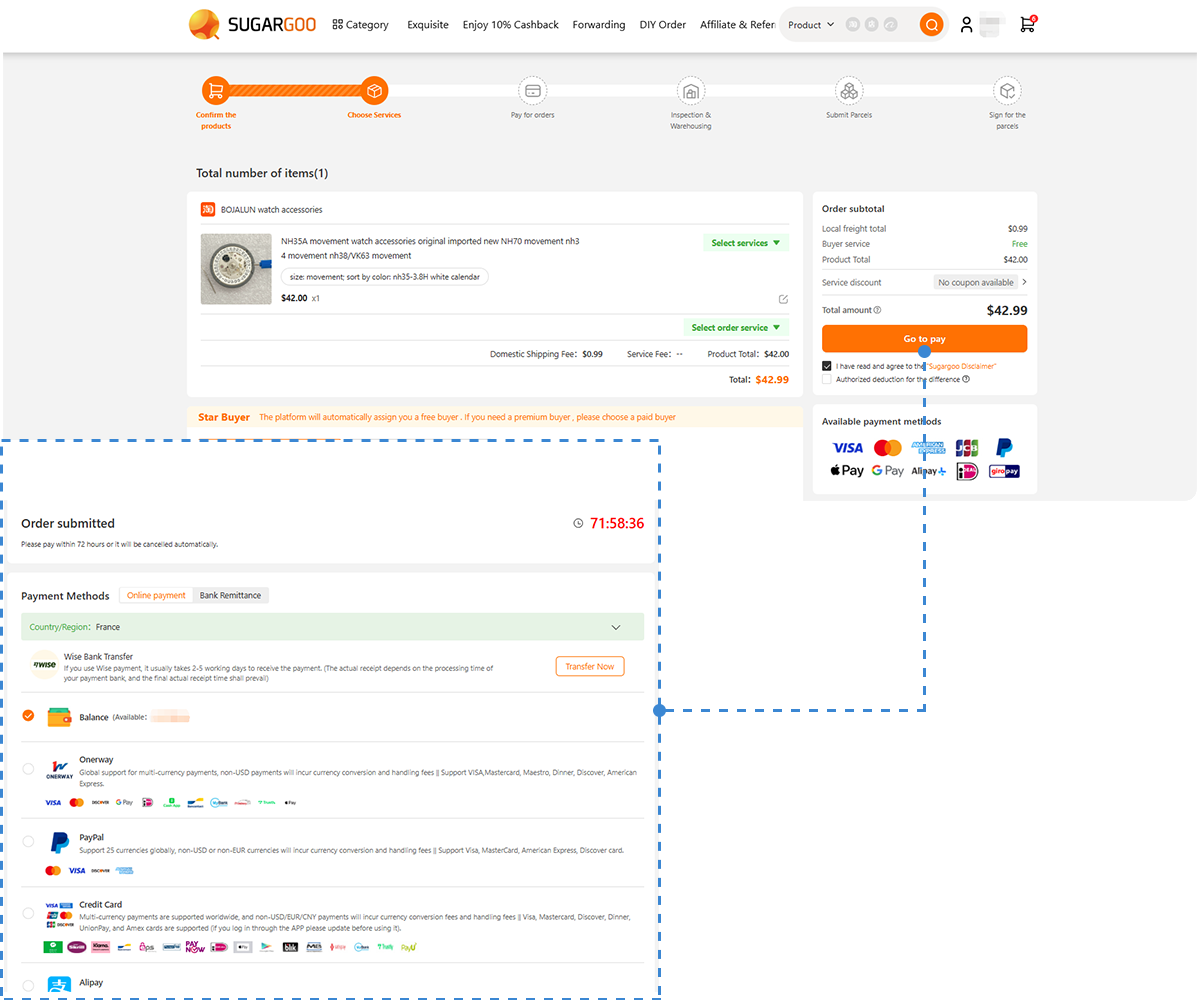

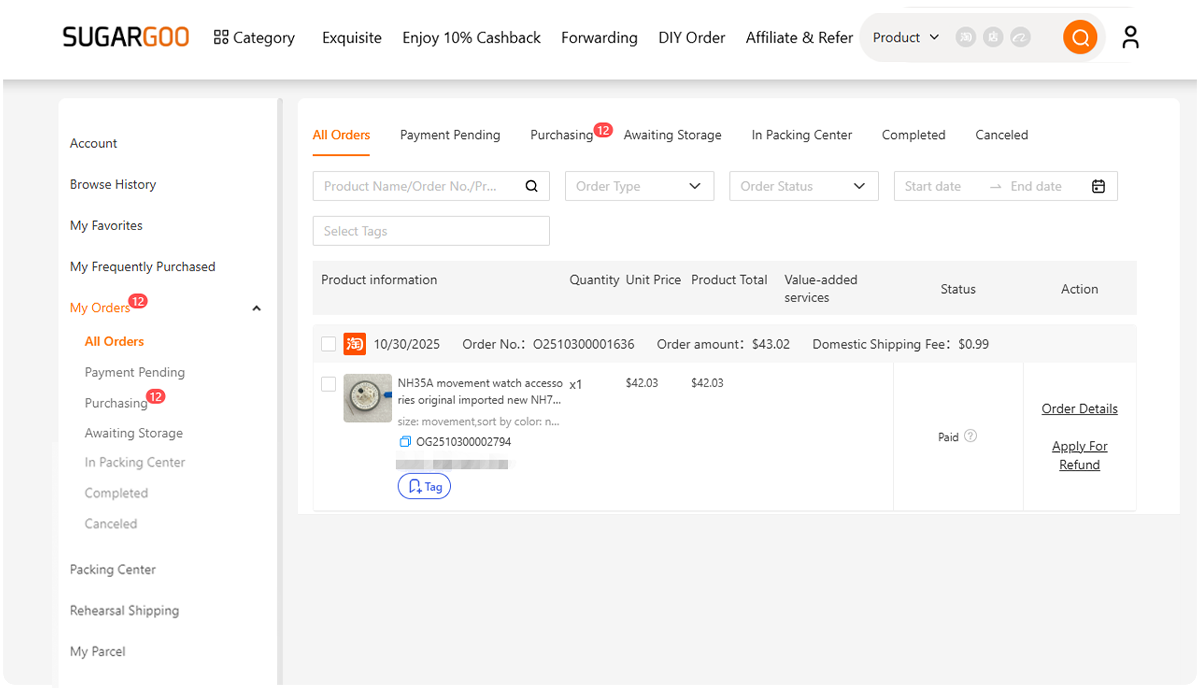

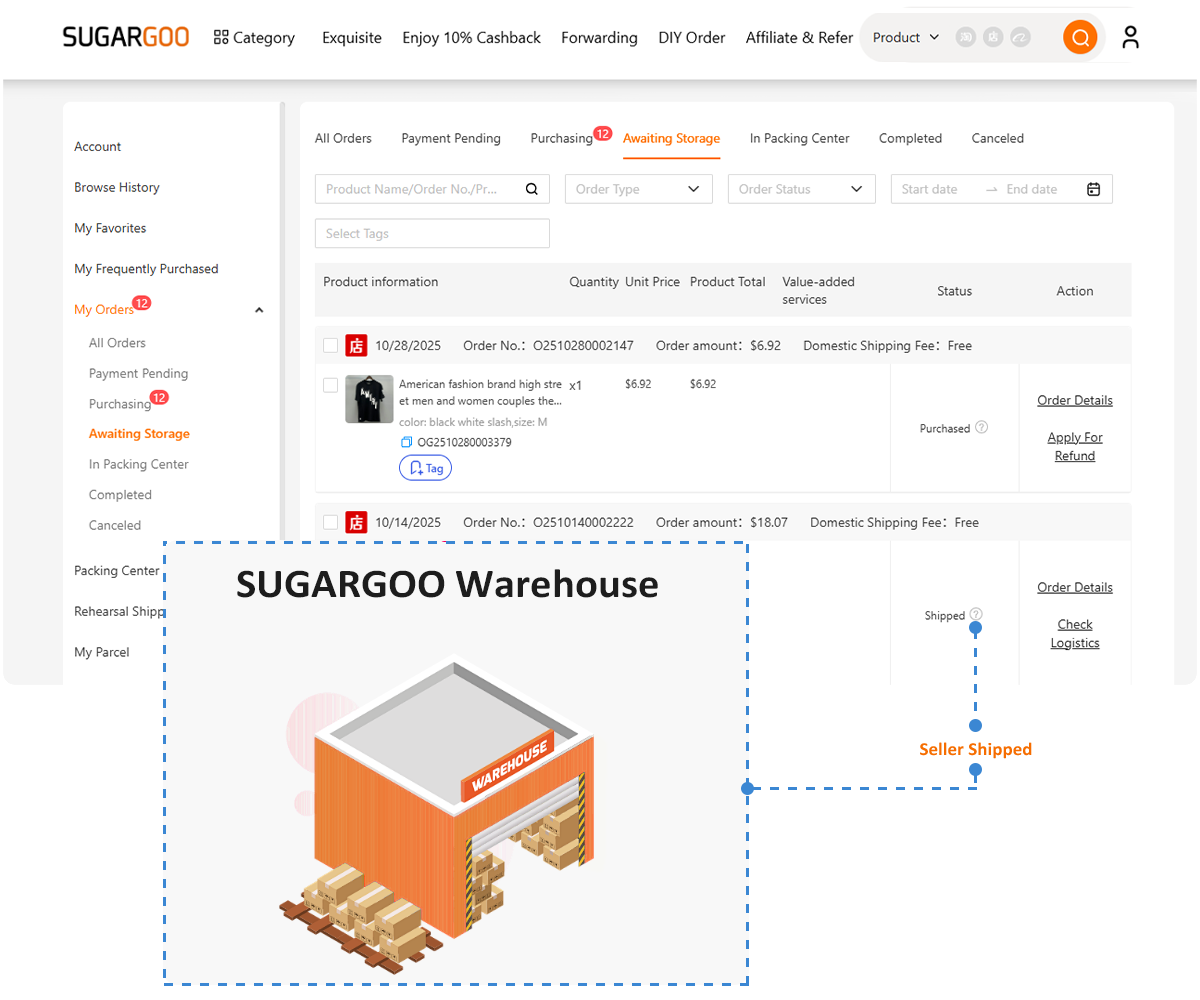

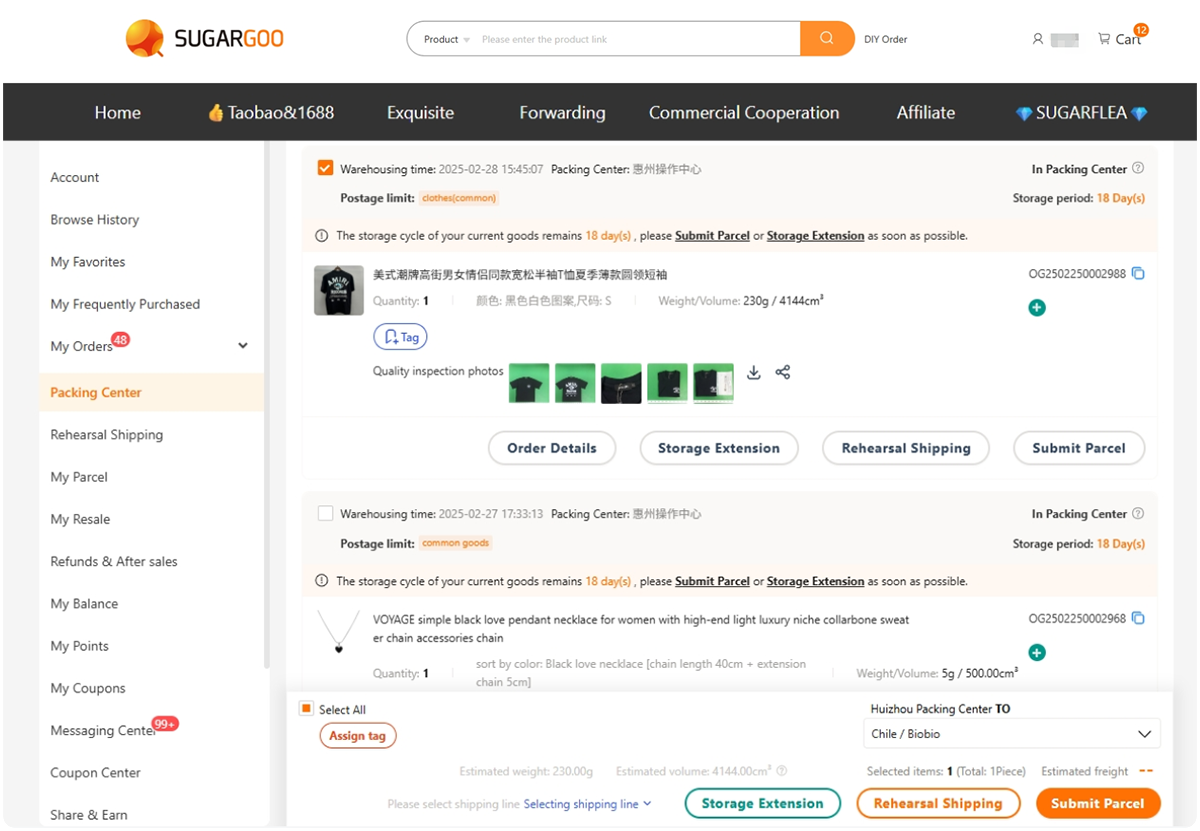

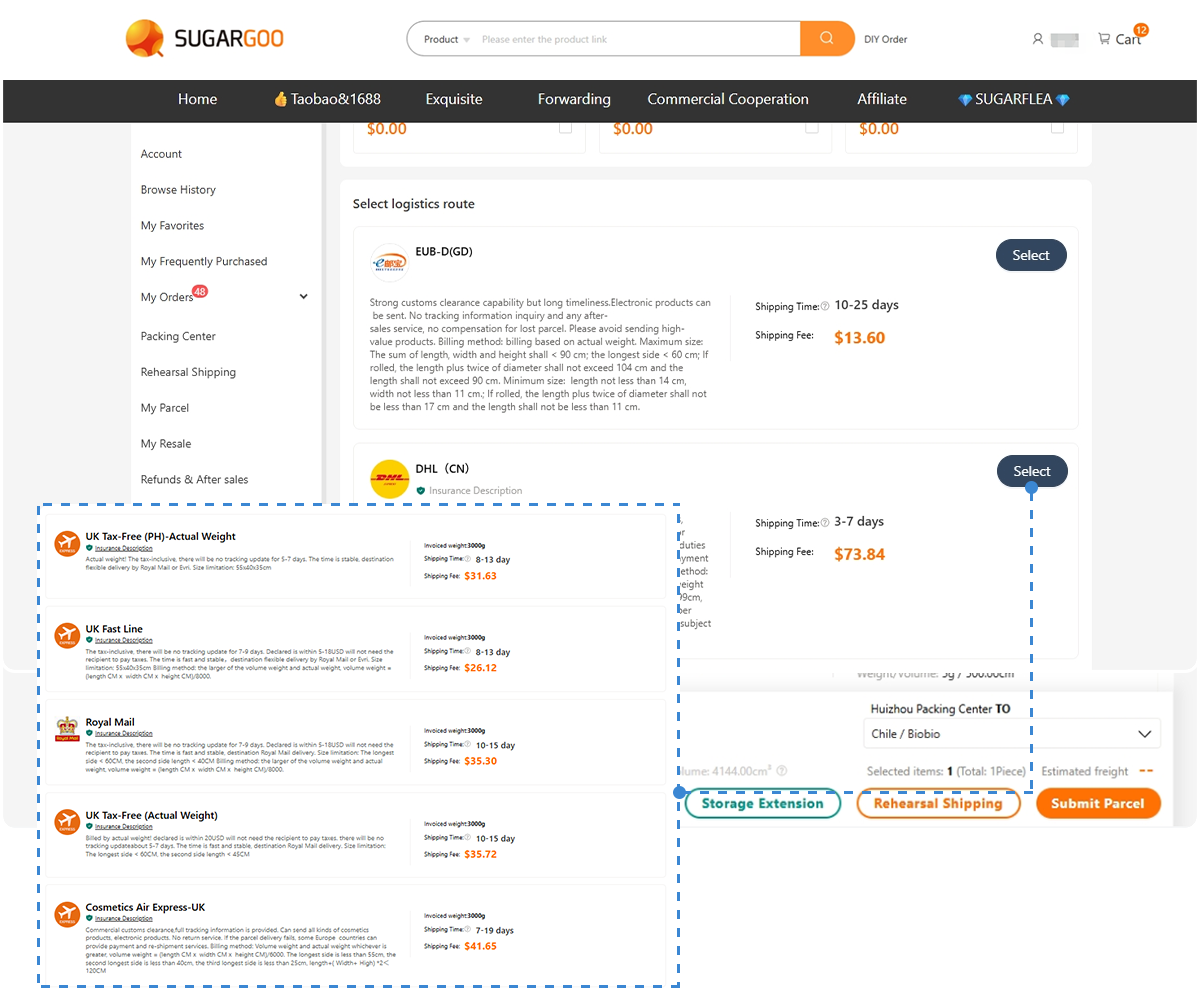

How SUGARGOO Approaches Insured Shipping

SUGARGOO offers an insured parcel service designed for international shipments leaving China.

Typical coverage includes:

- Full parcel loss during transit

- Loss caused by customs seizure of the entire shipment

- Partial loss due to missing items or damage

- Returns not triggered by buyer actions

- Compensation for qualifying delivery delays

Key parameters generally include:

- Insured value limits between ¥500 and ¥5000

- Insurance fees calculated as a percentage of the declared amount

- One insurance policy per parcel

For buyers who want a clearer explanation of how these policies apply in practice, SUGARGOO provides a dedicated breakdown in its article on insured parcel services.

Insurance Is Strongest When Combined with Other Risk Controls

Shipping insurance works best when it supports—not replaces—other protective measures. Smart buyers typically combine insurance with:

- Pre-shipment inspections

- Thoughtful consolidation to reduce handling frequency

- Reinforced packaging for sensitive items

- Shipping line selection based on destination risk, not just price

Insurance handles the financial side of failure; preparation reduces the chance of failure in the first place.

Is Shipping Insurance Worth It for China Orders?

Shipping insurance is not mandatory, and it is not always necessary. But for many China orders—especially consolidated shipments or higher-value purchases—it offers a practical way to limit downside risk.

The cost is usually small compared to the potential loss, and the benefit is predictability. Instead of worrying about worst-case scenarios, insured buyers know there is a defined outcome if something goes wrong.

A simple guideline applies:

If losing the shipment would cause real financial stress, insurance is worth considering.

Used selectively and combined with good logistics practices, shipping insurance turns uncertainty into a manageable part of buying from China.