Importing from China can feel deceptively simple: a low product price, a quick supplier reply, and a shipping quote that looks “good enough.” Then the parcel moves—and the numbers start changing.

If you want predictable margins, you need to think in landed cost (also called total delivered cost): the amount it takes for goods to arrive at your door, cleared and ready to sell.

This guide shows where extra charges typically appear, what triggers them, and a practical checklist you can use before you pay.

Why “Cheap China Price” Isn’t the Full Price

Many China quotes are based on the part the seller controls:

- Domestic price

- Local delivery to a forwarder (sometimes not included)

- Basic packaging suitable for domestic transport

What usually comes later—often from different parties—includes:

- Billable weight adjustments (especially volumetric weight)

- Fuel/peak surcharges and remote delivery fees

- Customs duties, VAT/GST, and clearance charges

- Last-mile handling, re-delivery, storage, and appointment fees

- Risk costs (damage, delays, returns)

These don’t appear “all at once.” They appear when the parcel changes hands.

The Landed Cost Formula (Simple and Useful)

Use this as your baseline:

Landed Cost =Product + China domestic shipping + packing/QC + add-on services + international freight (billable weight) + taxes + clearance+ last-mile fees + risk buffer

You don’t need perfect precision. You need enough visibility to avoid “profit surprises.”

Surprise Charge #1: Billable Weight (Volumetric Weight)

This is the most common “why is shipping higher than expected?” moment.

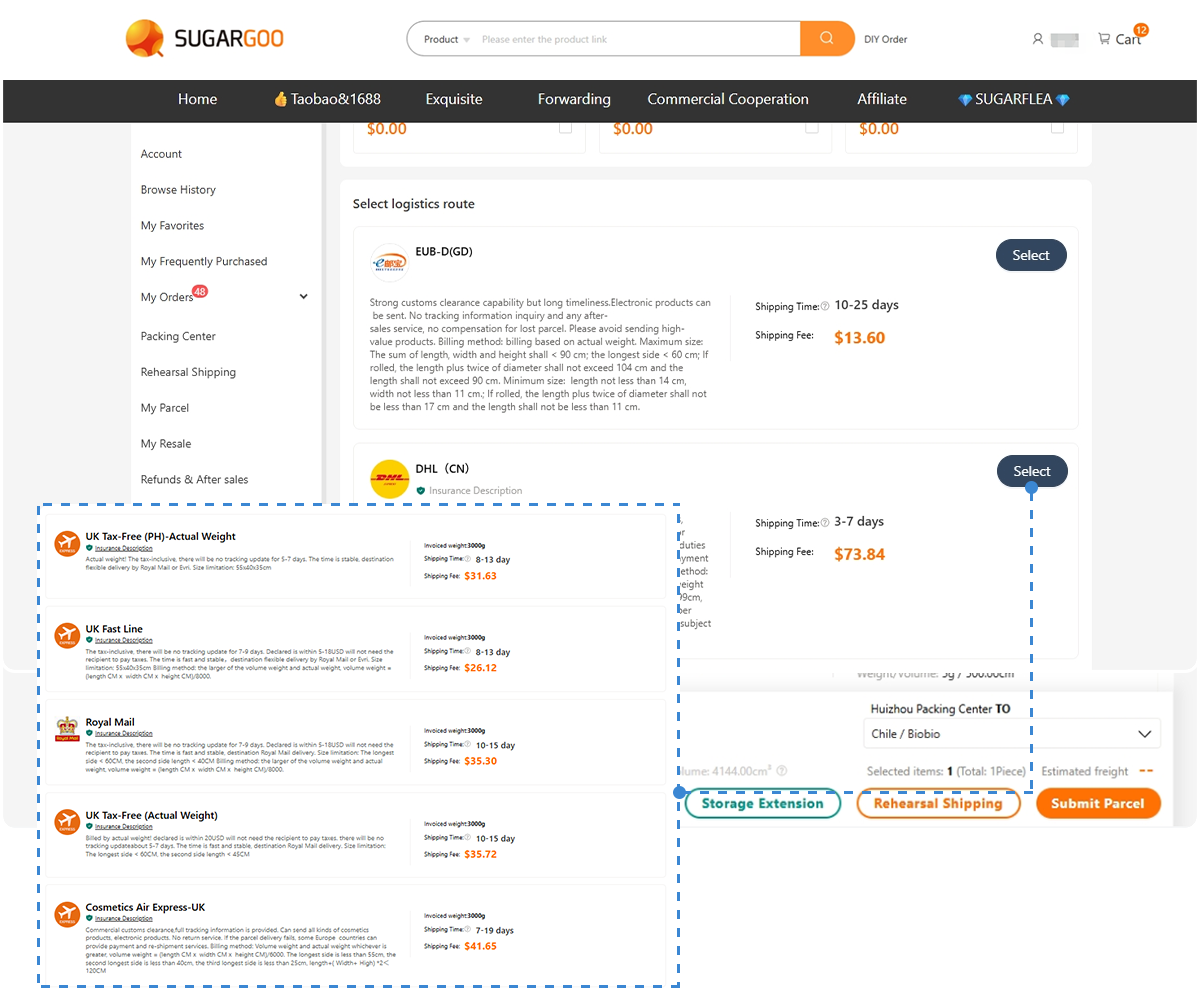

Carriers often charge by billable weight, which is whichever is larger:

- Actual weight (scale weight)

- Volumetric weight (size-based weight)

Bulky-but-light categories get hit hardest:

shoes, jackets, plush toys, bags, boxed accessories, home goods.

How to reduce it

- Ask for packed dimensions, not just weight

- Remove unnecessary retail boxes (when acceptable)

- Consolidate items and choose packing that reduces empty space

- Compare routes that price volumetric weight differently

Surprise Charge #2: “Dynamic” Shipping Add-Ons (Fuel, Peak, Remote Areas)

Even when the base rate is correct, carriers frequently apply adjustments:

- Fuel surcharges that change with market conditions

- Peak season fees (holidays, high congestion periods)

- Remote area surcharges triggered by postal codes

How to reduce it

- Avoid shipping during peak weeks if timing isn’t critical

- Check whether your destination is classified as remote

- Prefer shipping options with transparent, published surcharge rules

Surprise Charge #3: Taxes, Duties, and Brokerage Fees

Two buyers can import the “same value” and pay different totals due to:

- Product classification/category rules

- Destination country thresholds

- Declared value policies and documentation quality

- Whether taxes are prepaid vs paid on delivery

On top of taxes, commercial couriers may add service fees such as:

- Customs processing fees

- Brokerage/clearance fees

- “Advance payment” fees when they pay duties on your behalf

- Documentation handling fees

How to reduce it

- Treat “taxes” and “brokerage” as separate line items

- Confirm whether your route includes tax-inclusive / DDP-like options

- Keep invoices and item descriptions clear and consistent

- Don’t optimize for the lowest declared value if it increases seizure/return risk

Surprise Charge #4: Inspections, Holds, and Storage Fees

Customs checks aren’t rare—and delays can create costs even when nothing is “wrong.”

Common downstream costs include:

- Temporary storage fees during holds

- Extra document requests and handling charges

- Missed delivery windows that trigger re-delivery or appointment fees

How to reduce it

- Ensure item descriptions match what’s actually inside

- Avoid mixing restricted items with normal items

- Leave time buffer for seasonal selling

Surprise Charge #5: Last-Mile Delivery Fees

When parcels enter the destination country, new rules may apply:

- Residential delivery surcharges

- Oversize handling fees

- Address correction and re-delivery charges

- Missed appointment fees (common with large parcels)

- “Return to sender” fees if delivery fails

How to reduce it

- Use a deliverable address format and phone number where required

- Avoid oversize packaging when possible

- For heavy/large parcels, consider routes that specialize in bulky cargo

The Most Expensive “Hidden Fee”: Risk

Some costs never appear as a single invoice—but still hit your margins:

- Damaged items that can’t be resold

- Partial loss or missing accessories

- Returns caused by wrong variants or incorrect specs

- Delays that miss your sales season

- The time cost of disputes and back-and-forth communication

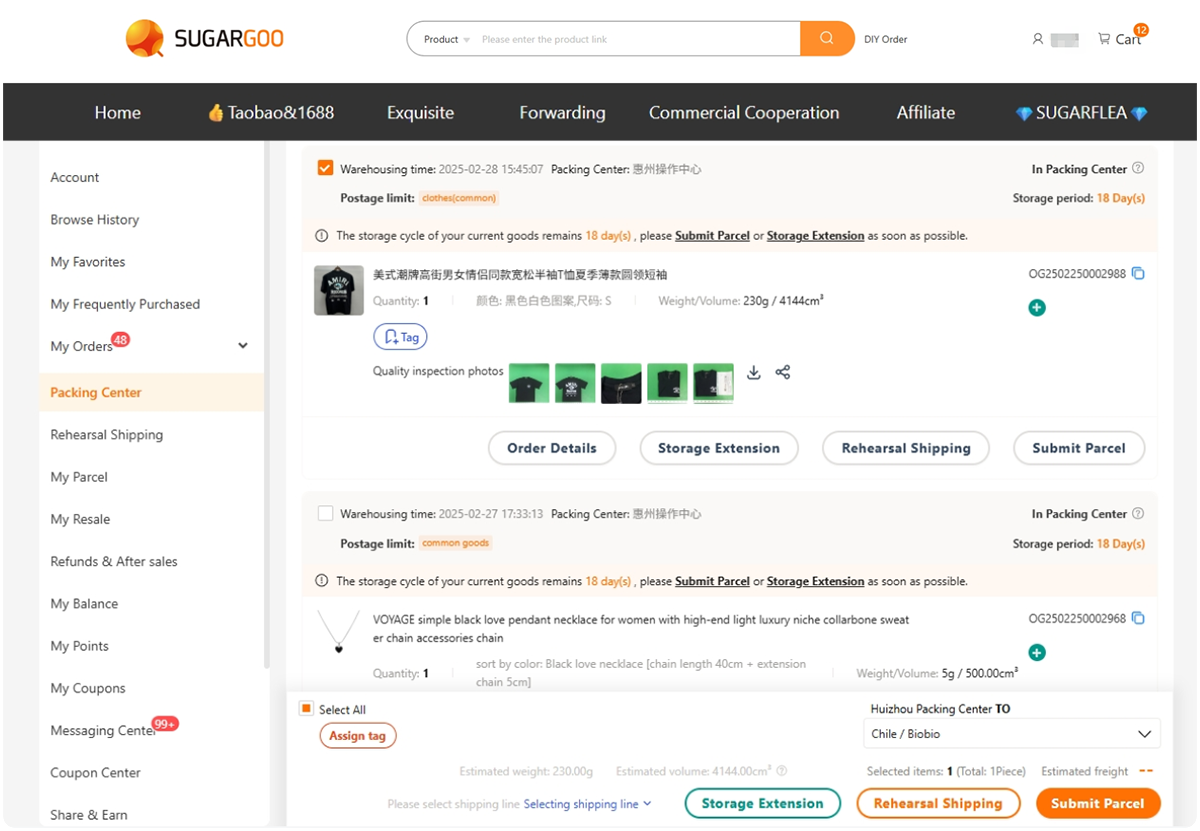

A practical fix: build a small risk buffer into your landed cost estimate and reduce uncertainty with checks before international dispatch.

A Pre-Ship Landed Cost Checklist

Before you pay for international shipping, confirm:

- Packed weight AND packed dimensions (not listing weight)

- The route’s billable weight rule (actual vs volumetric)

- Whether the quote includes fuel/peak/remote surcharges

- Estimated taxes for your product category and country

- Whether the carrier will charge brokerage/advance fees

- Last-mile conditions: residential/oversize/appointment rules

- Your “risk plan”: QC proof, photos, packaging reinforcement, insurance option

- Your final landed cost number (even as a range)

If you can’t confirm these, your “shipping quote” isn’t a quote—it’s a guess.

A More Predictable Option: Use a Buying Agent to Price the Whole Route

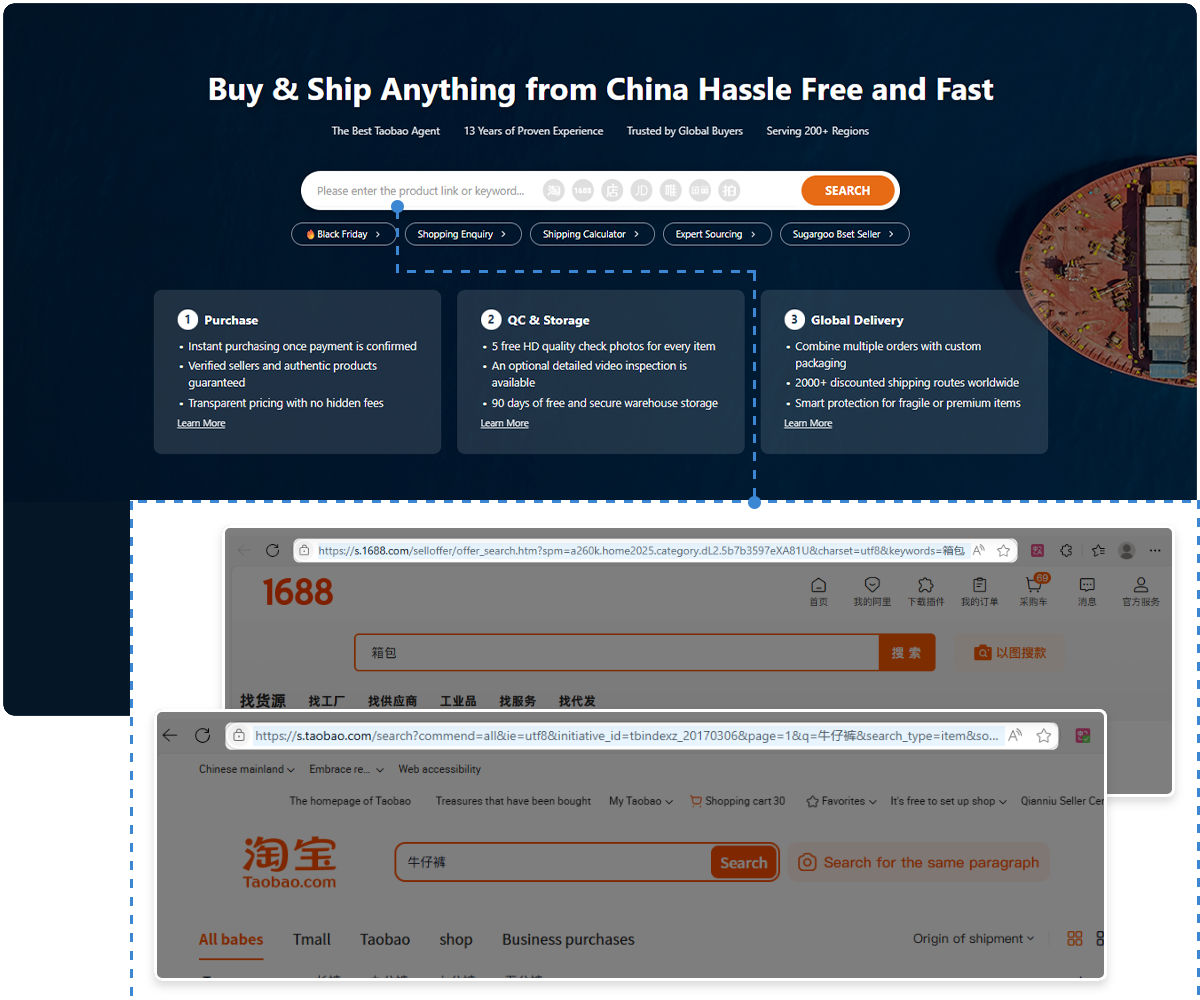

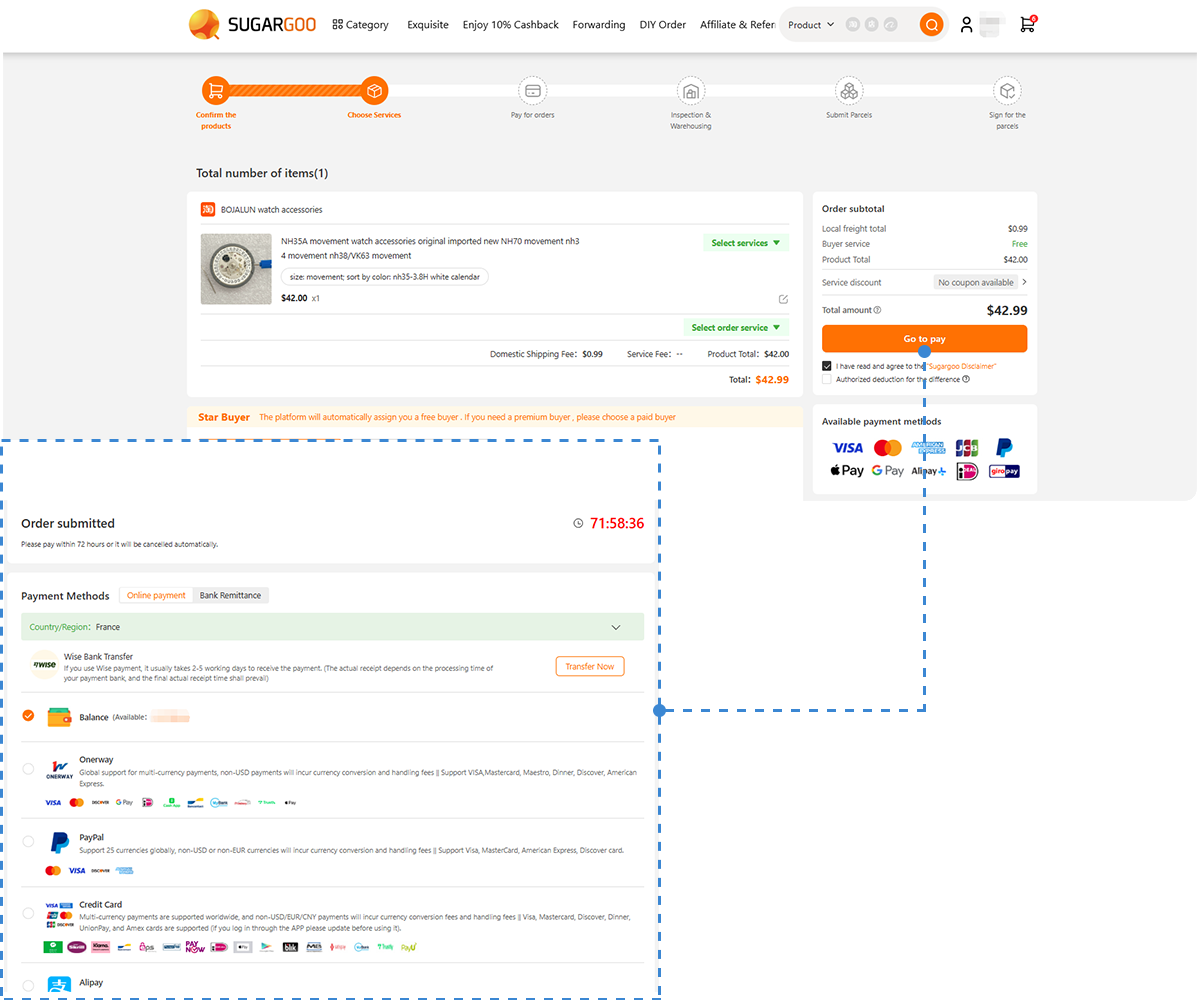

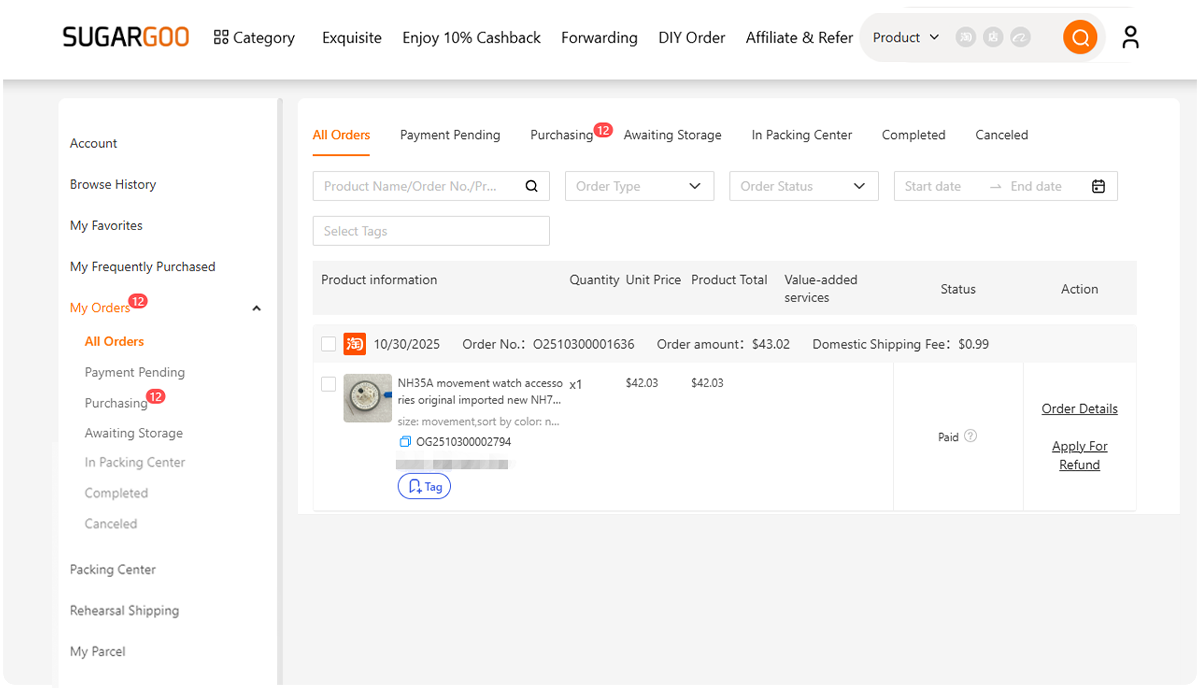

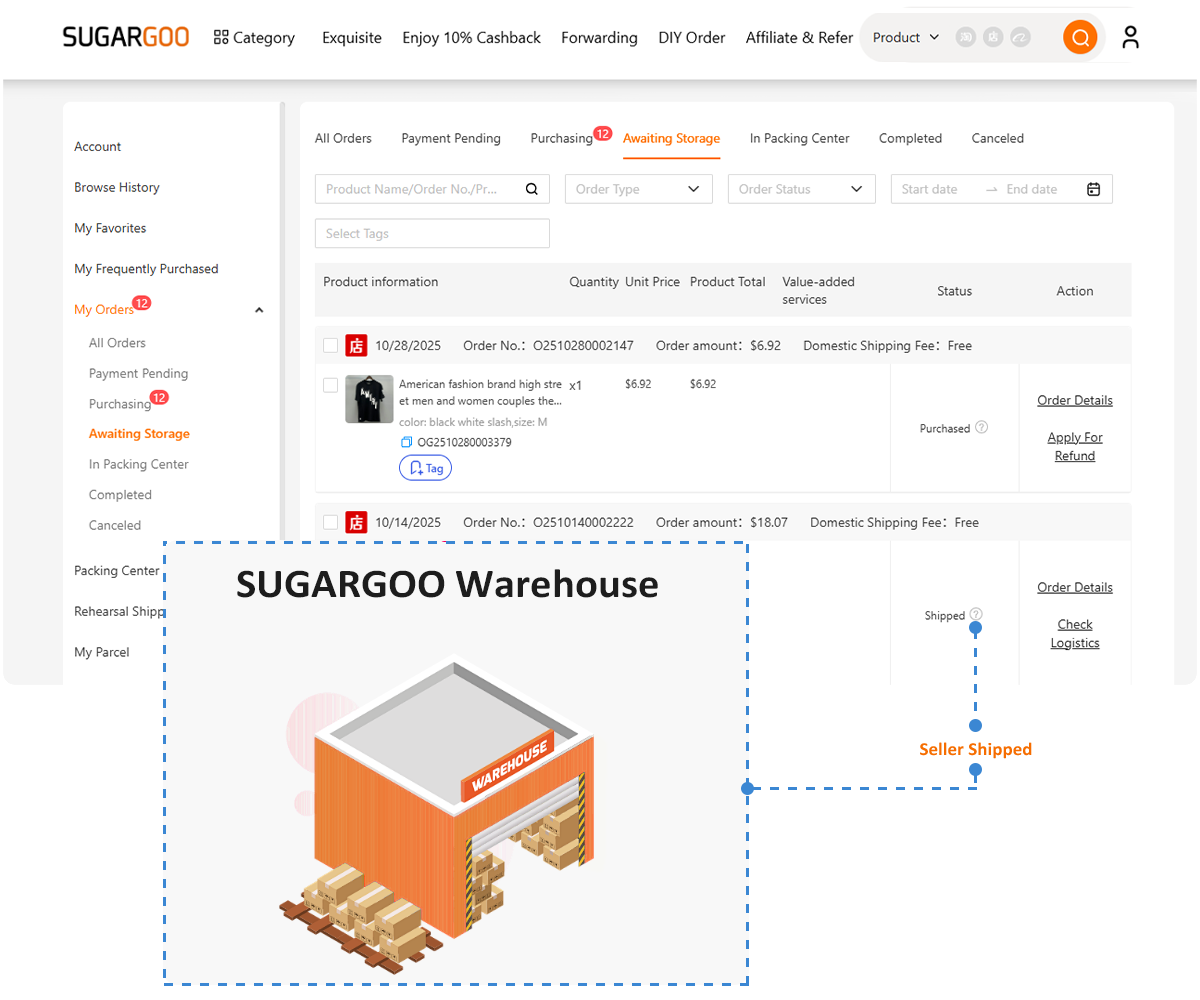

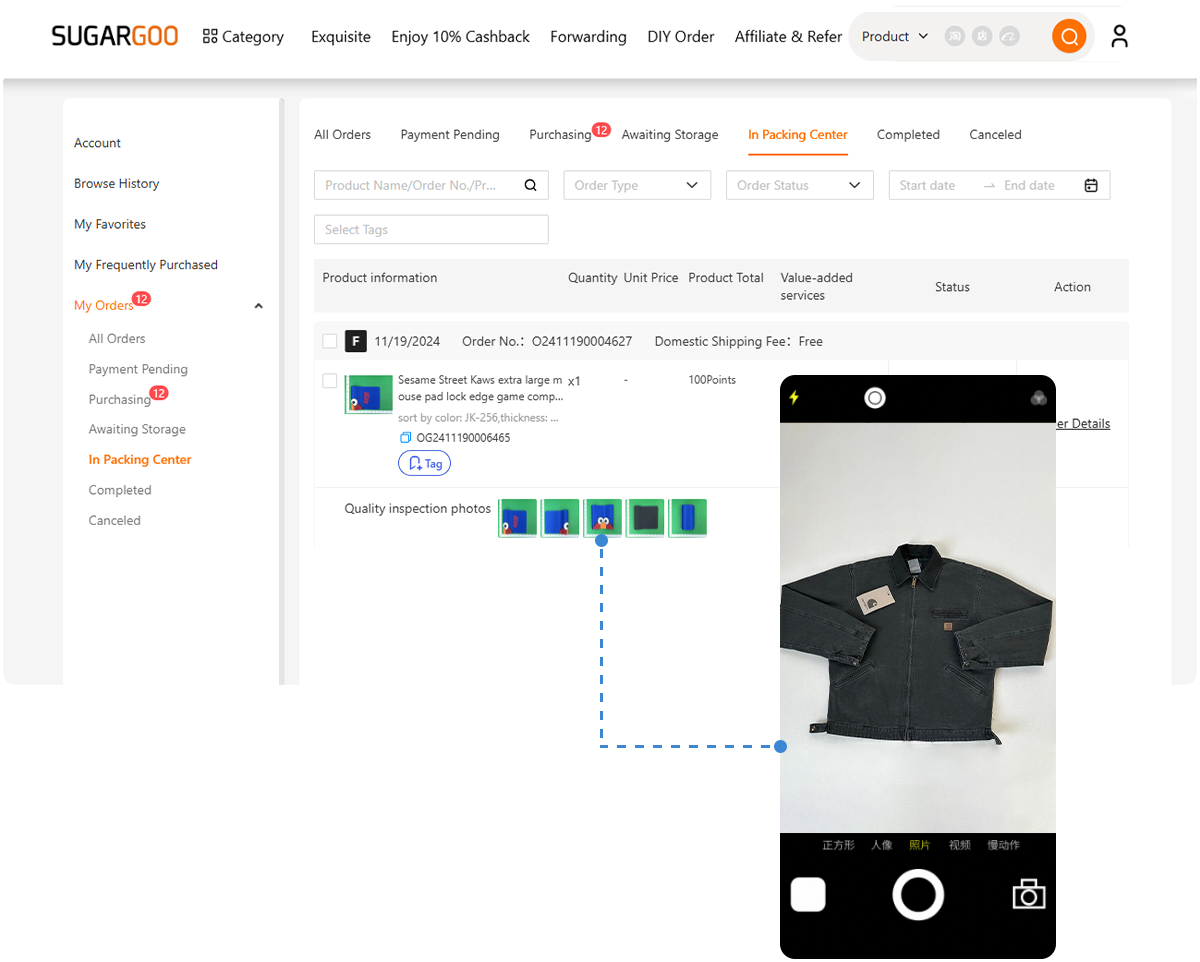

Many overseas buyers reduce surprise charges by routing marketplace purchases through a proxy/buying agent workflow:

- Items ship from multiple sellers to one warehouse

- The platform receives goods and can perform basic checks

- Parcels are consolidated to reduce repeated fees

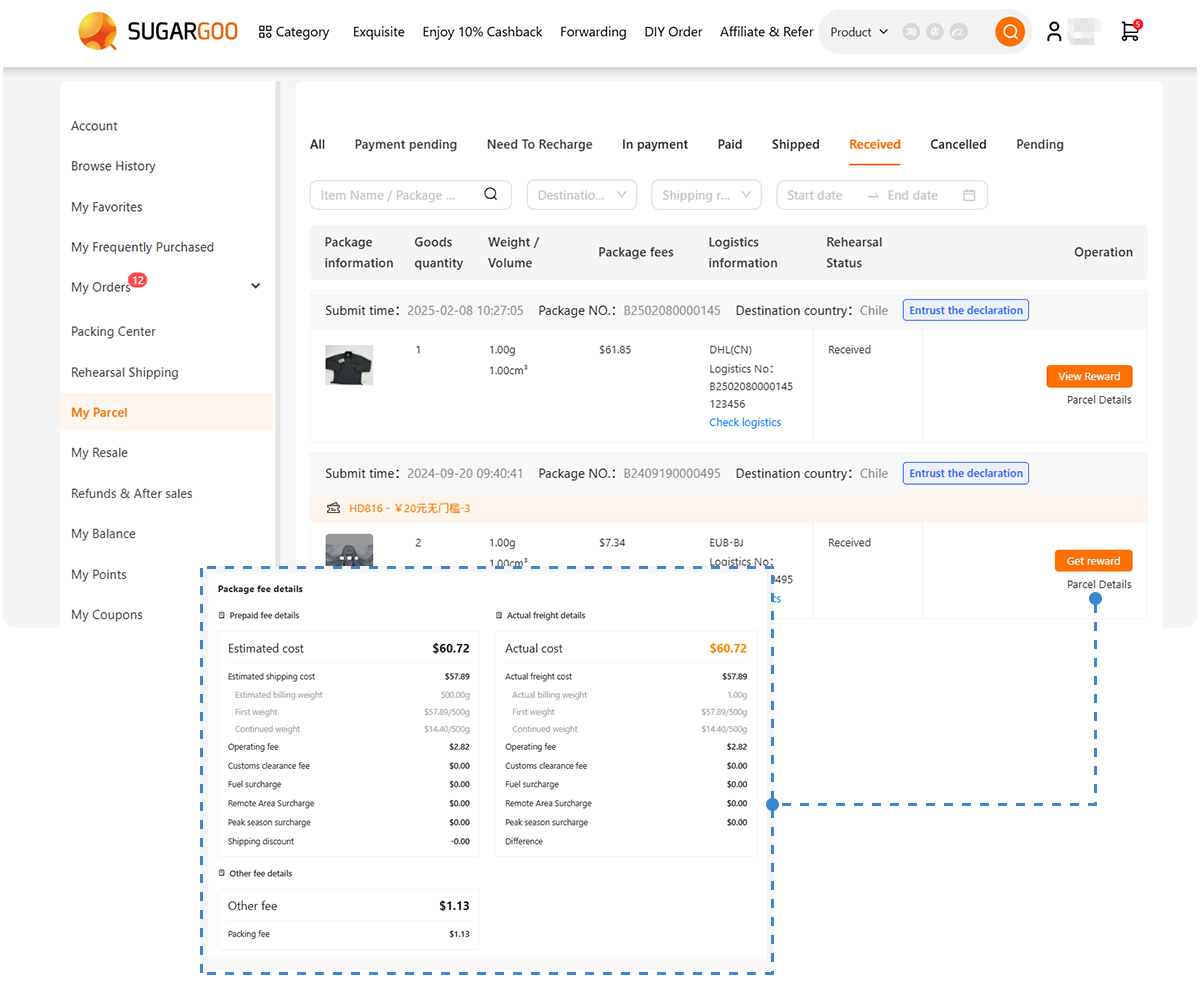

- You see available shipping lines and the final payable total before dispatch

This approach is especially helpful when you’re buying from marketplaces (not a single exporter) and need a clearer “all-in” view.

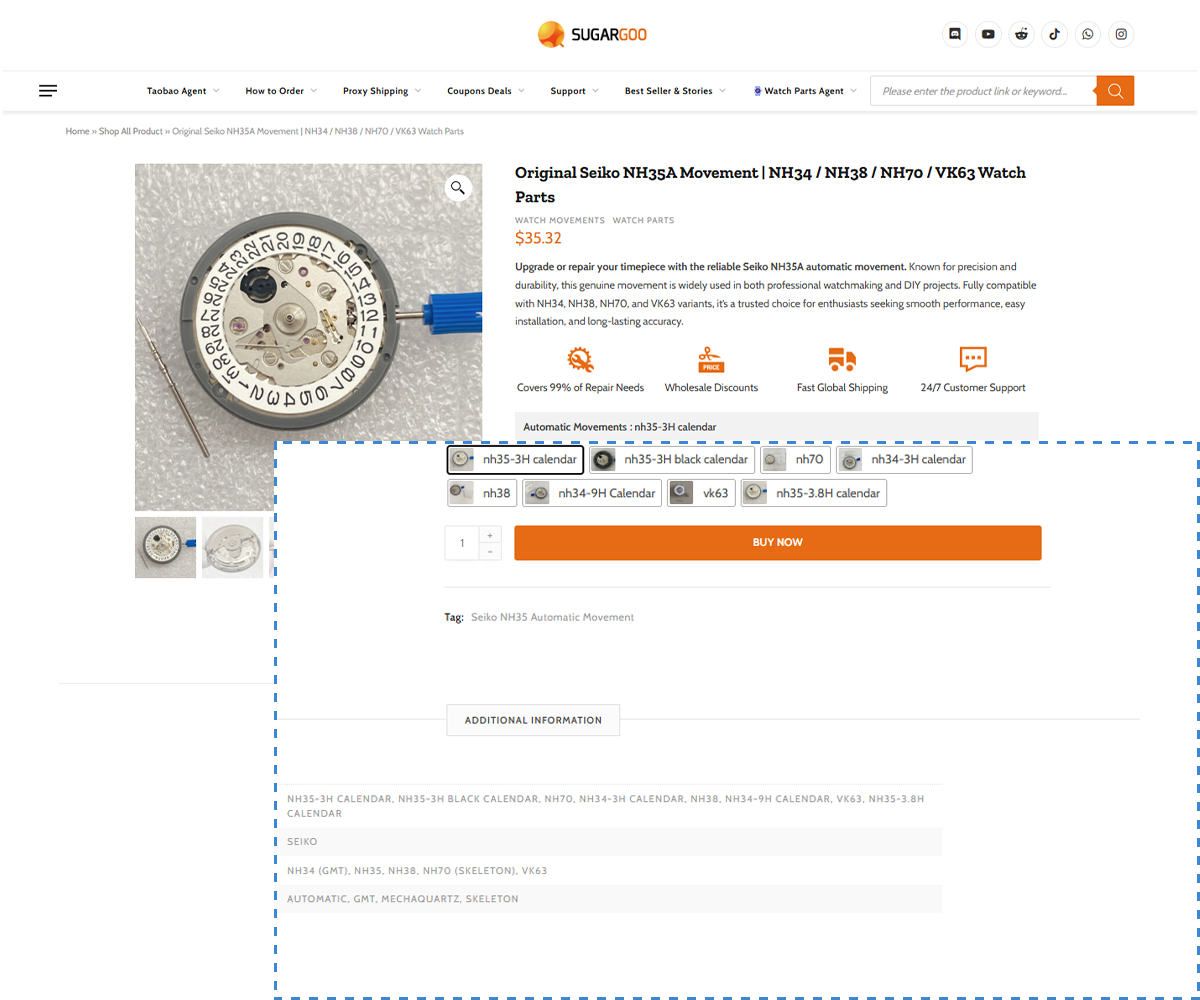

For example, platforms like Sugargoo combine purchasing support, warehousing, quality checks, package consolidation, multiple shipping lines, and optional insurance into a single process—so you can compare routes and pay based on a more complete cost picture, rather than discovering fees step by step.

If you’re still learning how agent-based purchasing works end to end, here’s a step-by-step walkthrough: How Does Ordering from Sugargoo Work

FAQ: Landed Cost and “Hidden Fees” When Importing from China

Are hidden fees always avoidable? Not always. But most are predictable once you know the triggers (billable weight rules, brokerage, taxes, last-mile conditions).

Which shipping method has the most surprise charges? Any method can, but courier-style shipping often adds brokerage and advance-payment fees. Bulky parcels are most exposed to volumetric pricing changes.

Should I consolidate shipments? Often yes. Consolidation can reduce repeated minimum charges and per-unit freight costs—especially for multi-seller marketplace orders.

Bottom Line: Importing Isn’t Cheaper by Accident

The cheapest product price rarely equals the cheapest delivered cost.

Buyers who protect their margins don’t obsess over a single quote. They control the process:

dimensions, billable weight, route rules, tax handling, last-mile terms, and risk management.

Once you price imports as landed cost, “hidden fees” stop being surprises—and start being numbers you planned for.