When I first dipped my toes into shopping directly from China, I was convinced the most challenging part would be clicking around Taobao’s Chinese pages or deciding whether 1688 had better wholesale prices than JD. That was… until my first parcel got flagged by customs.

Here’s how it went: I ordered some jackets, felt like a genius for snagging them cheap, and then—bam—a message from my local post office asking for extra payment. The “cheap” clothes ended up costing nearly double. That was my crash course in import taxes.

If this sounds familiar, you’re not alone. Many first-time buyers are often caught off guard by duties or VAT. Some even have boxes returned, never to be seen again. This guide is my way of saving you that pain. I’ll explain how customs works, why some goods attract more attention, what “duty-free” actually means, and the strategies I use to avoid nasty surprises.

⚠️ remember: this is based on my experience and general research. Rules shift often, so always double-check with your own country’s customs office before placing an order.

Why Customs Exist in the First Place

People often complain: “Didn’t I already pay for the product? Why am I being charged again?” Believe me, I’ve muttered the exact words. But there’s a reason for it.

Governments charge border fees because:

- They want to protect local industries from being undercut.

- They need to regulate restricted or sensitive products.

- And yes, they want the tax revenue.

What form do these charges take?

- Import duties (border tariffs, basically).

- Consumption taxes like VAT or GST.

- Extra levies on luxury goods, cigarettes, or alcohol.

- Clearance fees from the courier handling your package.

No matter how small, every parcel is looked at. The only variable is whether you pay nothing, a small amount, or a lot.

Think Beyond “Product Price”

Here’s a mistake I made early on: I saw a gadget for $30, ordered it, and thought that was all I’d spend. By the time it reached my hands, I’d shelled out another $35 in postage and taxes. Lesson learned.

So, before you rush to checkout, here’s what to do:

- Run a cost check. Most platforms have shipping calculators now—use them.

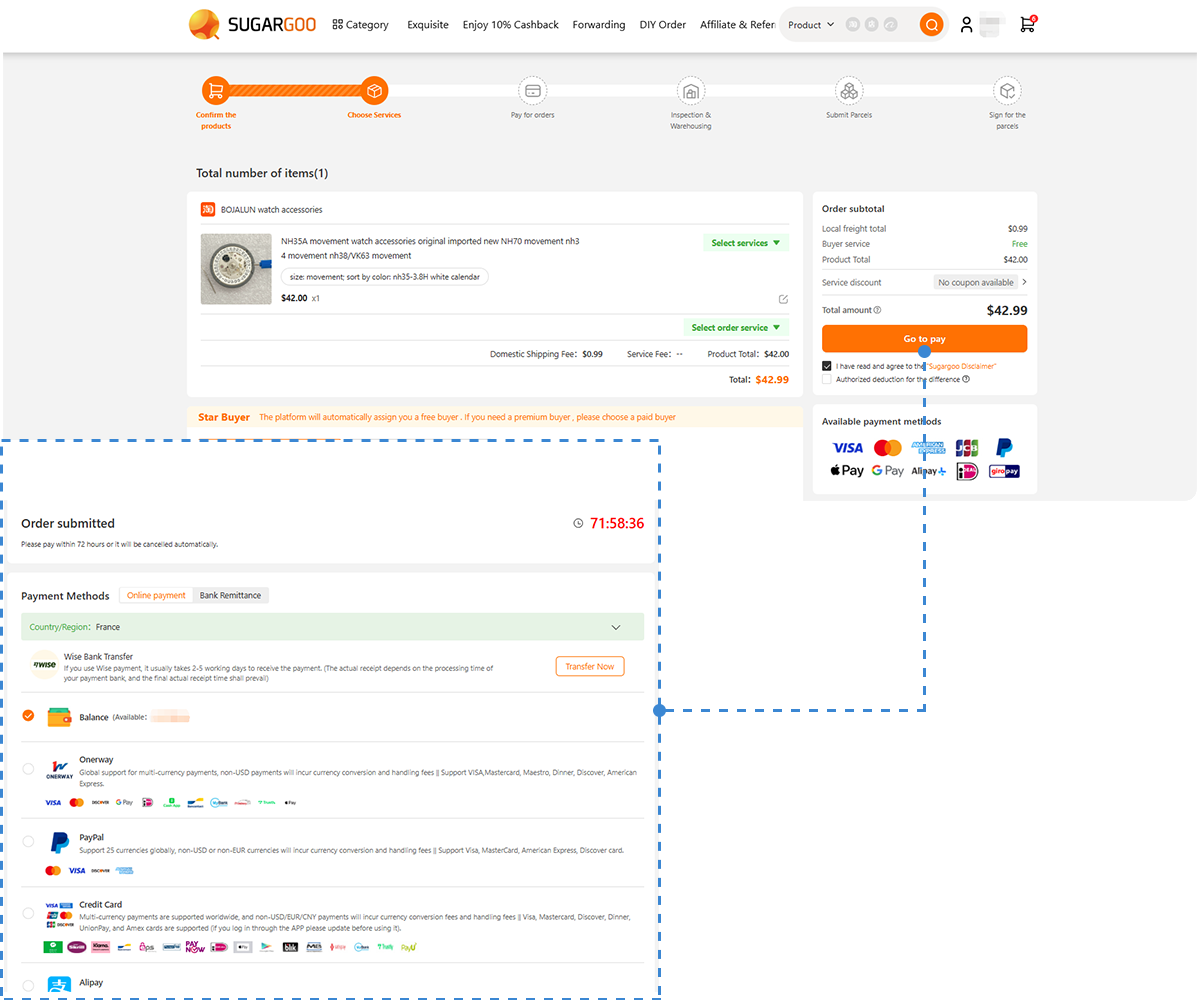

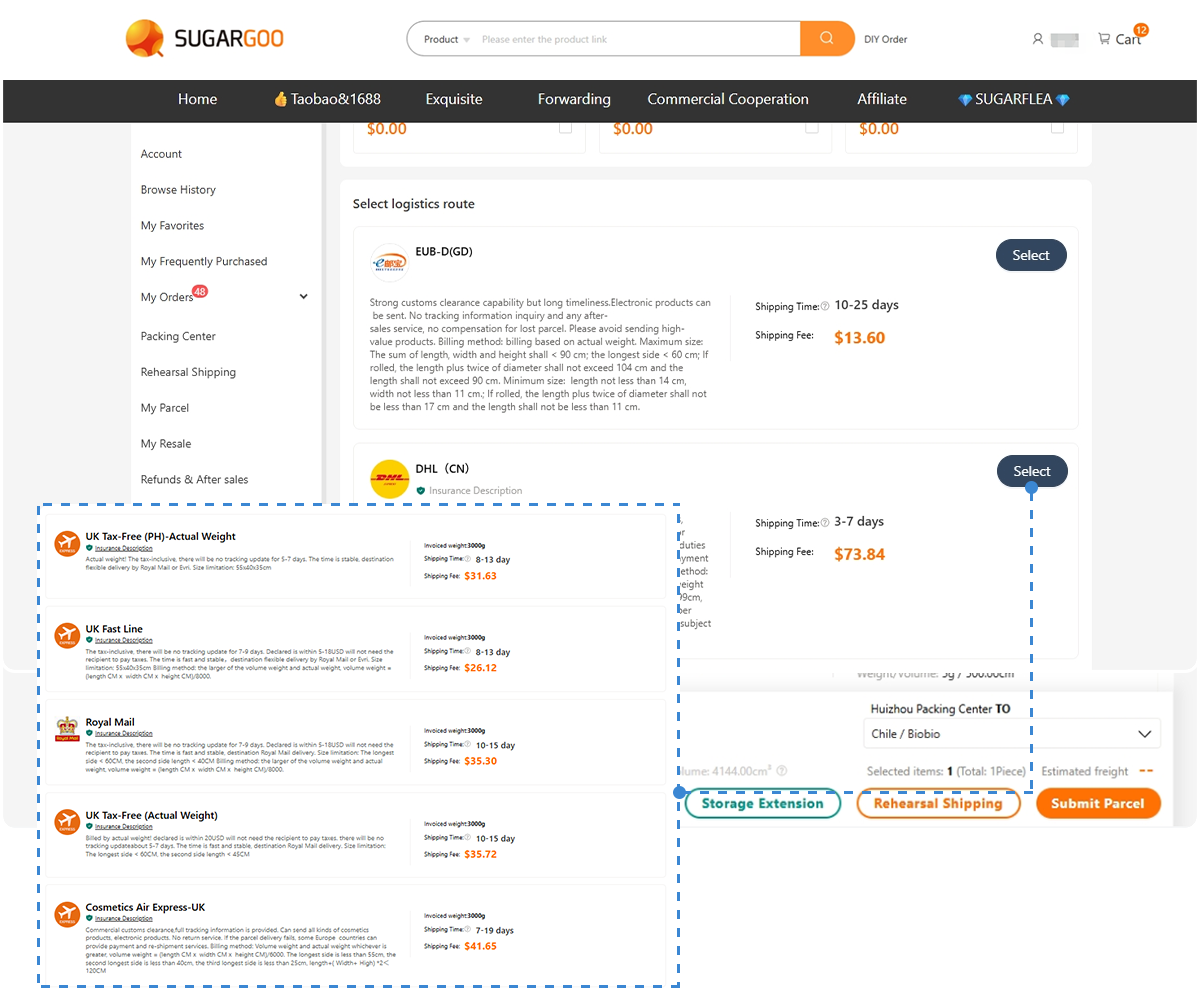

- Compare delivery options. DDP routes cover tax upfront, DDU makes you pay later.

- Bundle orders together. Combining two or three packages into one shipment can be much cheaper.

👉 My quick rule:

- Heavy but compact items (like shoes) are best on weight pricing.

- Light but bulky items (like pillows or jackets) are billed by volume.

- Buying from multiple sellers? Go for parcel consolidation.

Picking the Right Route

Not all shipping methods are created equal. The route you choose can decide whether your parcel breezes through or ends up on a customs officer’s desk.

Here’s my breakdown:

| Package Type | Best Route | Why |

| Small + expensive (phones, jewelry) | Express courier (DHL, FedEx, UPS) | Quick, trackable, but almost always inspected |

| Everyday goods (clothes, skincare, toys) | Air freight | Strikes a balance between cost and speed |

| Bulk shipments (furniture, cartons) | Sea freight | Cheapest per kilo, but clearance is slow |

| Restricted goods (batteries, liquids, food) | Specialized lines | Built to comply with tricky import rules |

And don’t forget the jargon:

- DDP (Delivered Duty Paid): All duties prepaid, no drama at the border.

- DDU (Delivered Duty Unpaid): Customs holds your parcel until you cough up.

If you’re new, DDP will save you many headaches.

Duty-Free Limits Around the World (2025 Update)

Every country sets a line, sometimes called a tax-free limit or de minimis. Stay below it and you usually pay nothing. Cross it, and you’re hit with fees.

The biggest shocker recently? On August 29, 2025, the U.S. scrapped its famous $800 allowance. From that date forward, every import—yes, even a $10 phone case—faces duties or flat fees.

Here’s where major countries stand now:

| Country/Region | Duty-Free Limit | Notes / Updates |

| United States | None (used to be $800) | As of Aug 29, 2025, all imports are taxed. |

| Canada | CAD $800 | Personal goods only; GST/HST may still apply. |

| European Union | €0 | Since 2021, all parcels are taxable. |

| United Kingdom | £15 | One of the lowest thresholds. |

| Australia | AUD $1,000 (~USD $650) | Generous compared to most. |

| Japan | ¥10,000 (~USD $70) | Small parcels can escape tax. |

| South Korea | ₩150,000 (~USD $110) | Personal-use goods only. |

| Singapore | SGD $400 (~USD $290) | Relatively high allowance. |

| New Zealand | NZD $35 | Almost everything taxed. |

| Malaysia | RM 500 (~USD $108) | Low; taxes apply above this. |

👉 Example: a $200 box might clear in Australia with no extra cost, but in the EU it’ll definitely trigger VAT, and in the U.S. (post-2025) it’s now taxed too.

Items Customs Can’t Resist Inspecting

From what I’ve seen, some products almost guarantee extra attention:

- High-value tech and luxury goods (phones, watches, handbags).

- Liquids and cosmetics (safety regulations apply).

- Food and supplements (often need health permits).

- Batteries and lithium products (strict air transport rules).

If you’re in these categories, plan ahead—extra checks are likely.

Customs rules can feel intimidating, and it’s normal for new shoppers to worry whether using a third-party agent is safe at all. If you’ve been asking yourself this question, here’s a safety guide that explains the risks and the protections available.

Tricks That Actually Work

Over time, I’ve figured out some habits that keep packages moving:

- Keep it under 10kg. Large boxes look commercial.

- Don’t ship 10 identical items. Customs will assume resale.

- Declare fairly. Too low? They’ll suspect you. Too high? You overpay.

- Split orders. Two medium parcels often sail through faster than one giant one.

- Pack strong. Weak packaging breaks, and broken boxes invite inspections.

Simple tweaks, but trust me, they reduce stress.

What Clearance Looks Like in Real Life

When your parcel hits customs, one of several things happens:

- It clears instantly (lucky day).

- It gets opened for a random check.

- You’re asked for proof of purchase.

- You’re billed for taxes (if DDU).

- Or, worst case, it’s returned—or destroyed—if they can’t reach you.

After being burned once, I now almost always pick tax-inclusive (DDP) routes. Paying upfront is easier than sleepless nights waiting for a customs notice.

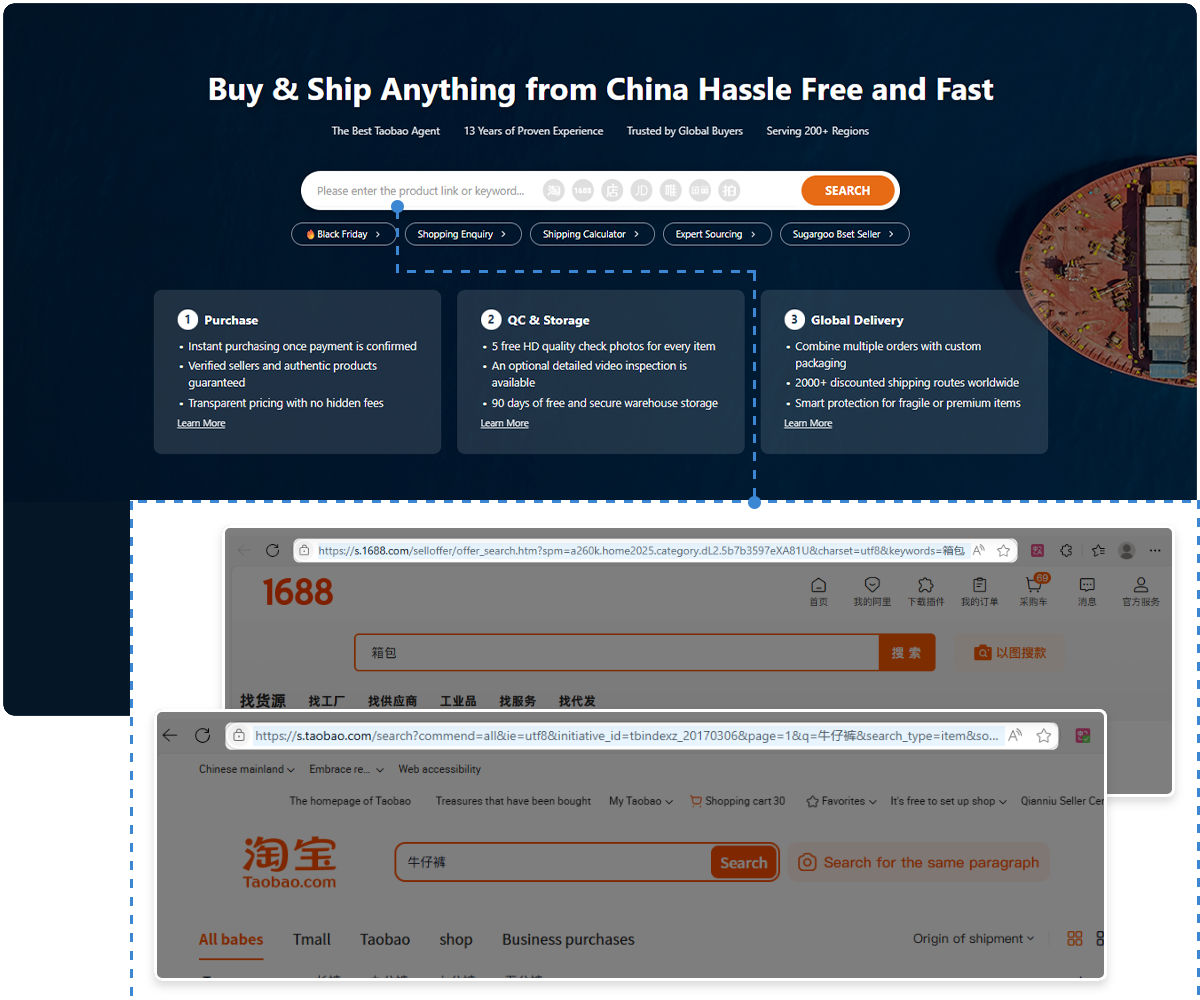

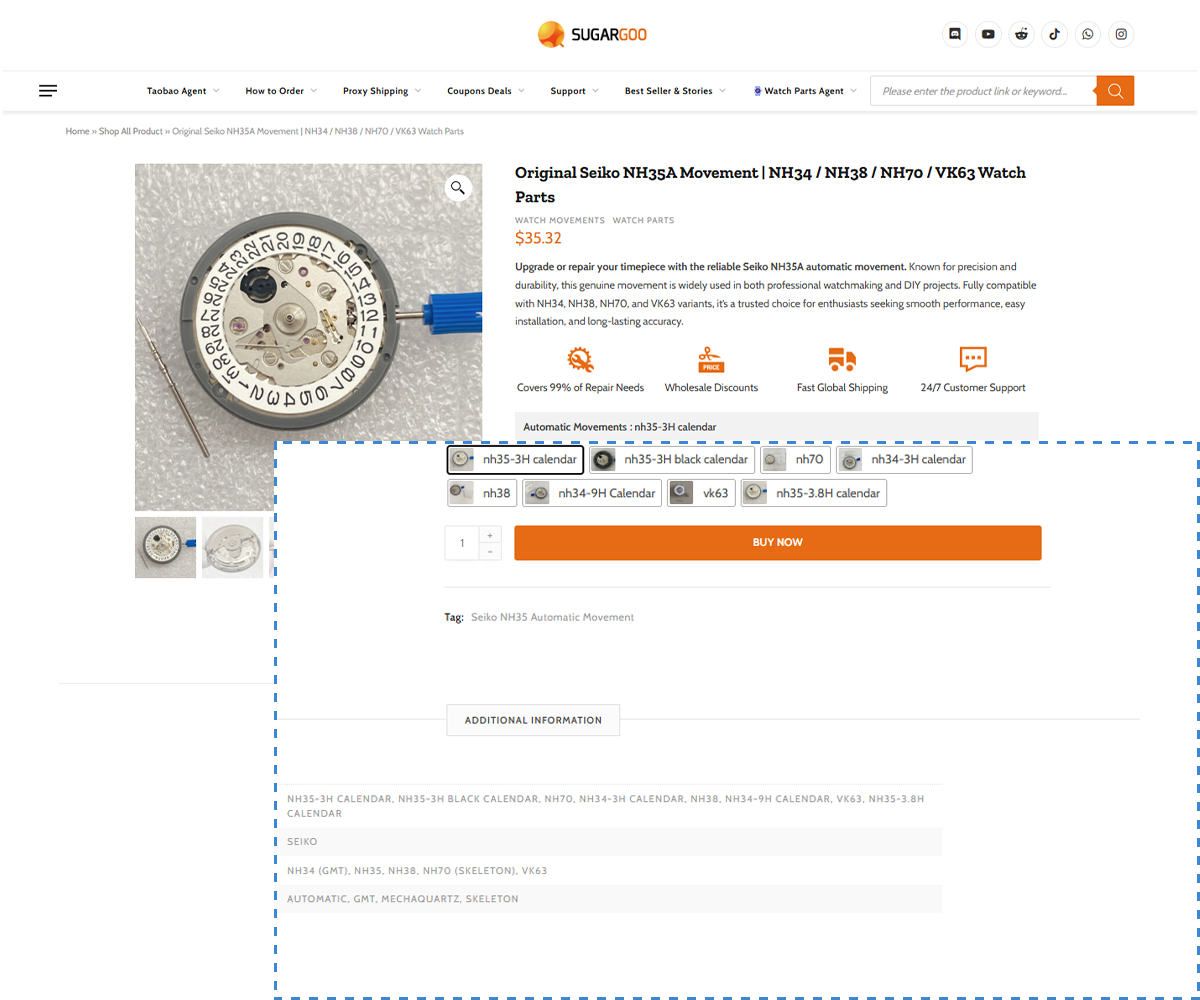

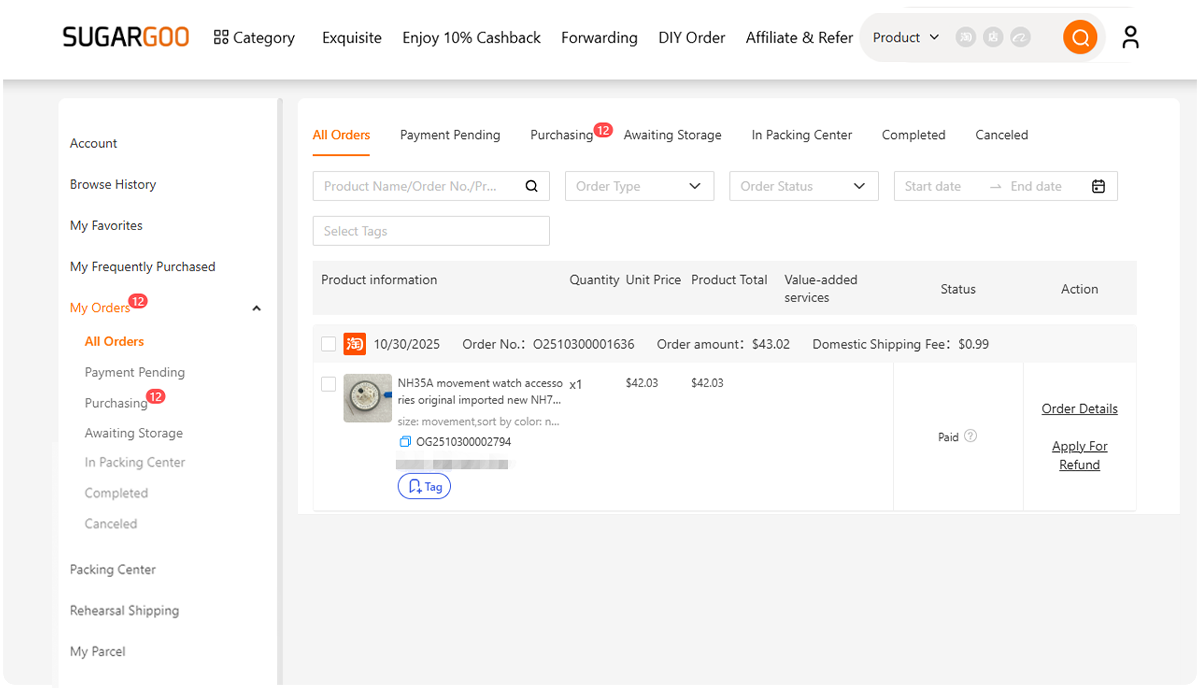

Sugargoo: My Go-To Partner for Chinese Shopping

Even with all this knowledge, managing orders, payments, and logistics on your own can be overwhelming. That’s where Sugargoo steps in. It’s not just another Taobao agent—it’s the platform I lean on to smooth out the messy parts.

Here’s why Sugargoo works for me:

- Real-time exchange rates: Other agents freeze rates in their favor. Sugargoo calculates based on live numbers, so you don’t lose out when the market shifts. For frequent buyers, those small savings add up.

- Multiple payment options: With over 25 methods—from Visa, and MasterCard to Alipay, WeChat Pay, and local options—you can pay however suits you best. Need help? Their payment guide shows the process clearly.

- Wide delivery network: Sugargoo has more than 2,000 international routes. Whether you’re in the U.S., Europe, or Southeast Asia, you’ll find something that balances speed, cost, and customs safety.

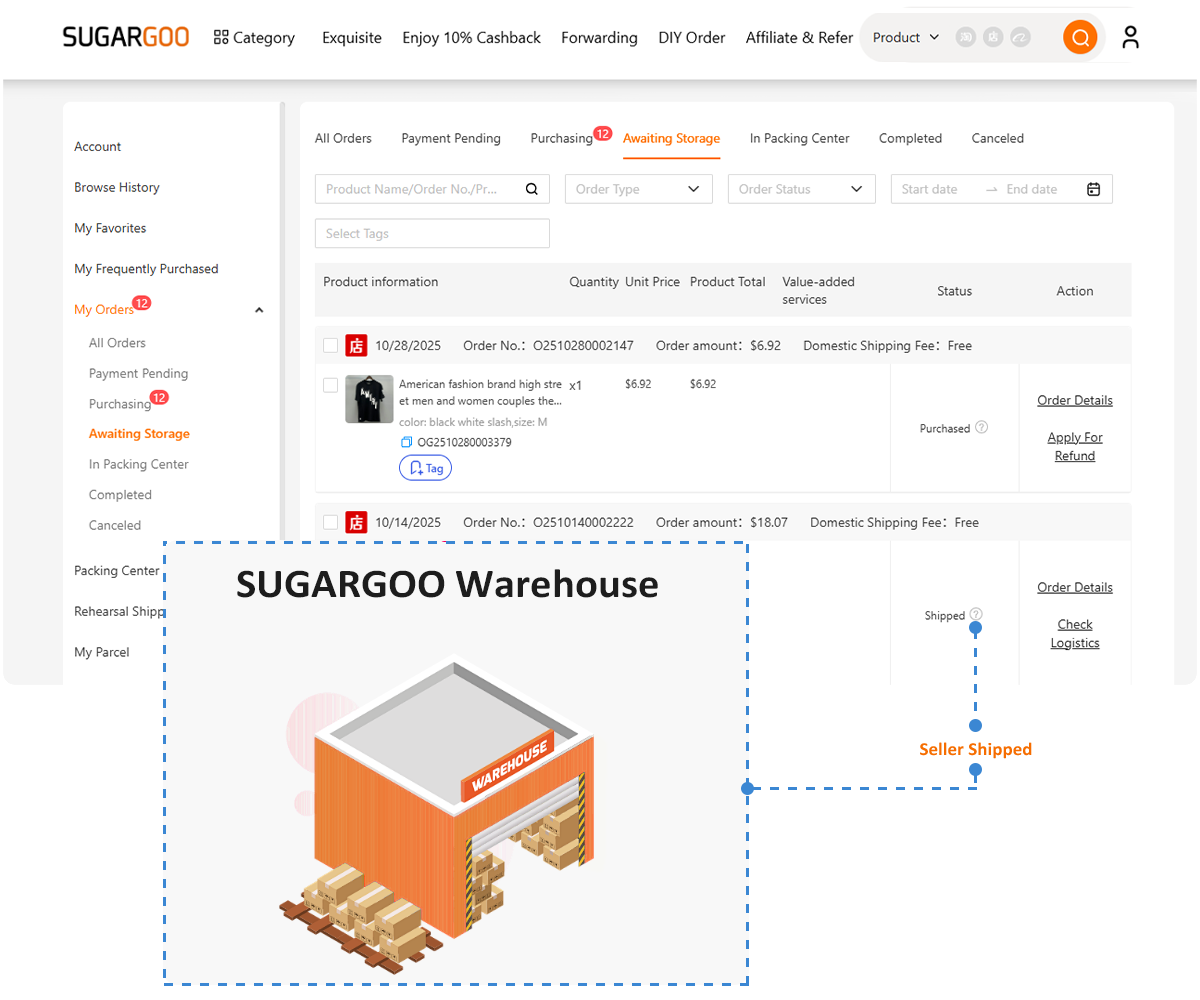

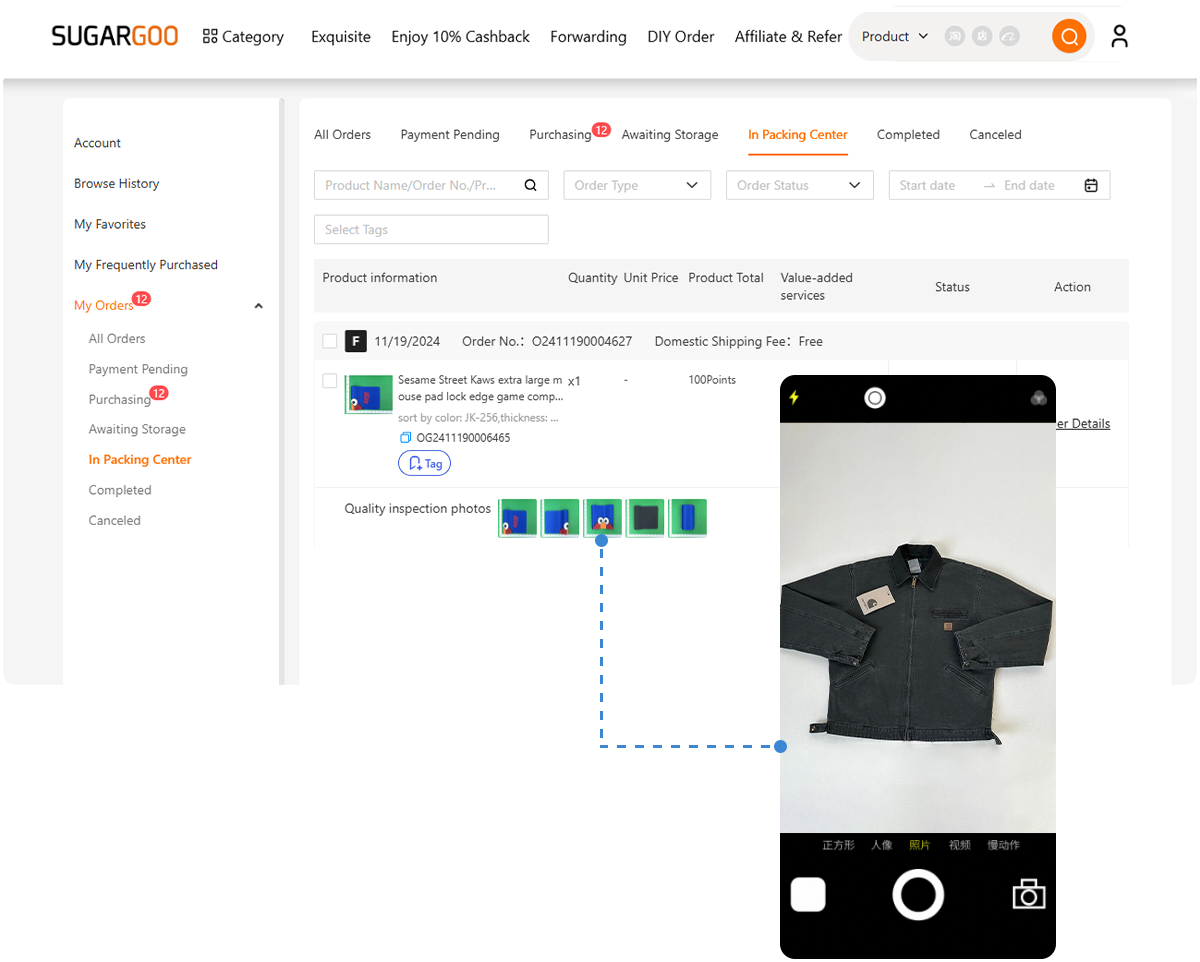

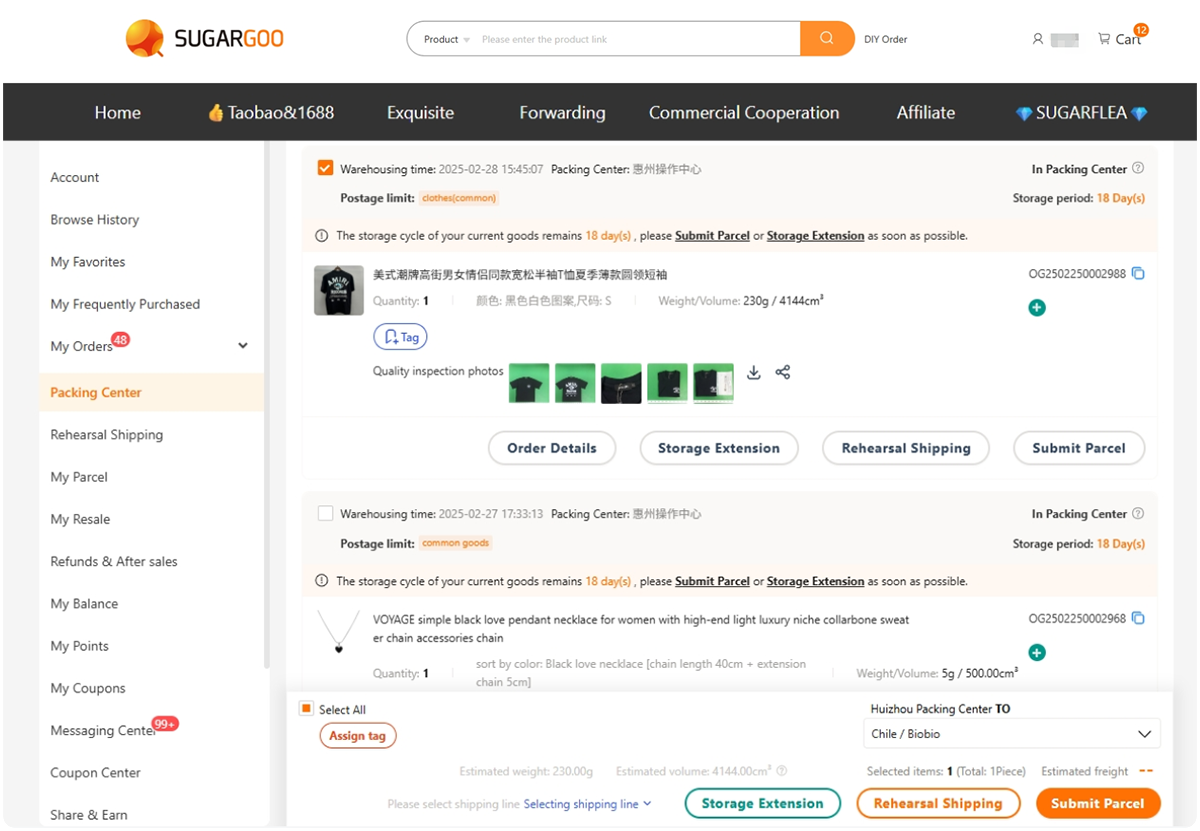

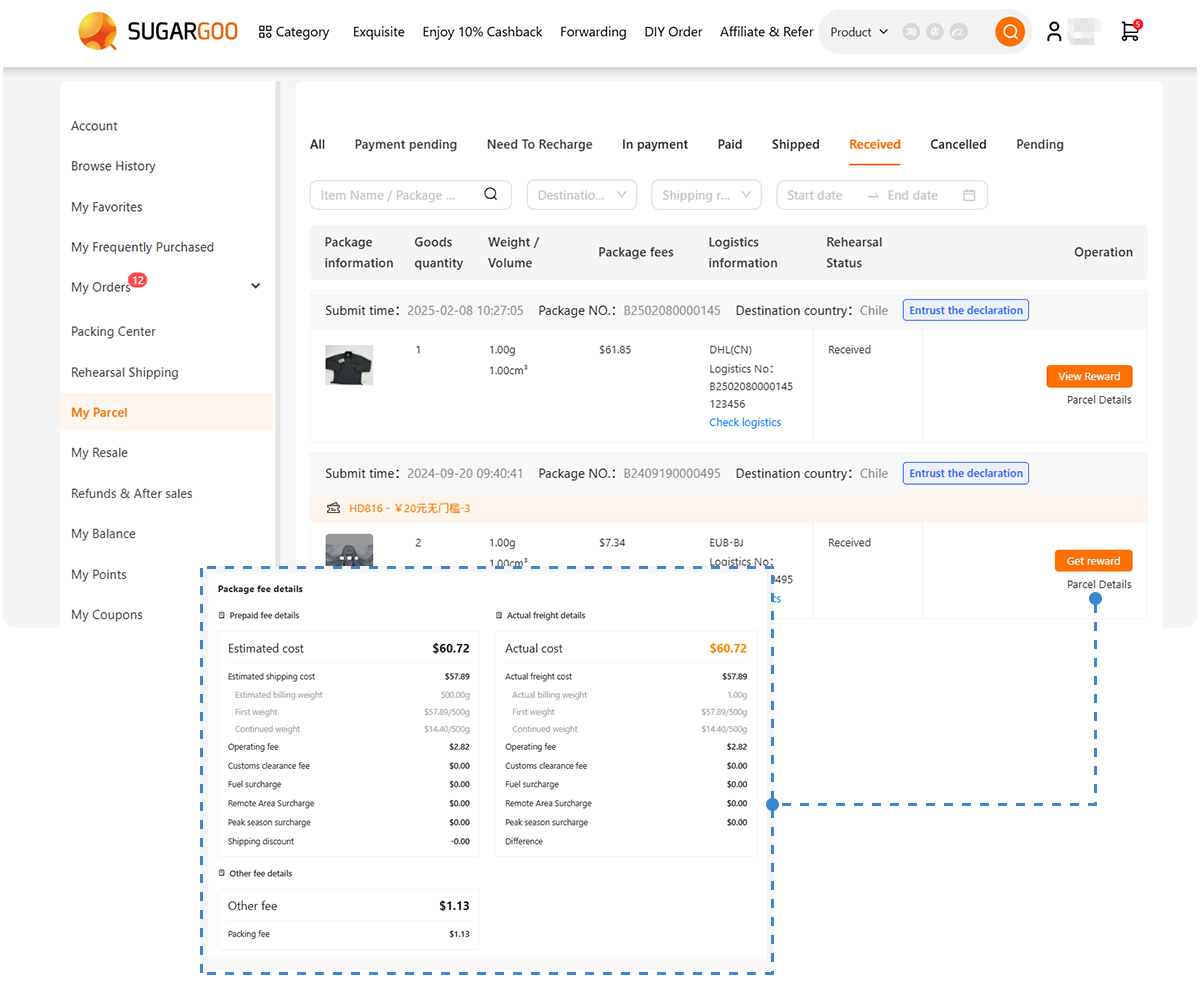

- Add-on extras: I love that I can choose reinforced packaging for fragile items, request photos of my parcel before shipping, extend warehouse storage, or insure the box for full value. Curious? Check their delivery add-on article, or the guide on shipping insurance.

- Actual customer support: Unlike some agents that just send canned replies, Sugargoo’s team has helped me with everything from clearance delays to order consolidation. Whether you’re a casual buyer or a small business, they don’t leave you hanging.

- Helpful guides for every stage

- If you’re new, start by understanding what a Taobao agent really does. Or read a Sugargoo story for a real-world case.

- Still unsure where to shop? The Taobao vs JD comparison is handy. When you’re ready to dive in, the buying with Sugargoo guide gives step-by-step help.

- And once you’ve ordered, you’ll want to know how to consolidate packages and the storage limits.

Your Cross-Border Shopping Checklist

So, what’s the bottom line?

- Always check costs with a shipping calculator.

- Match your shipping method to your product type.

- Declare honestly and keep parcels manageable.

- Use add-ons like consolidation and insurance.

- And remember: product cost is only part of the total—you’ll always face shipping and possible duties.

Cross-border shopping can feel intimidating, especially with new rules like the U.S. ending its $800 exemption. But with preparation—and a reliable partner like Sugargoo—it’s not only manageable, it can even be fun.

Extra Perk for New Shoppers

Sugargoo also runs promotions that make international delivery even more affordable. For instance, once you complete your registration, new users automatically receive an 800 CNY shipping coupon credited to their account. This bonus can be applied to your first parcel right away, reducing upfront costs and letting you try the service with less risk.