More international buyers are now sourcing products directly from China as part of their regular purchasing routine. Instead of depending on traditional import channels, shoppers increasingly use Chinese platforms to access everything from simple consumer goods to specialized items and larger-volume orders. This shift is largely driven by practical factors such as wider availability, adaptable pricing, and closer connections to original manufacturers.

But once a package leaves China, a different question starts to matter more than price or product choice:

Do you actually need shipping insurance—or can you safely skip it?

The answer depends less on theory and more on how China-based shipments move in the real world. This guide breaks down when shipping insurance provides real value, when it may be optional, and how experienced buyers decide whether to insure their parcels.

What Shipping Insurance Actually Does for China Orders

Shipping insurance does not prevent delays, inspections, or mistakes. Instead, it defines what happens financially if something goes wrong after dispatch.

In practice, shipping insurance works like this:

- You declare the value of your parcel (usually product cost + shipping)

- A small insurance fee is charged as a percentage of that value

- If a covered issue occurs, compensation is issued according to policy rules

For international shipments from China, insurance commonly applies to:

- Parcels that are completely lost during transit

- Damage caused by handling or transportation

- Missing items from consolidated shipments

- Certain customs-related losses, depending on conditions

- Qualified delivery delays defined by the policy

Insurance does not remove risk—but it caps your downside.

Why Buyers Ordering from China Face More Transit Uncertainty

International shipping always involves risk, but China-based orders tend to include additional layers:

- Longer shipping routes with multiple handoffs

- Several logistics providers managing the same parcel

- Customs inspections that vary widely by destination

- Limited direct communication between overseas buyers and domestic sellers

Even when sellers ship correctly, outcomes can still change once parcels enter global logistics networks. That is why many overseas shoppers focus less on whether issues might happen—and more on what happens if they do.

Situations Where Shipping Insurance Is Usually Worth It

Most experienced buyers do not insure every shipment. They insure selectively, based on exposure.

Shipping insurance is typically worth considering when:

- The total parcel value is high, even if items are individually inexpensive

- Multiple items are combined into one consolidated package

- Products are fragile, collectible, or difficult to replace

- The destination country has strict or unpredictable customs clearance

- The shipment is tied to resale, deadlines, or planned use

In these cases, the insurance cost is often small compared to the potential loss of the entire parcel.

When Shipping Insurance May Be Optional

Not every China order needs insurance.

Buyers often skip insurance for:

- Low-value, single-item purchases

- Test orders or product samples

- Orders where loss would be inconvenient but financially manageable

A simple decision rule helps:

If this package never arrives, would I regret not insuring it?

If the answer is no, insurance may not be necessary.

What Shipping Insurance Does Not Cover

Understanding limitations is critical. Shipping insurance is not a blanket guarantee.

Most policies do not cover:

- Incorrect value declarations by the buyer

- Issues caused by prohibited or restricted items

- Minor cosmetic packaging damage

- Delays caused by holidays or force majeure events

- Returns initiated after delivery

Insurance protects against defined losses—not every inconvenience.

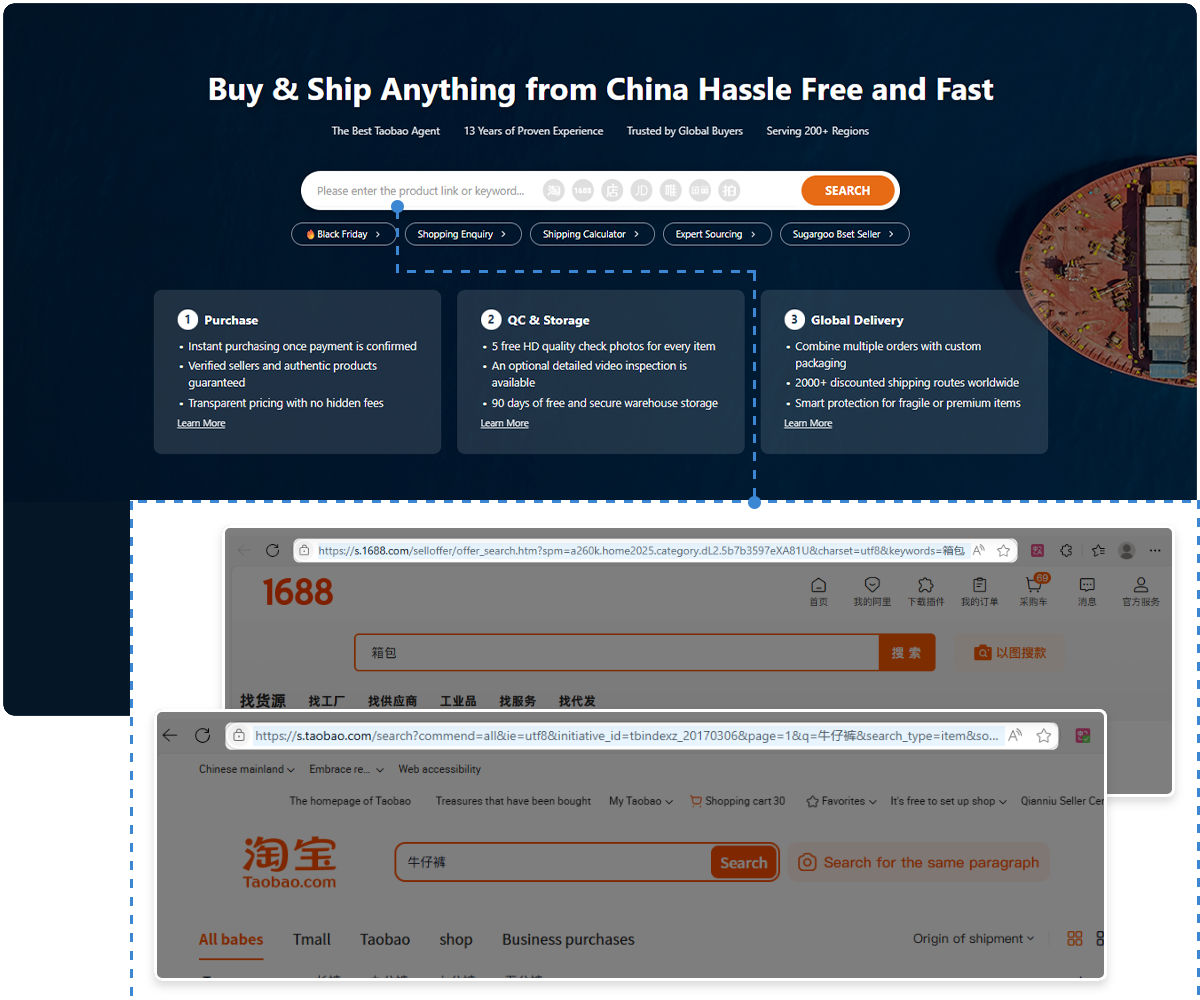

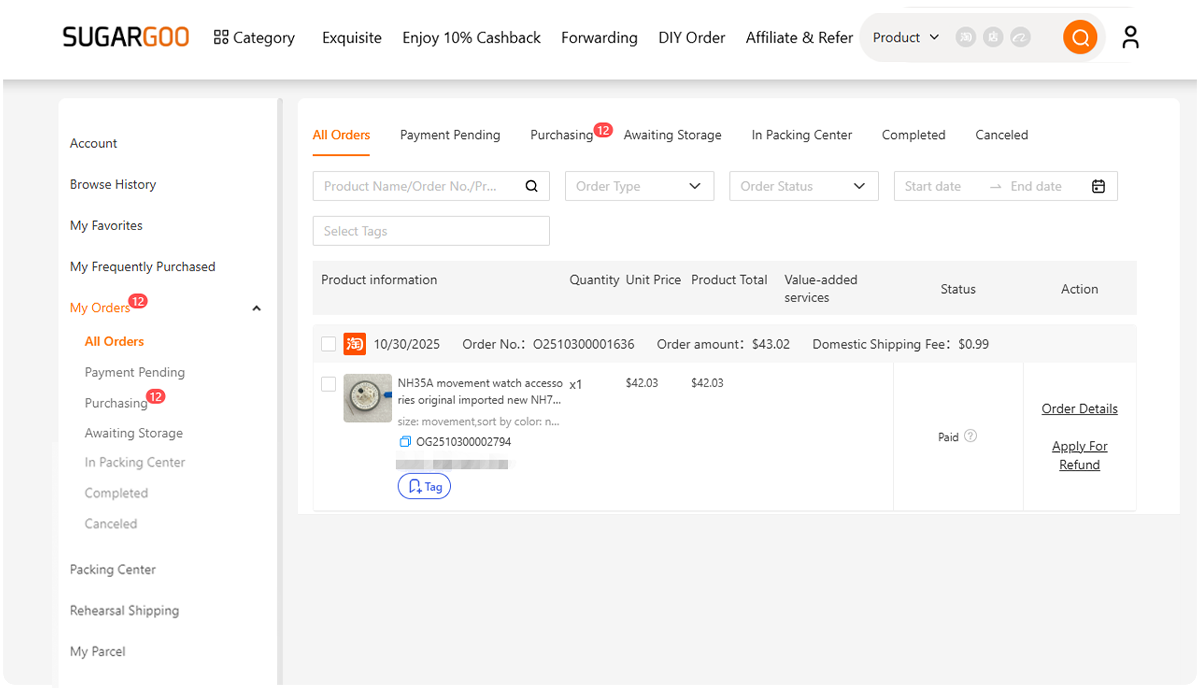

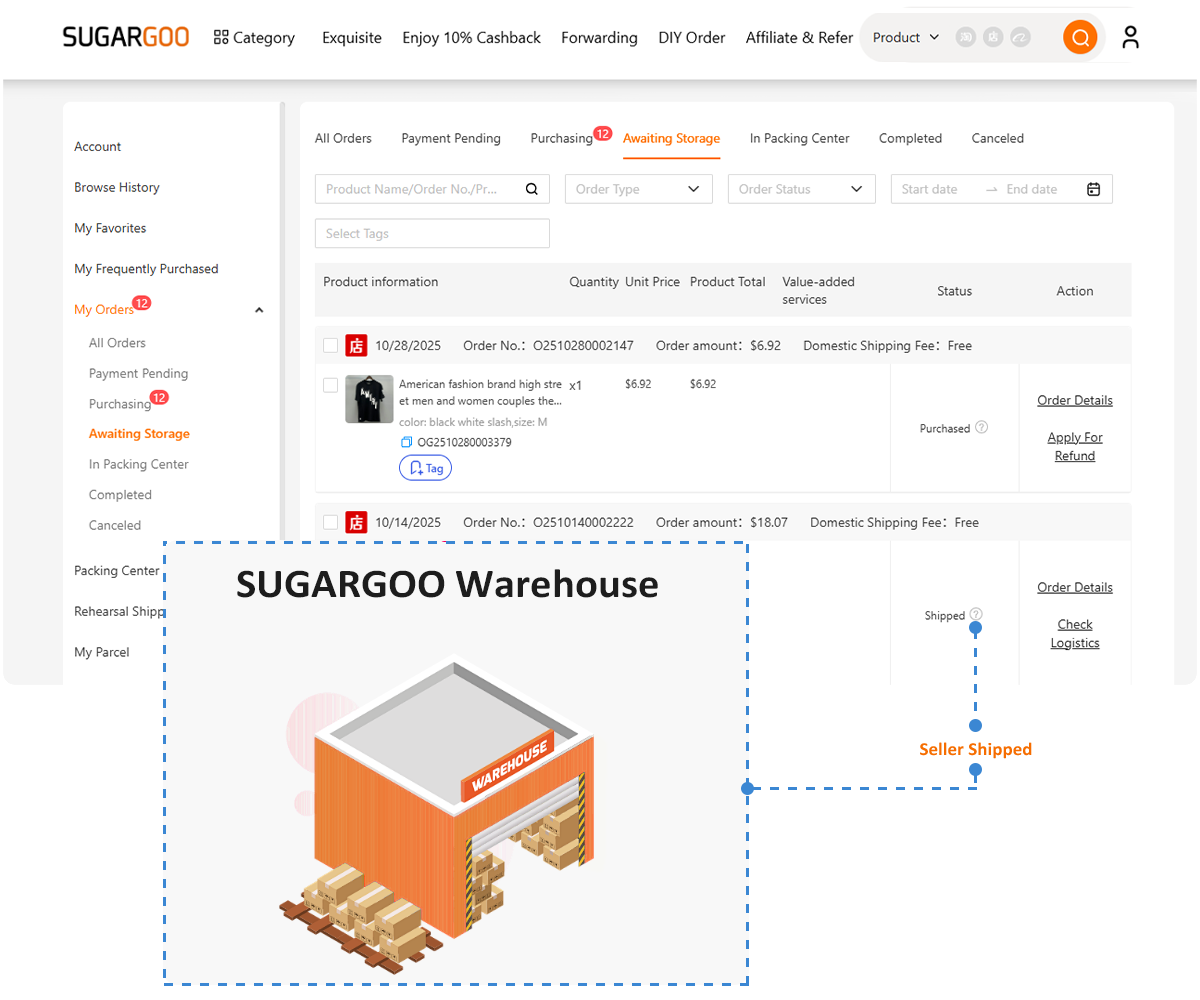

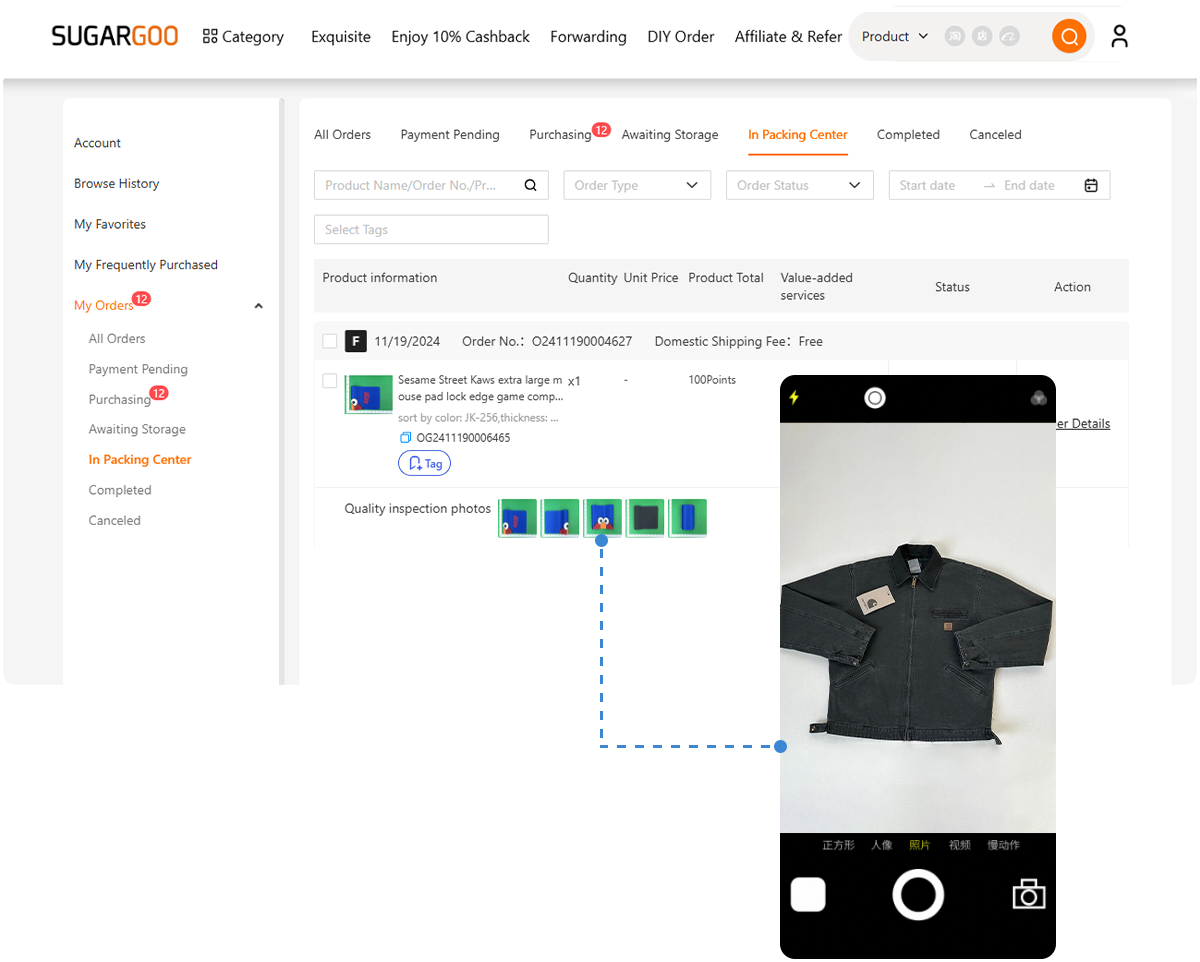

Where Buying Agents Reduce Risk—and Where Insurance Still Matters

Buying agents play an important role in reducing problems before shipping. They help with:

- Seller communication and order accuracy

- Item inspection and condition verification

- Package consolidation and preparation

- Logistics setup for international shipping

However, once a parcel leaves the warehouse, control shifts to carriers, customs authorities, and routing decisions. Insurance becomes relevant at this stage—not as a substitute for good preparation, but as protection when preparation is no longer enough.

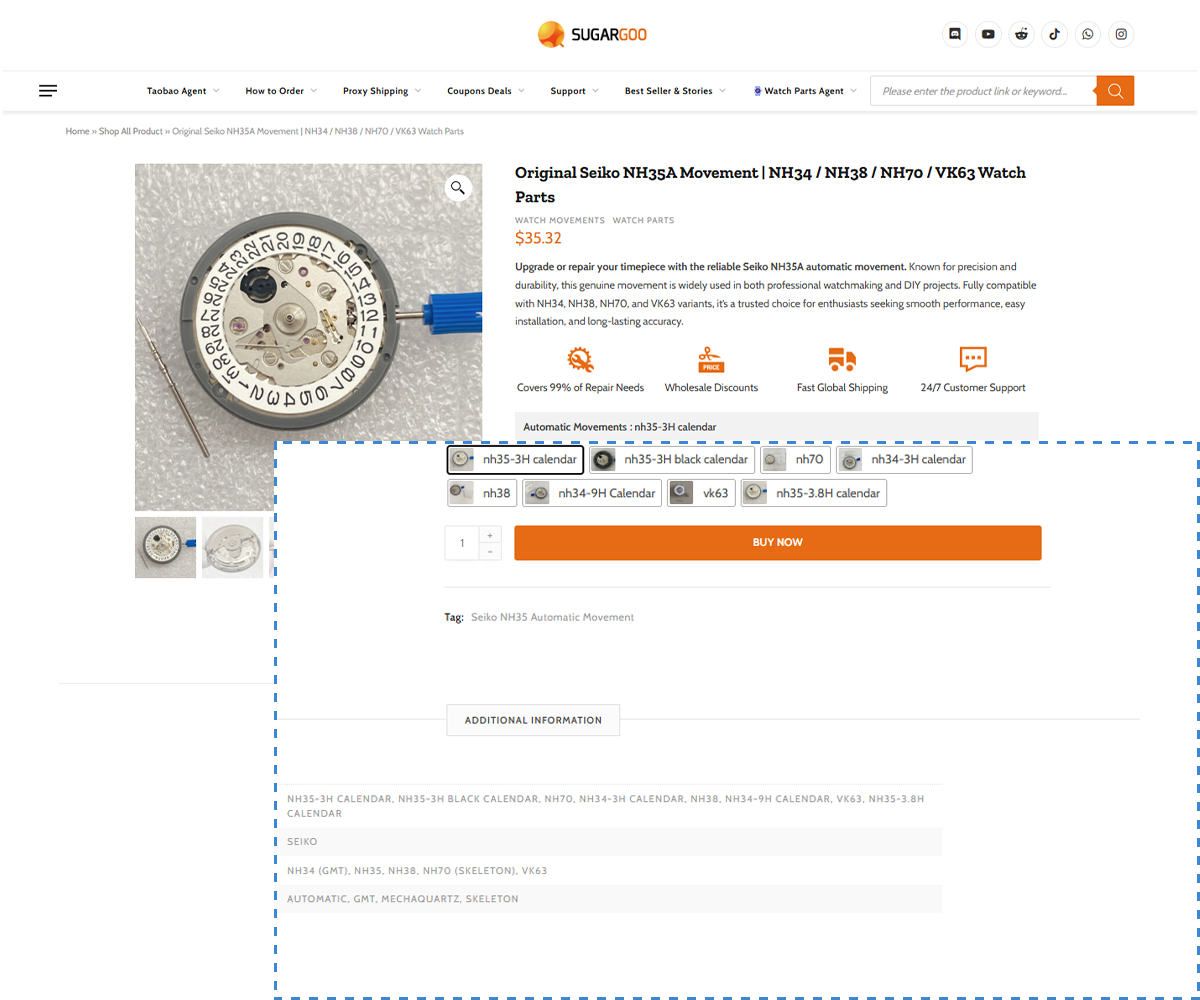

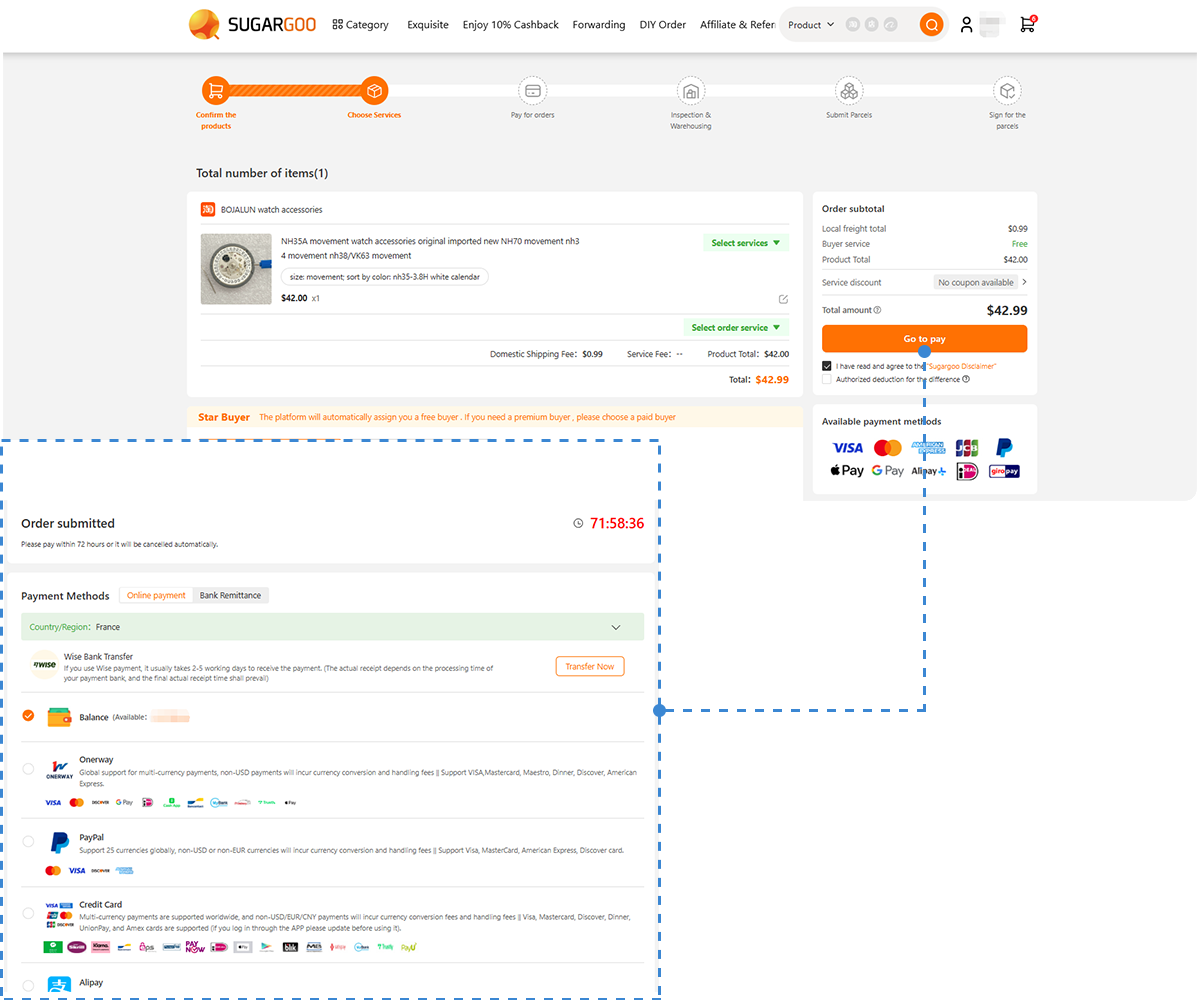

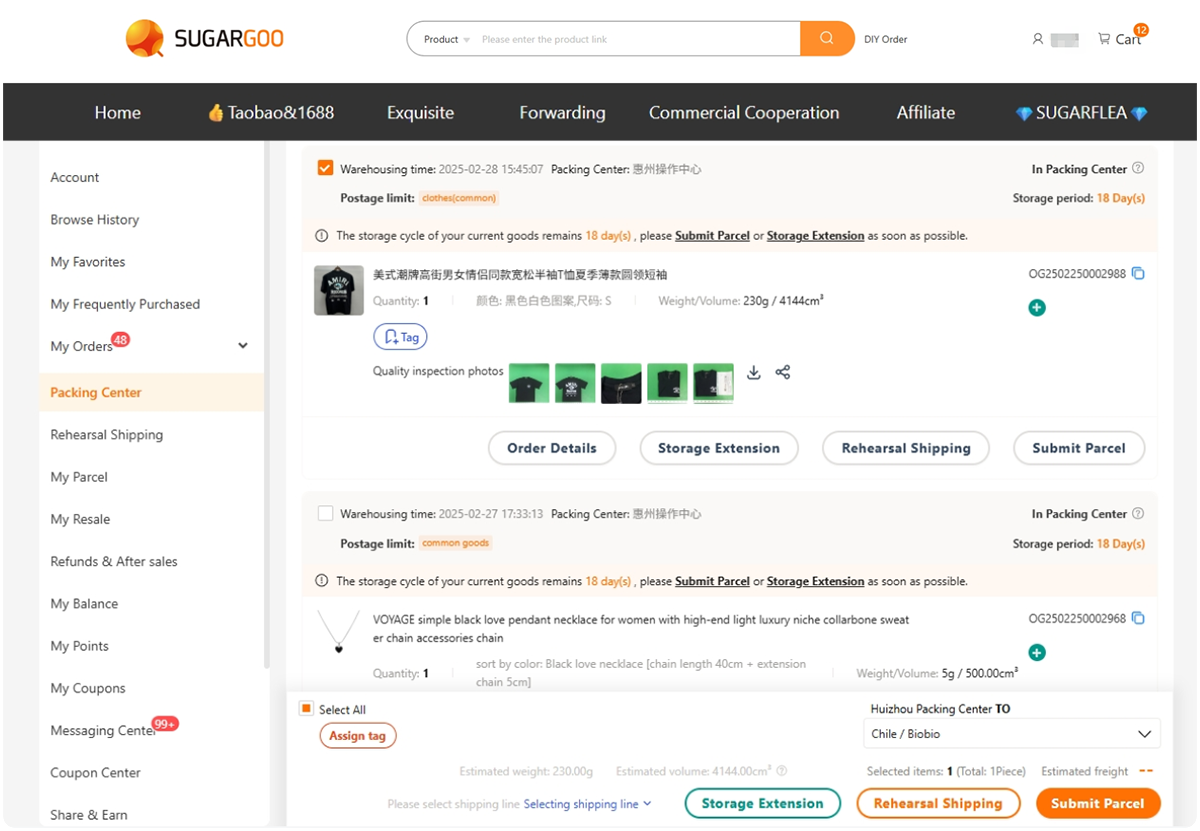

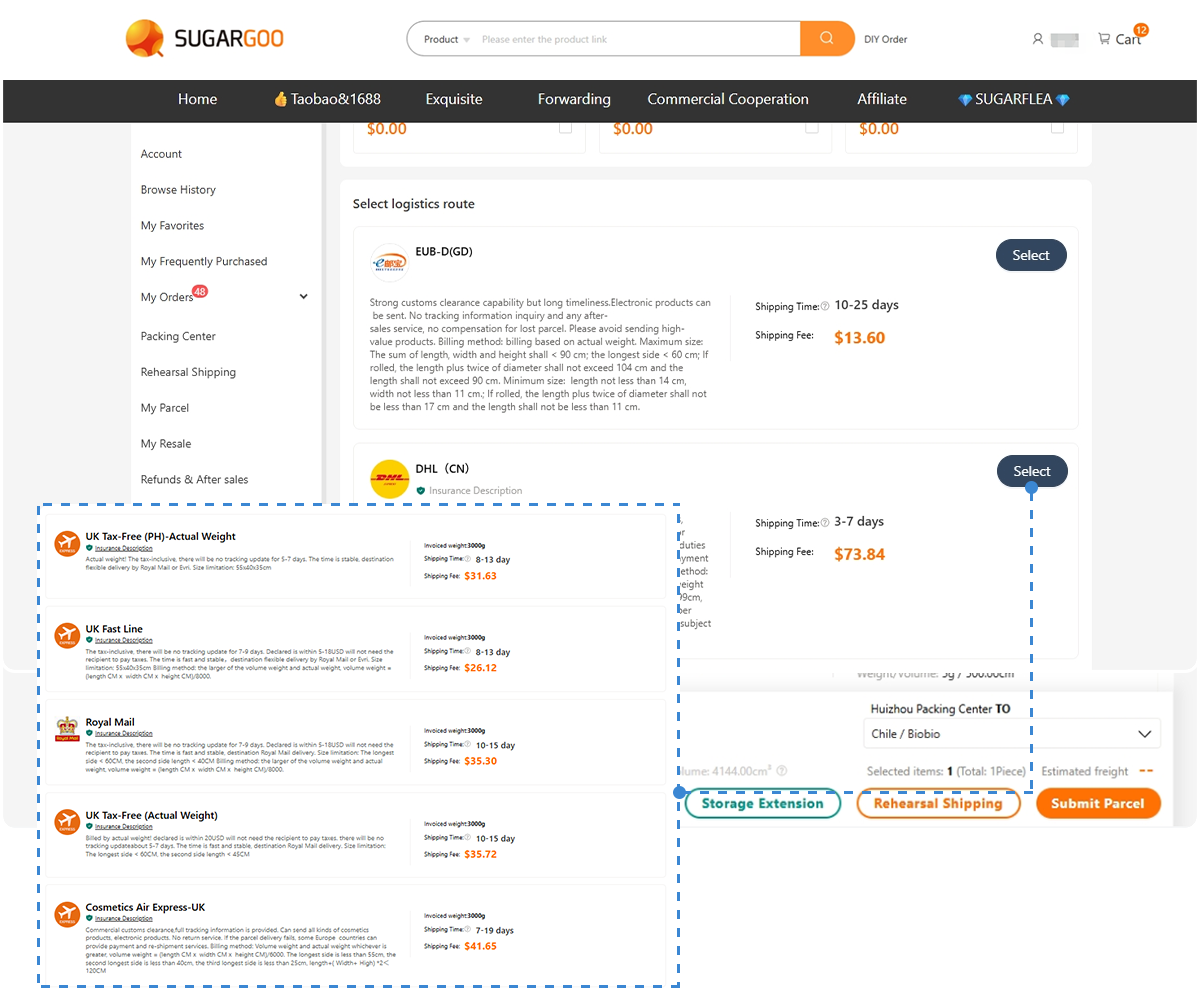

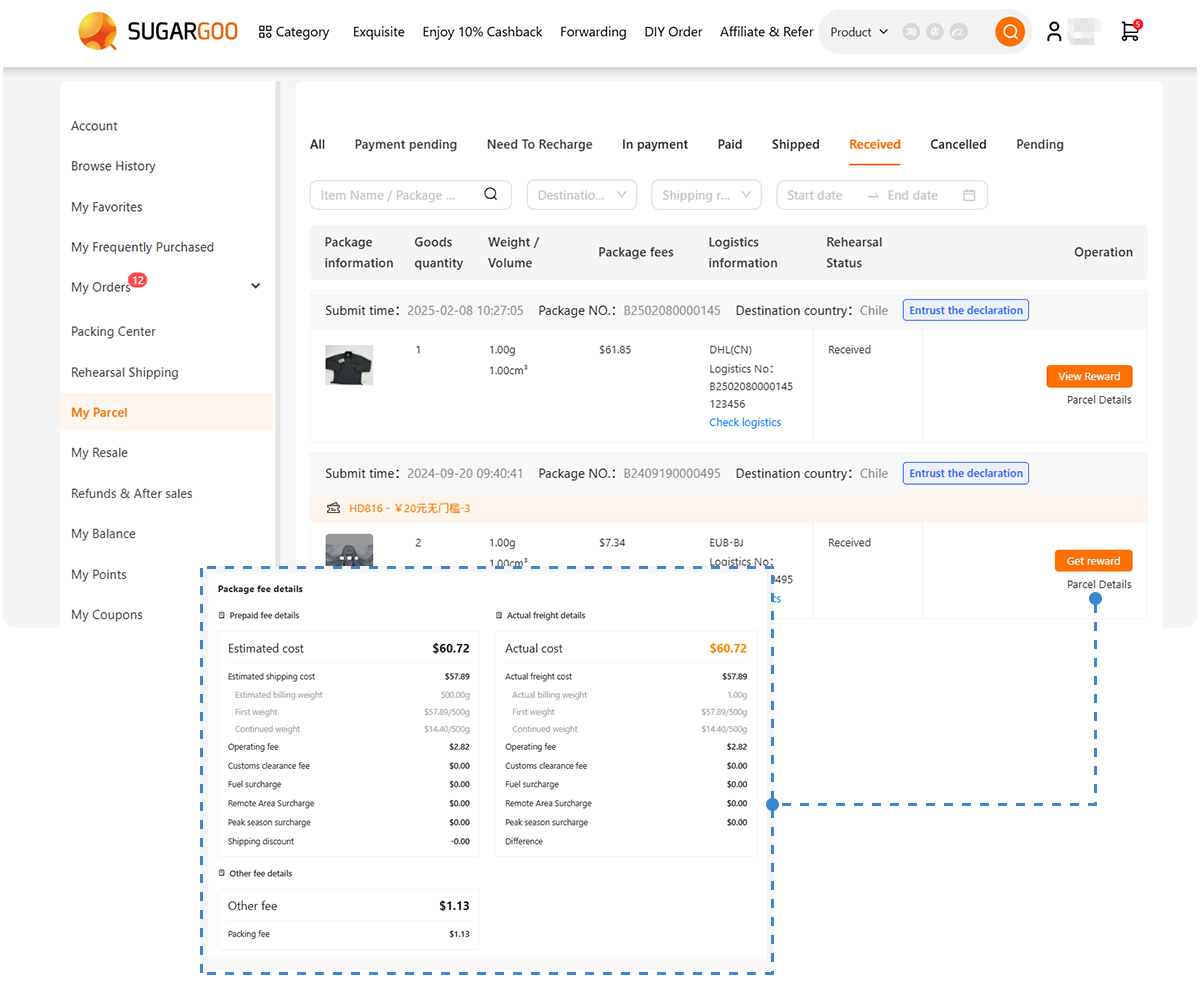

How Insured Shipping Works with SUGARGOO

SUGARGOO offers insured parcel options designed for international shipments departing from China. While exact terms vary by route, coverage typically includes:

- Full parcel loss during transit

- Loss caused by customs seizure of the entire shipment

- Partial loss from missing or damaged items

- Returns not initiated by buyer actions

- Compensation for qualifying delivery delays

Common parameters usually include:

- Insured value limits per parcel

- Insurance fees calculated as a percentage of declared value

- One insurance policy per consolidated shipment

For buyers managing higher-value or multi-item parcels, insurance adds predictability to outcomes that would otherwise remain uncertain. For a clear explanation of coverage scope, claim conditions, and how insured shipping applies to consolidated international parcels, see How SUGARGOO Shipping Insurance Protects Your Global Orders.

Insurance Works Best as Part of a Risk Strategy

Shipping insurance is most effective when combined with other precautions, such as:

- Pre-shipment inspections

- Thoughtful consolidation to reduce handling

- Reinforced packaging for fragile goods

- Choosing shipping lines based on reliability, not just price

Insurance manages financial consequences; preparation reduces the likelihood of problems occurring in the first place.

So—Do You Really Need Shipping Insurance When Ordering from China?

Shipping insurance is not mandatory, and it is not always necessary. But for many China orders—especially consolidated shipments or higher-value purchases—it provides a clear advantage: defined outcomes instead of uncertainty.

The cost is usually modest. The benefit is peace of mind and financial clarity.

A simple guideline applies:

If losing the shipment would cause meaningful financial stress, shipping insurance is worth serious consideration.

Used selectively and combined with good logistics practices, insurance becomes a practical tool—not an unnecessary add-on—when ordering from China.