When small buyers compare shipping options from China, most discussions focus on air versus sea freight. Rail shipping is often mentioned as an alternative, but rarely explained in a way that actually helps small buyers decide.

Small buyers don’t choose shipping methods based on formulas. They choose based on final quotes, delivery confidence, and risk tolerance.

This guide compares air, rail, and sea shipping from the perspective that matters most to small buyers: real-world outcomes.

Small Buyers Don’t Optimize Freight — They Manage Risk

Large importers optimize logistics at scale.

Small buyers manage uncertainty.

For small shipments, shipping decisions are shaped by:

- Limited volume

- Tight cash flow

- Low tolerance for delays or surprise costs

That’s why shipping comparisons for small buyers are not about finding the absolute cheapest rate — they’re about avoiding costly mistakes.

Key takeaway:

For small buyers, shipping decisions are risk decisions.

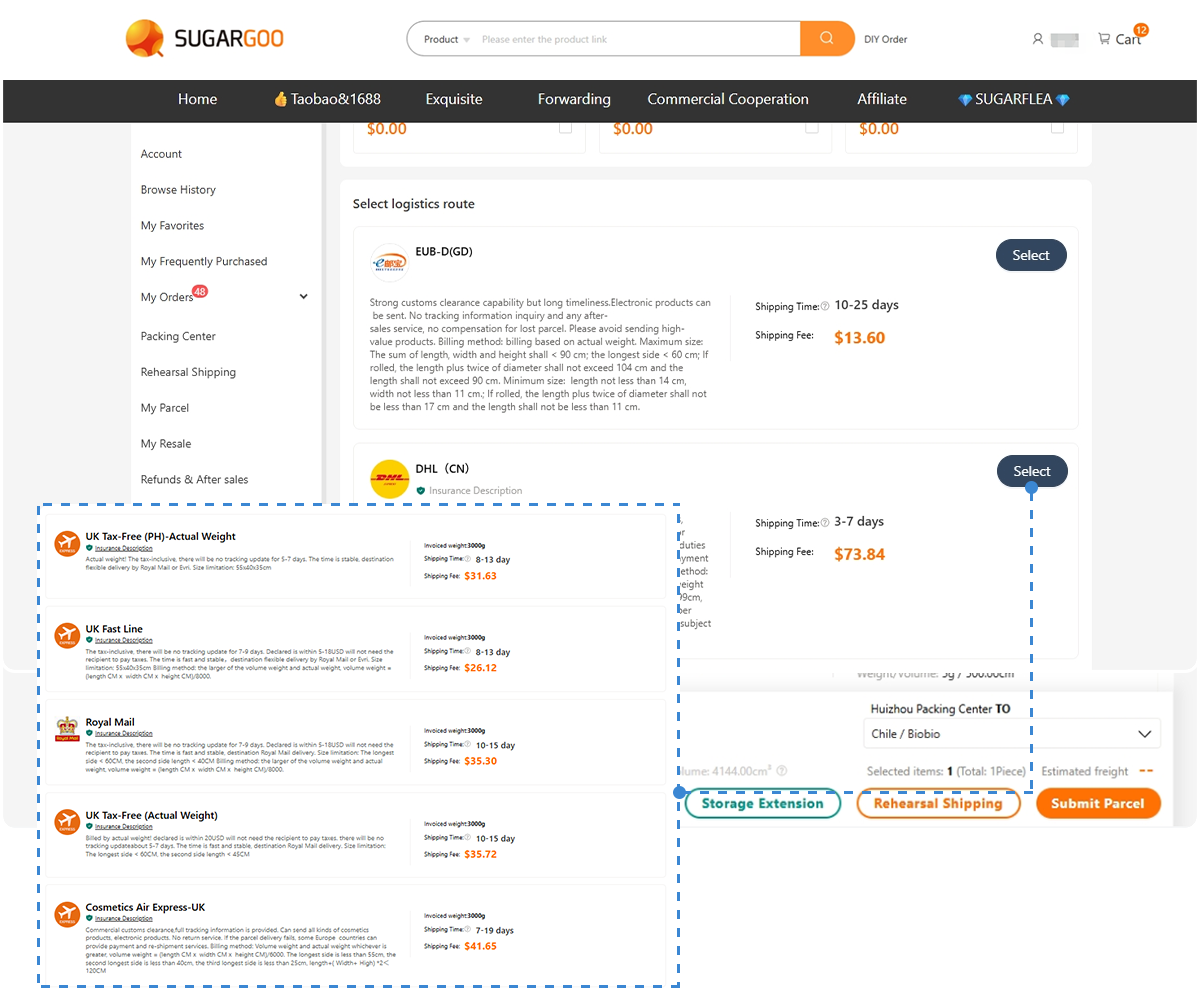

How Quotes Are Experienced: Predictable vs Variable Outcomes

Most small buyers receive a single, all-in quote from a logistics provider. How that quote behaves matters more than how it’s calculated.

Air shipping usually feels:

- Straightforward

- Stable from quote to payment

- Easy to evaluate before shipping

Rail shipping often feels:

- Moderately priced

- Clear upfront, but with limited route flexibility

- Dependent on schedules and destinations

Sea shipping for small volumes tends to feel:

- Cheap at first glance

- Less predictable by the end

- More sensitive to external factors

Key takeaway:

The cheapest-looking quote is not always the safest one.

Cost Comparison in Practice: What Small Buyers Actually Experience

At small volumes, the real-world cost gap between air, rail, and sea shipping is often narrower than expected.

In practice:

- Air shipping feels expensive per kilogram, but total cost is controlled

- Rail shipping often sits in the middle, balancing price and transit time

- Sea shipping may appear cheapest, but final costs can exceed expectations

For small buyers, cost stability is often more valuable than marginal savings.

Key takeaway:

For small shipments, predictability matters more than theoretical savings.

Time Is an Economic Factor, Not a Convenience Feature

Shipping time directly affects inventory turnover and cash flow.

- Air shipping enables fast testing, quick restocks, and flexible planning

- Rail shipping offers a compromise: slower than air, but faster than sea

- Sea shipping locks inventory for long periods and increases exposure to delays

For small buyers, time lost often costs more than money saved.

Key takeaway:

Slower shipping increases financial pressure for small buyers.

Risk Tolerance: Choosing Based on What You Can Afford to Lose

Each shipping method carries a different risk profile.

Air shipping is best for:

- New product launches

- First-time suppliers

- High-value or time-sensitive goods

Rail shipping works well when:

- Orders are too large for comfort by air

- Timing is important but not urgent

- Routes are available and stable

Sea shipping is most suitable when:

- Products are proven

- Demand is predictable

- Delays can be absorbed

Key takeaway:

The right shipping method depends on how much uncertainty you can tolerate.

Operational Simplicity Favors Smaller Buyers

Logistics complexity scales poorly downward.

- Air shipping has the shortest process chain and lowest friction

- Rail shipping adds coordination but remains manageable

- Sea shipping introduces long workflows where small issues can escalate

Small buyers typically lack the resources to manage complex exceptions.

Key takeaway:

What large importers can manage easily may overwhelm small buyers.

Minimum Volume and Access: Who Each Method Is Designed For

Accessibility is a critical but often ignored factor.

Air shipping:

- Naturally supports small parcels

- Works even at very low weights

- Ideal for frequent, irregular shipments

Rail shipping:

- Requires moderate volume

- Limited by destination and route availability

- Not suitable for very small parcels

Sea shipping:

- Fundamentally volume-driven

- Rarely efficient for small shipments

- Often unavailable or impractical below certain thresholds

This is a structural difference, not a pricing trick.

Key takeaway:

Air shipping is accessible by default. Rail and sea shipping require scale.

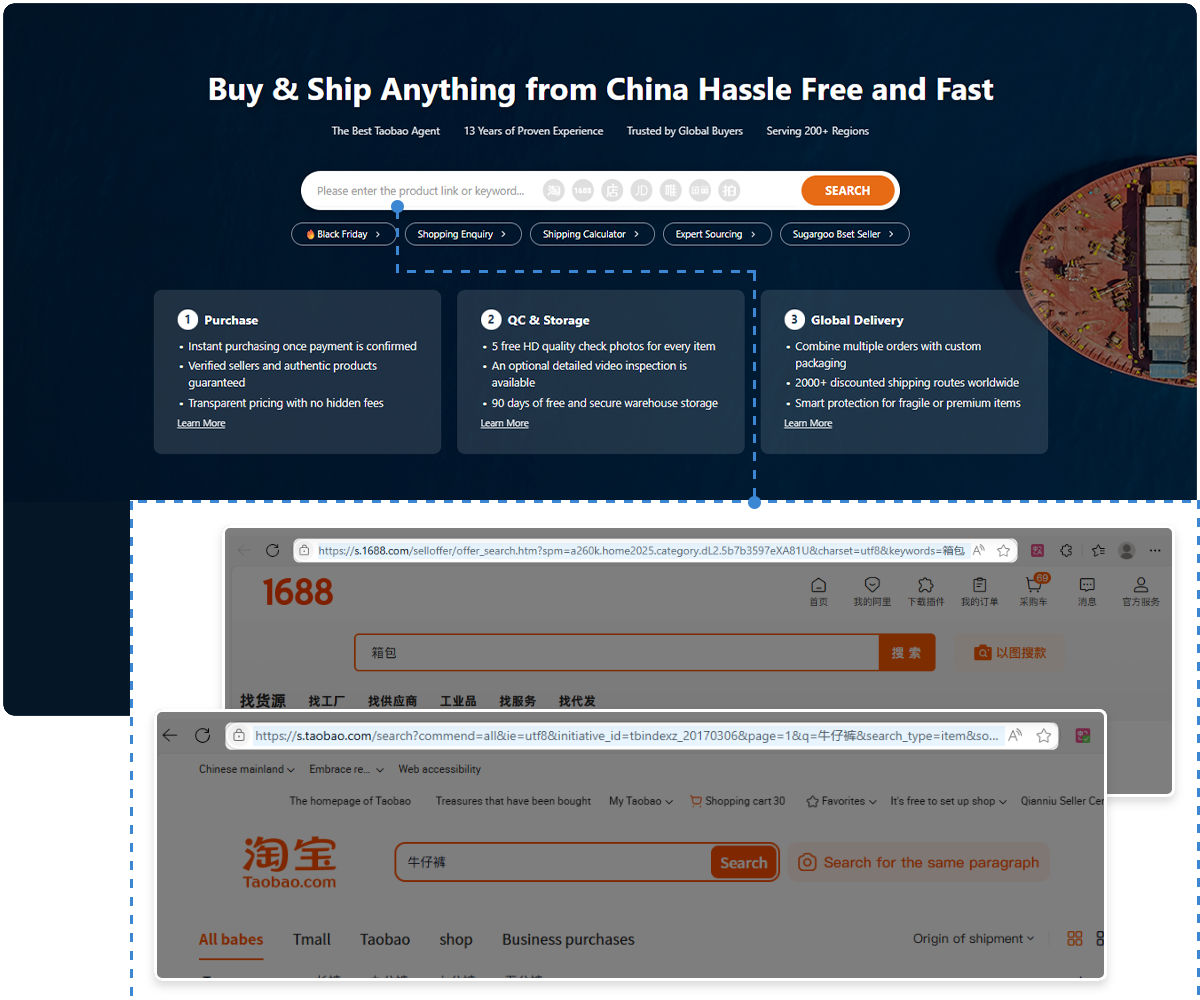

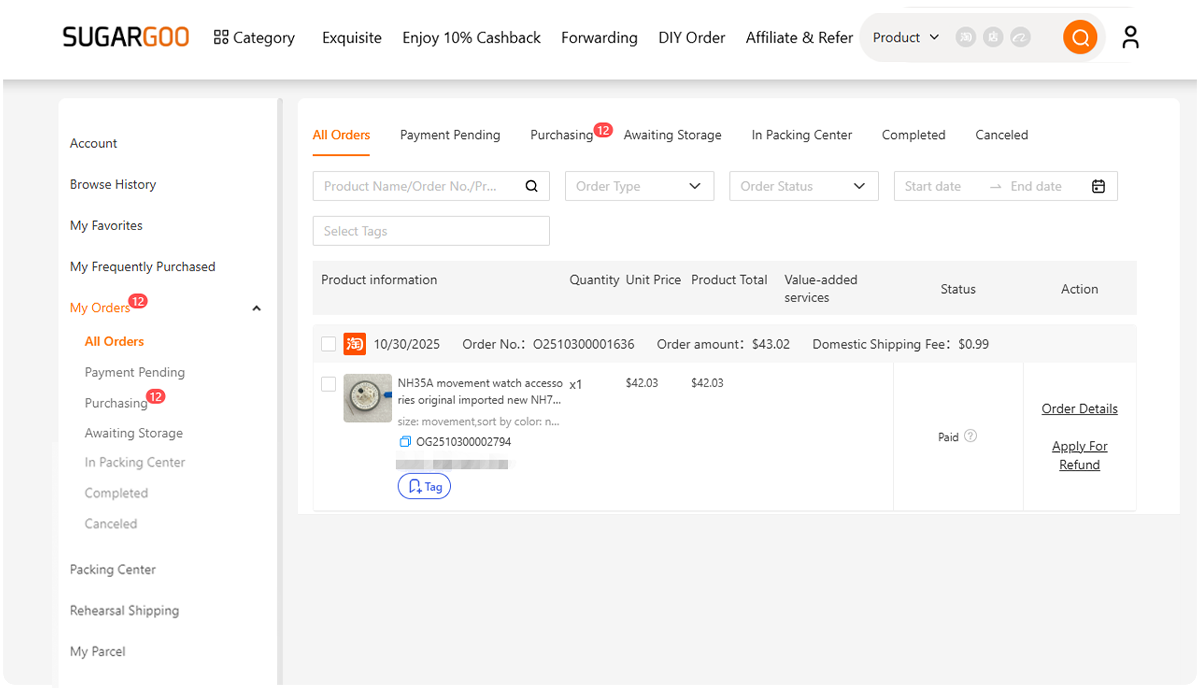

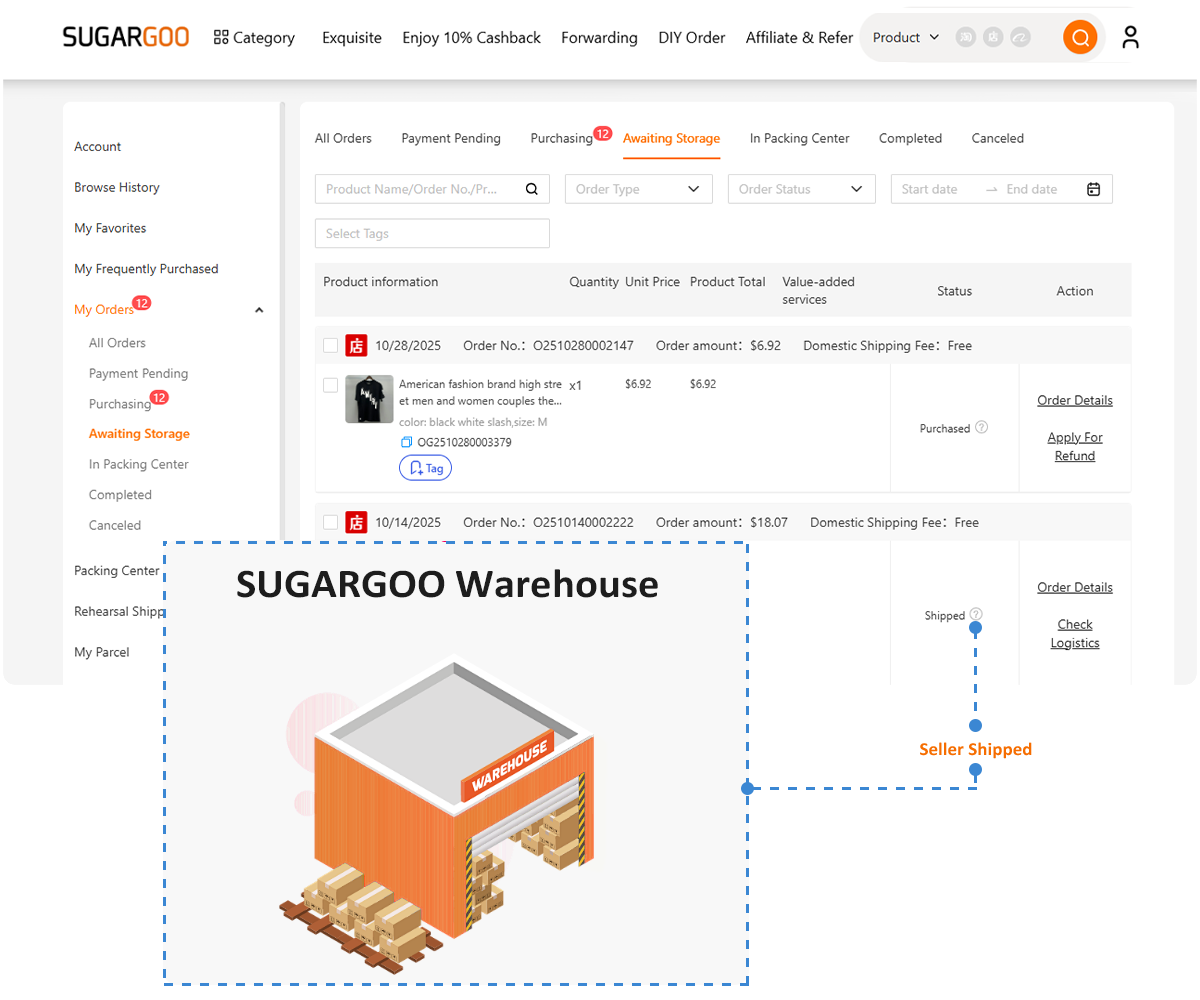

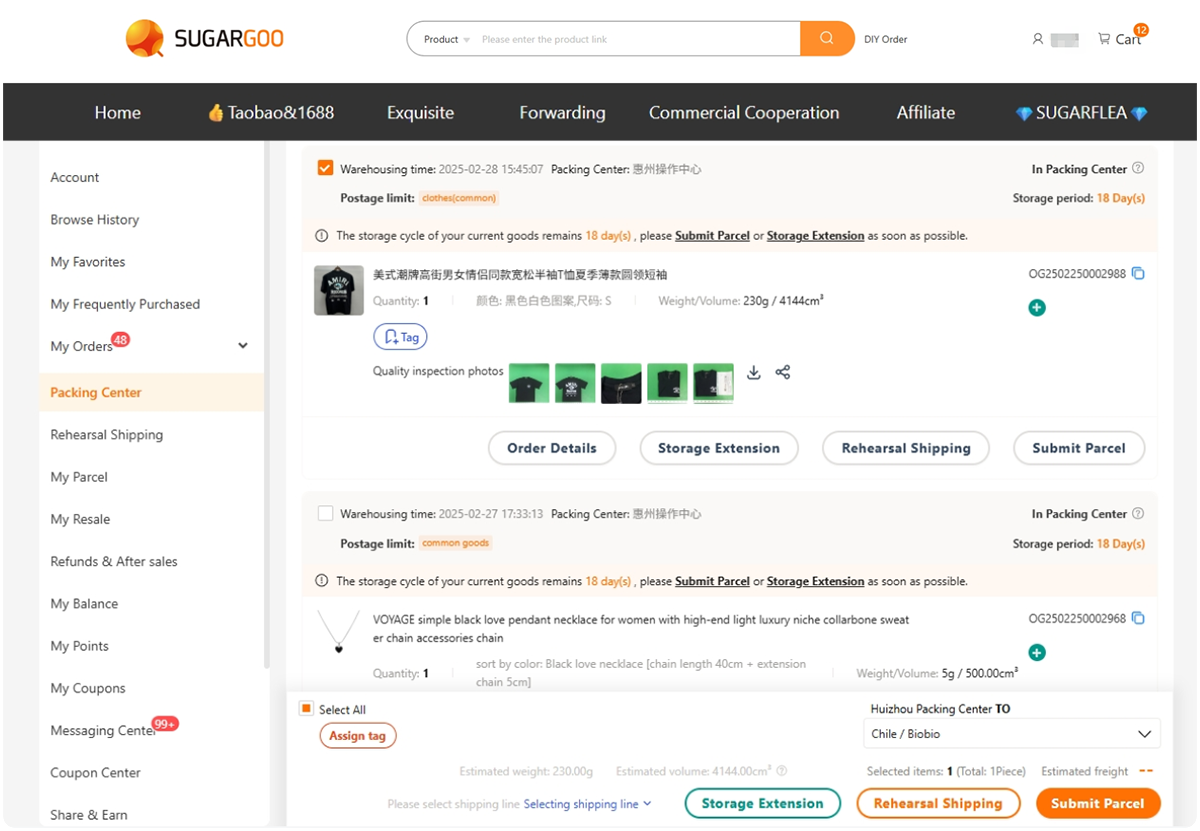

How Small Buyers Reduce Shipping Risk with Warehousing and Consolidation

For small buyers, the challenge is not choosing a single “best” shipping method — it’s gaining access to better options before volume is large enough.

This is where warehousing, consolidation, andmultiple shipping lines become practical tools rather than advanced logistics concepts.

By storing purchases in a local warehouse, small buyers can:

- Wait for multiple orders to arrive

- Combine small parcels into one shipment

- Choose the most suitable shipping line based on current weight, timing, and destination

Instead of being forced into air, rail, or sea shipping too early, buyers gain flexibility.

They can ship immediately when speed matters, or consolidate when cost efficiency becomes more important.

Key takeaway:

Warehousing and consolidation make shipping decisions more controllable.

Weight-Based Decision Guide (Quick Reference)

For small buyers looking for fast answers:

- 0-10 kg → Air shipping is almost always the most practical option

- 10-30 kg → Air or rail shipping, depending on urgency and risk tolerance

- 30-100 kg → Rail shipping becomes increasingly attractive where available → Sea shipping begins to make sense

Shipping Choice Depends on Your Stage

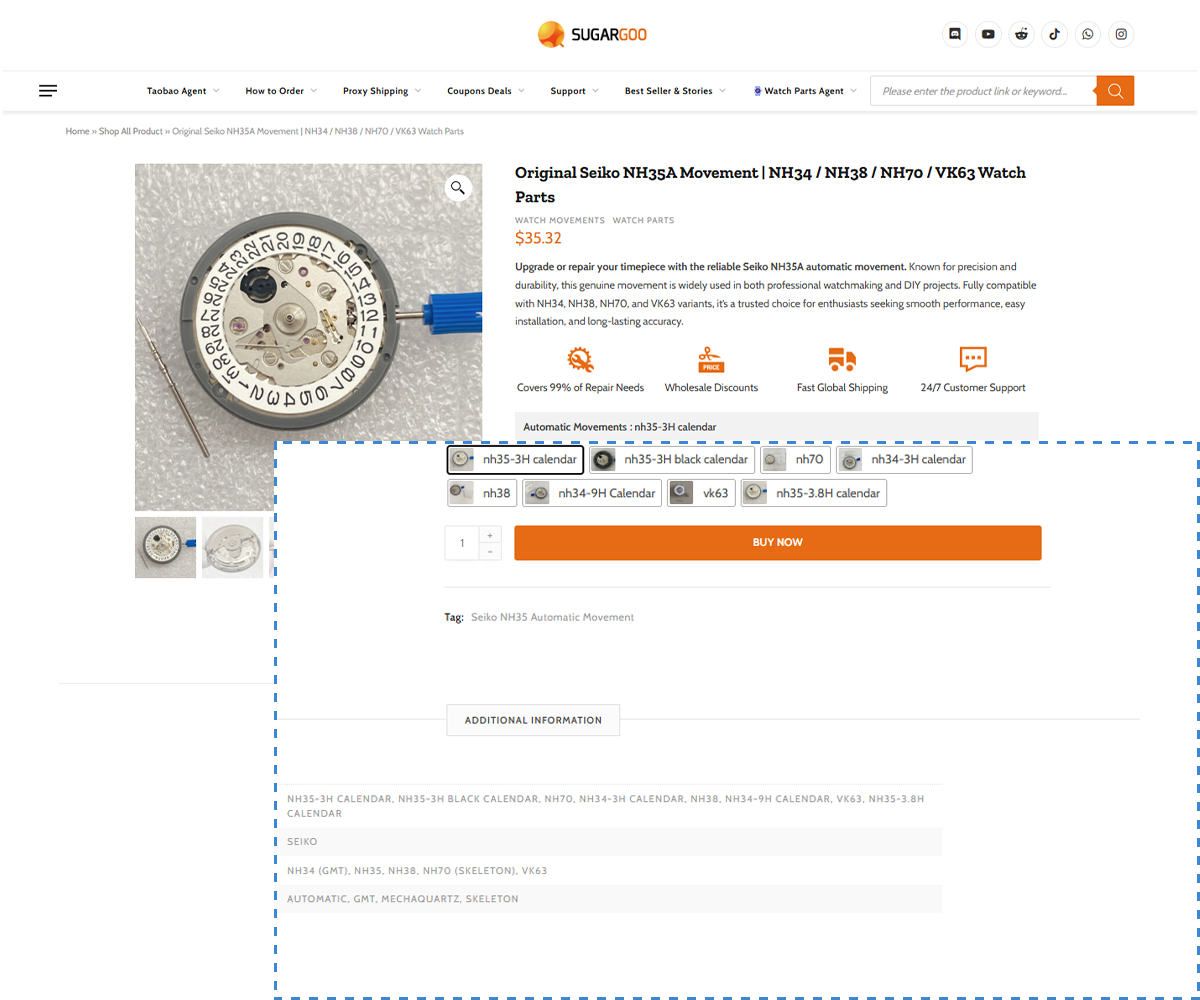

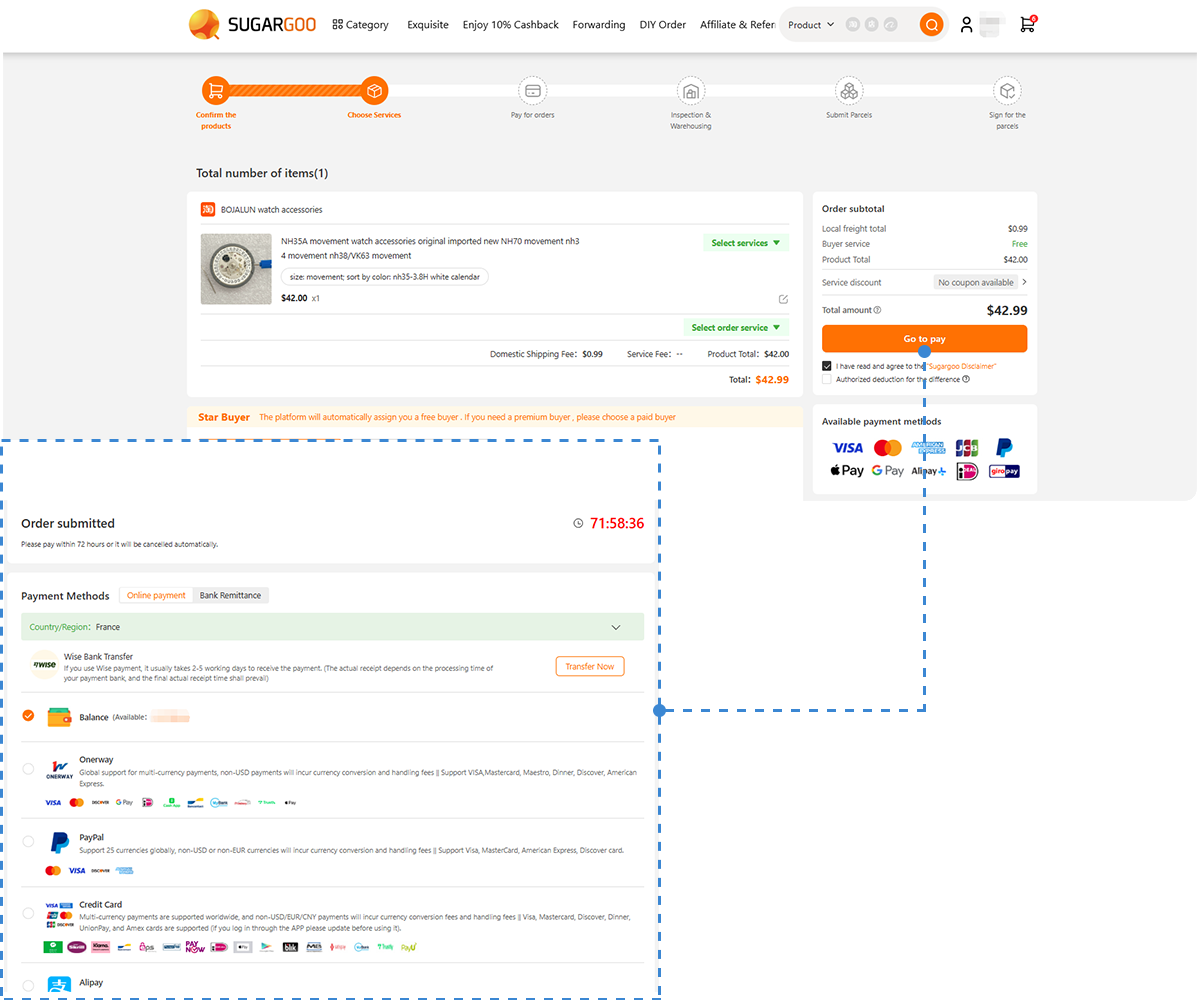

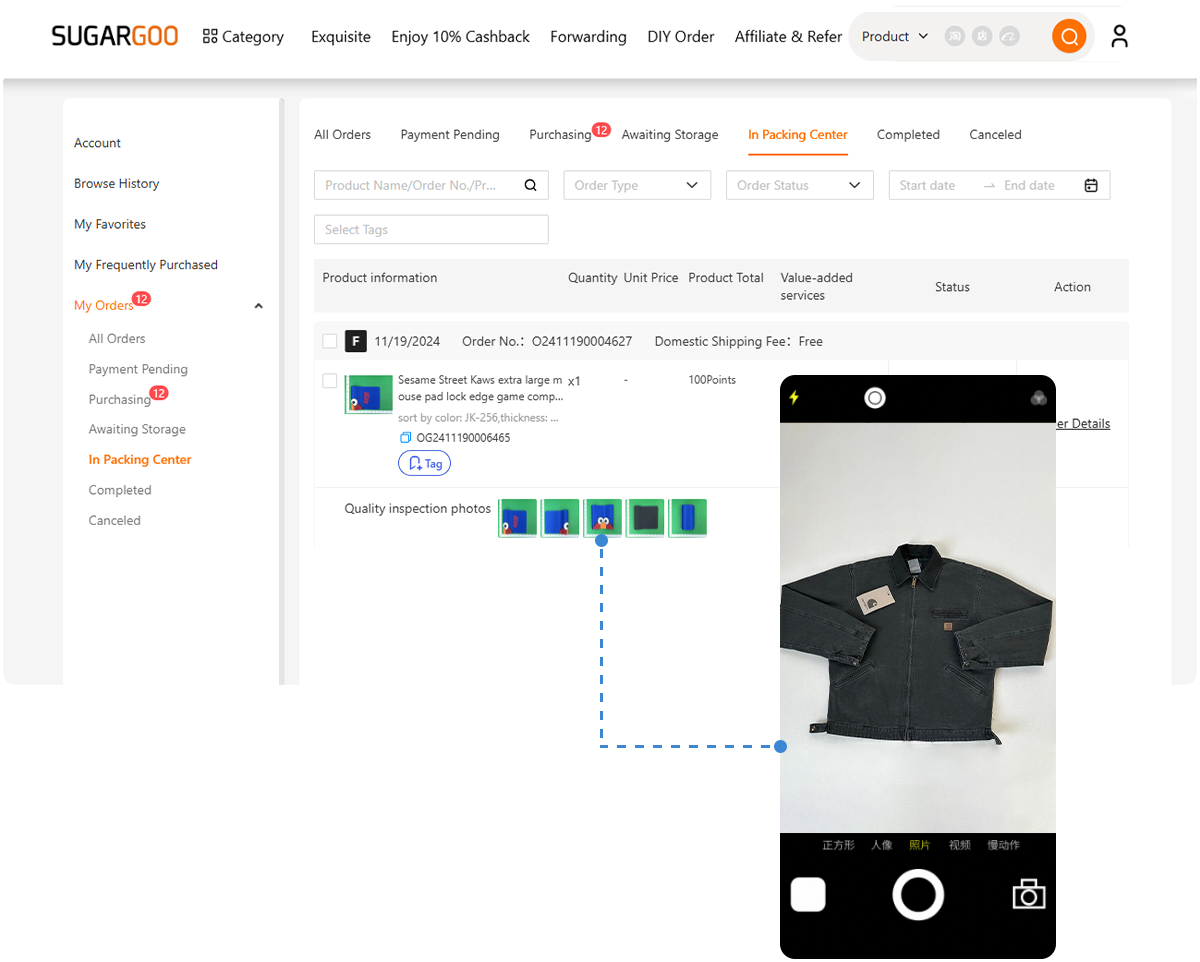

Air, rail, and sea shipping are not competitors — they are tools for different stages. For small buyers, success comes from choosing the method that keeps costs, timelines, and risks under control — not from chasing the lowest headline price. This is also why many buyers choose a proxy like Sugargoo to handle product quality inspection, warehousing, parcel consolidation, repacking and reinforcement,optional insurance, and access to multiple international shipping lines — all in one place.