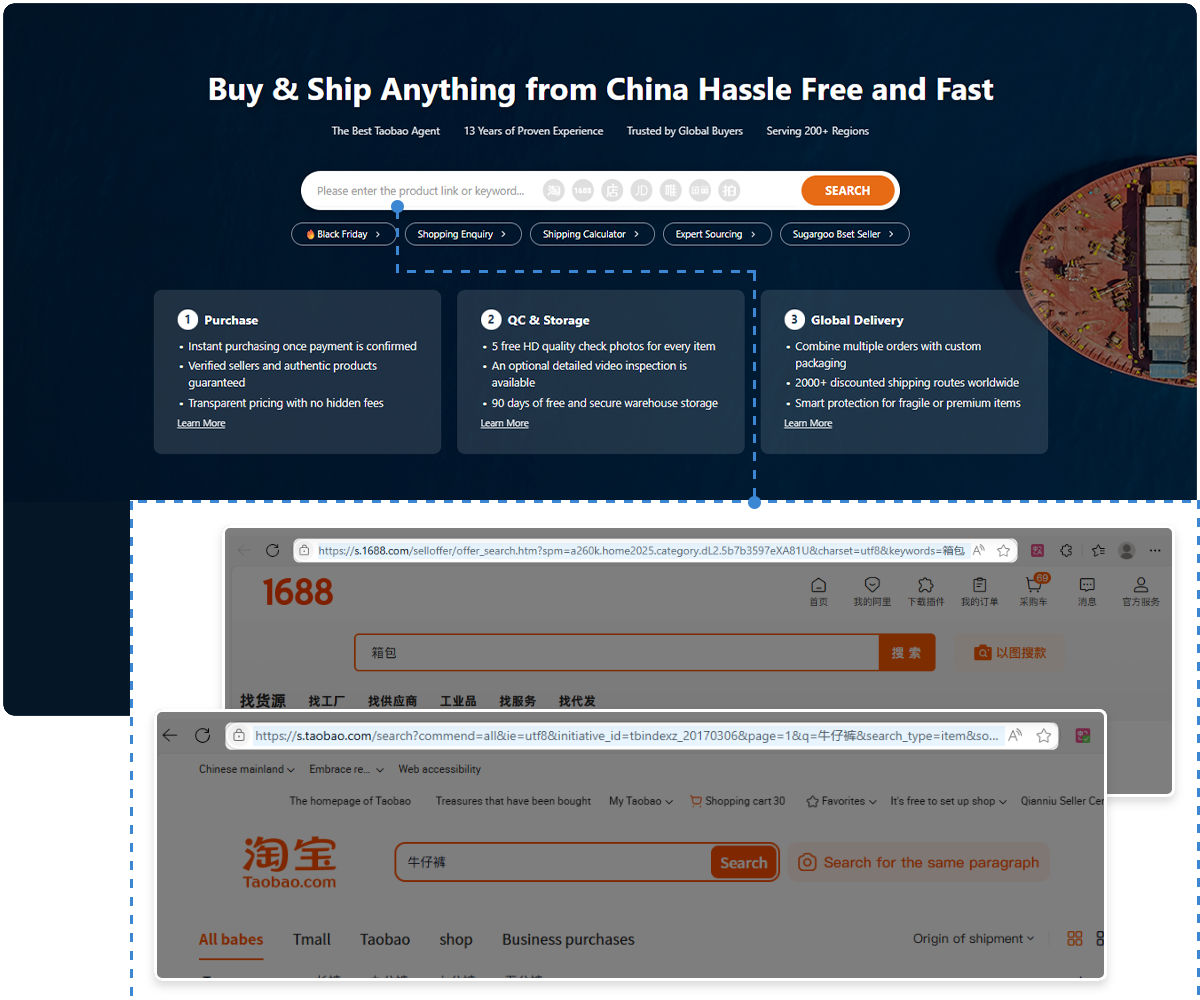

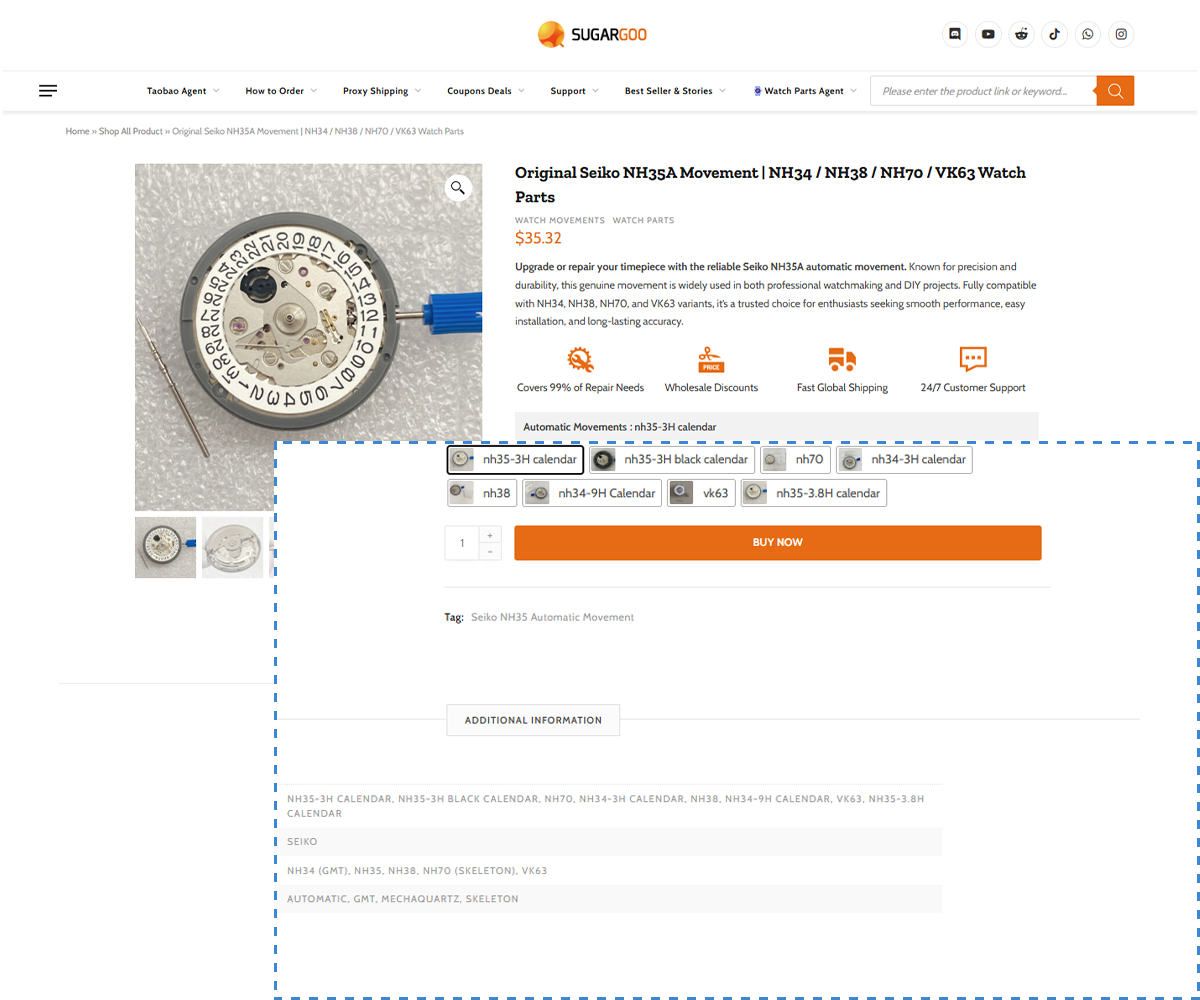

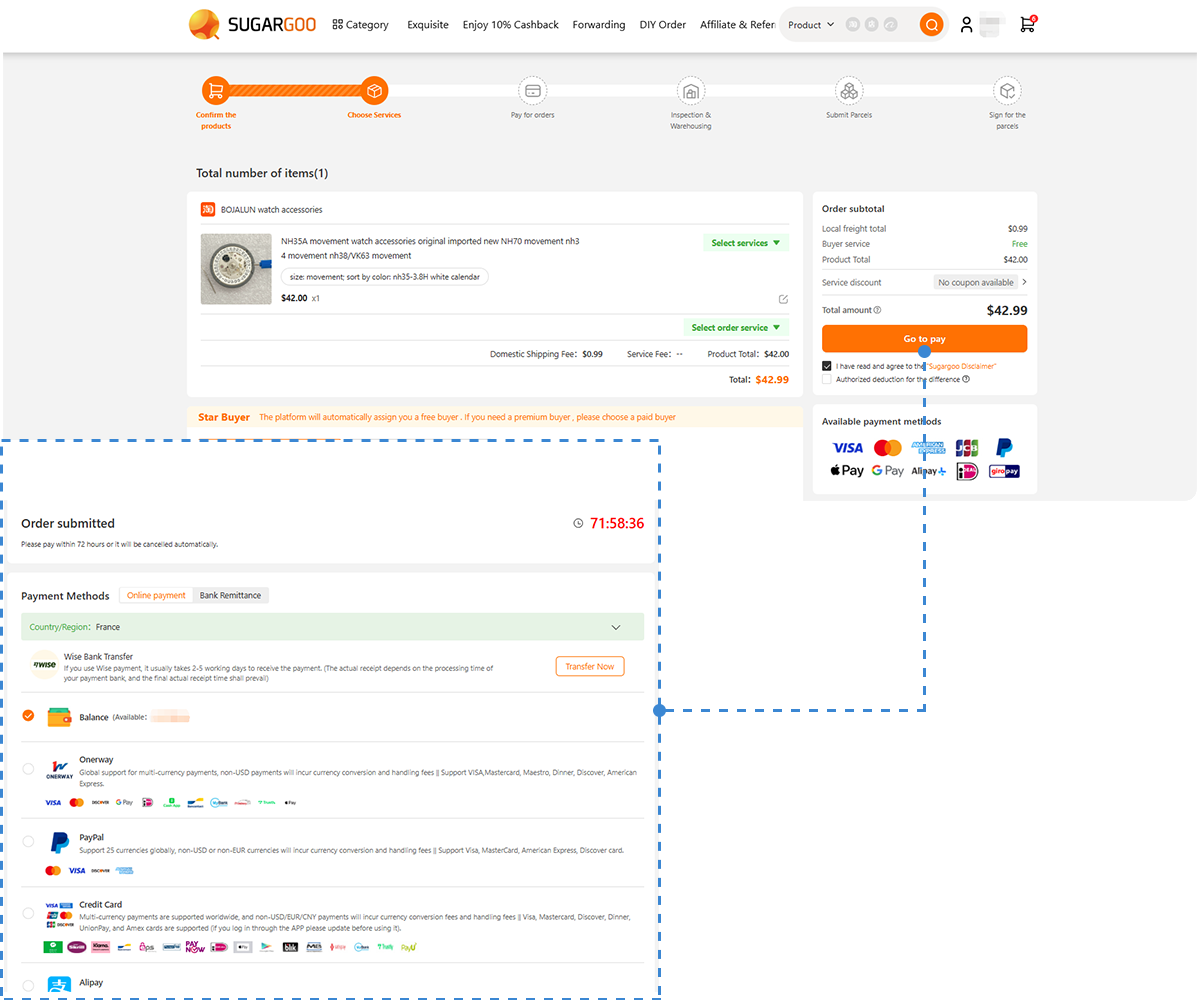

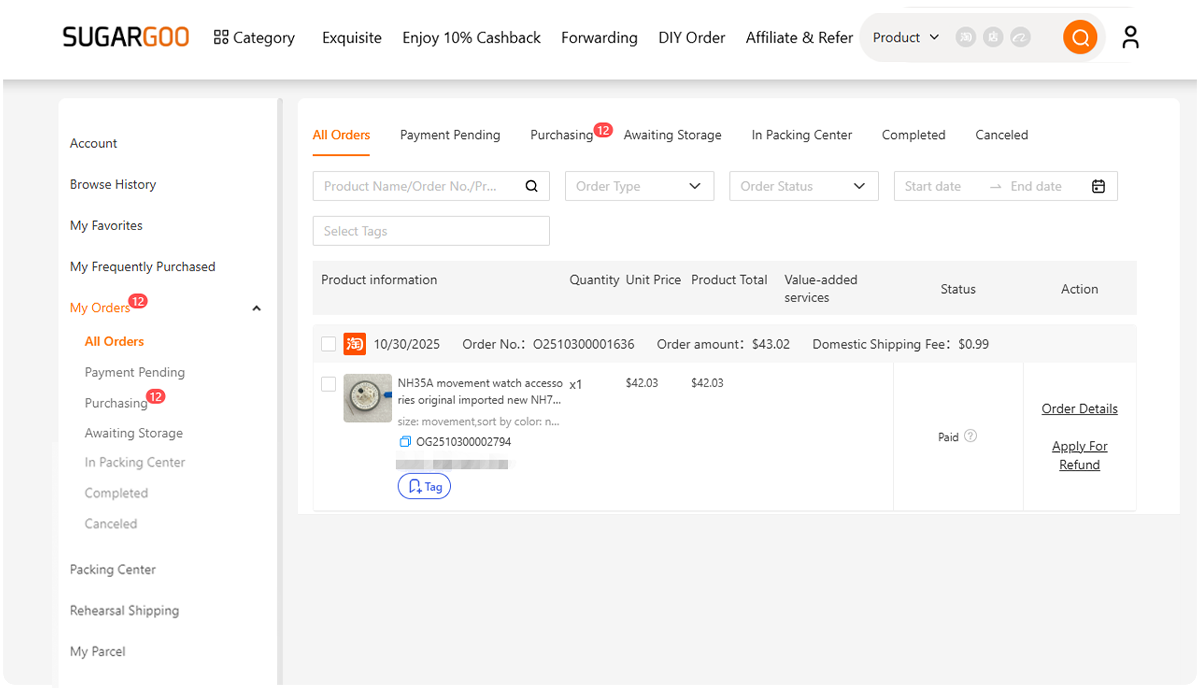

When shopping on Chinese platforms such as Taobao, 1688, or JD.com through a global purchasing agent, selecting the right logistics route is crucial, as it extends beyond cost and speed. Each country has its own customs regulations, tax thresholds, and import restrictions. For overseas users, understanding these differences can help avoid unexpected delays, taxes, or even failed deliveries.

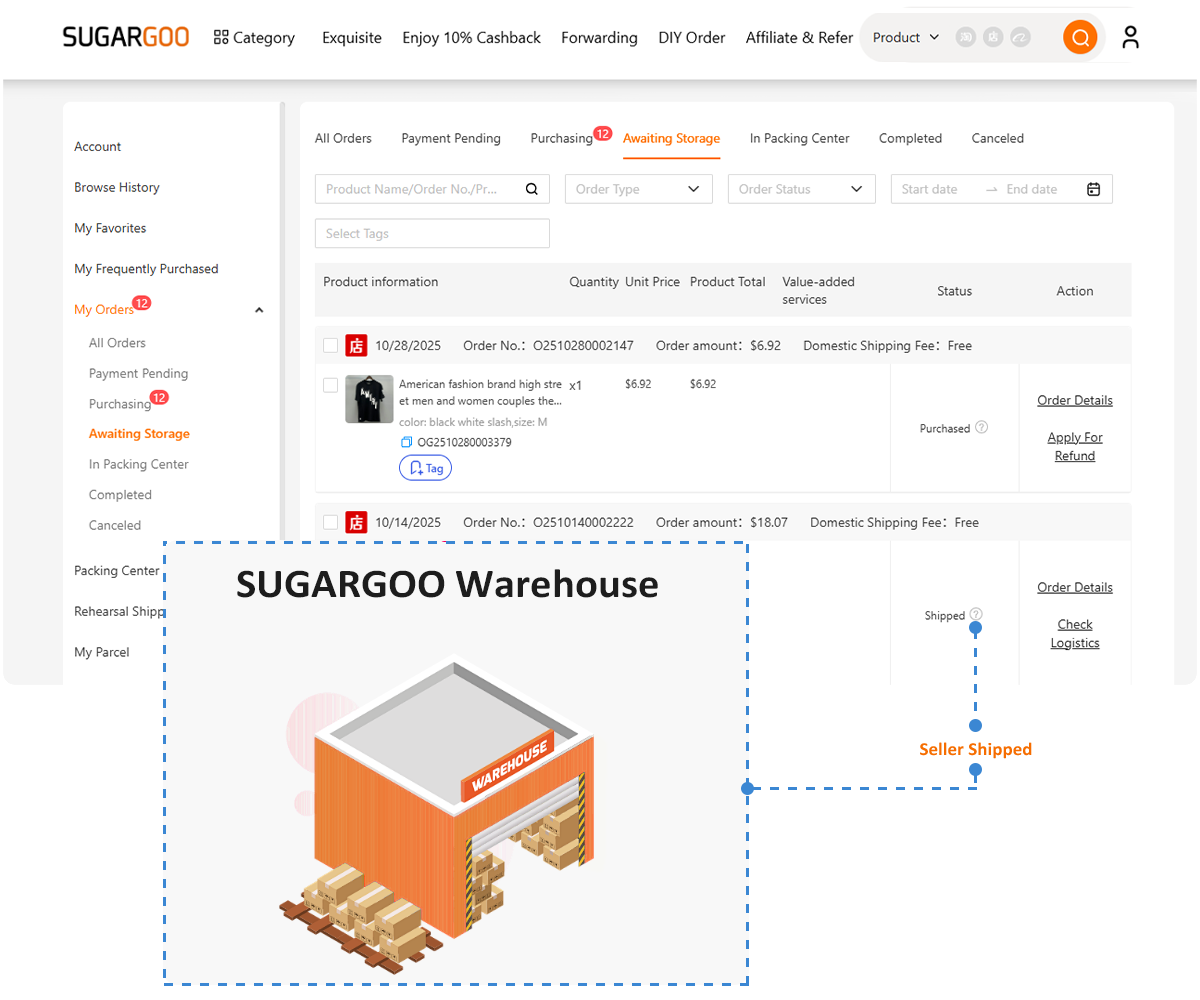

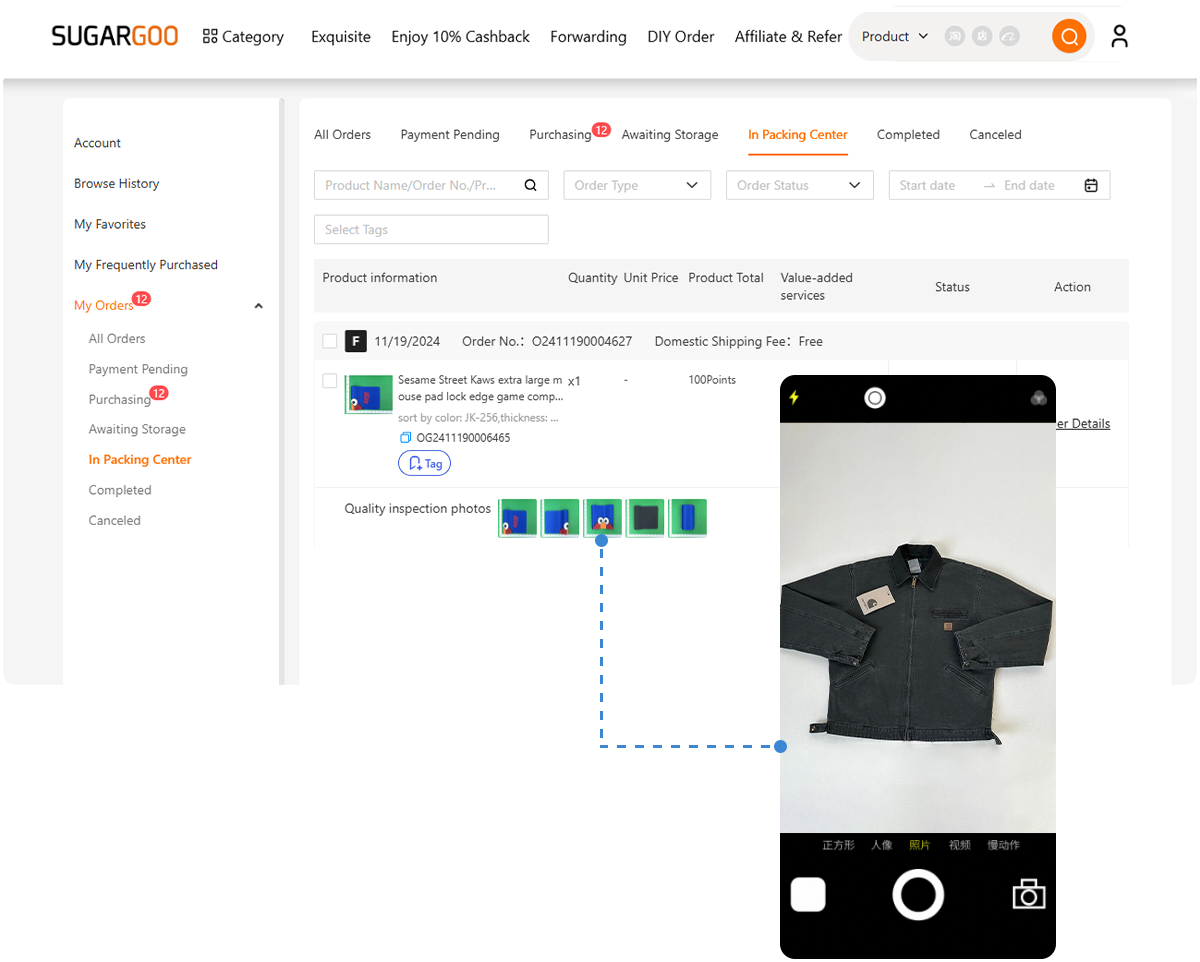

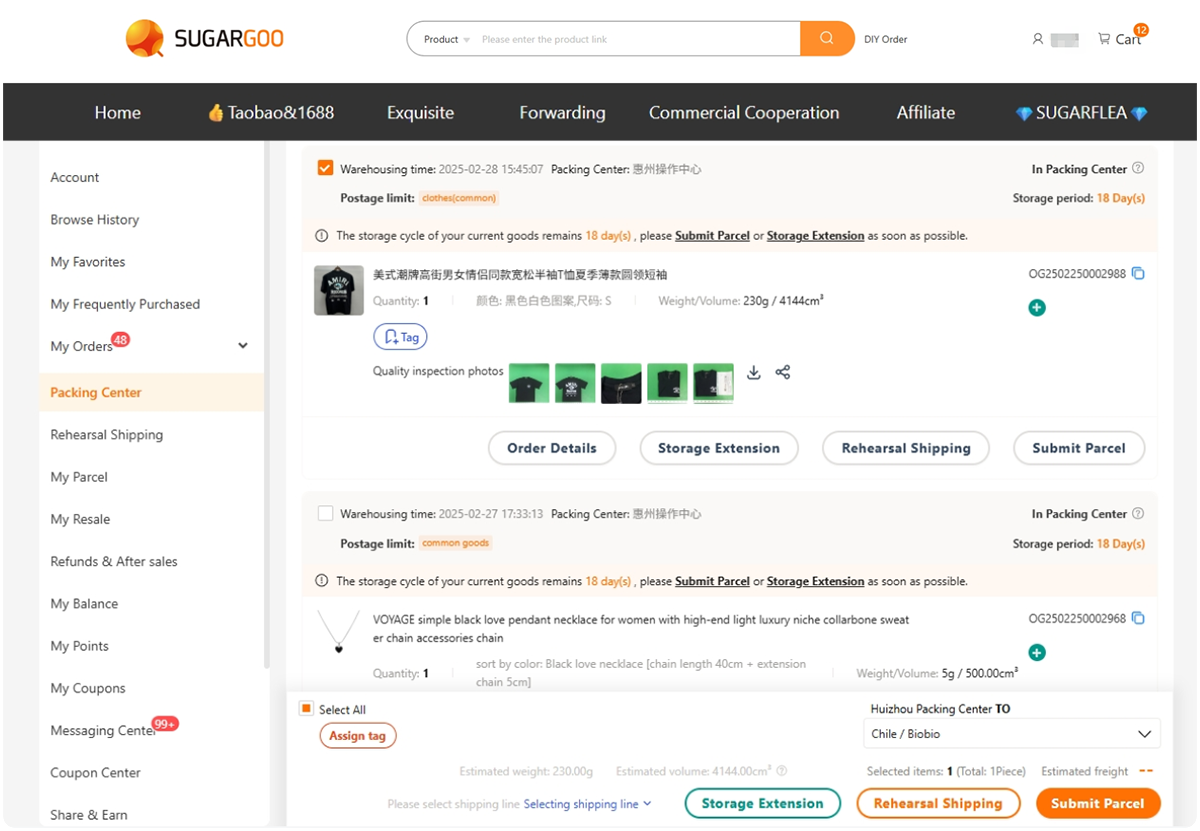

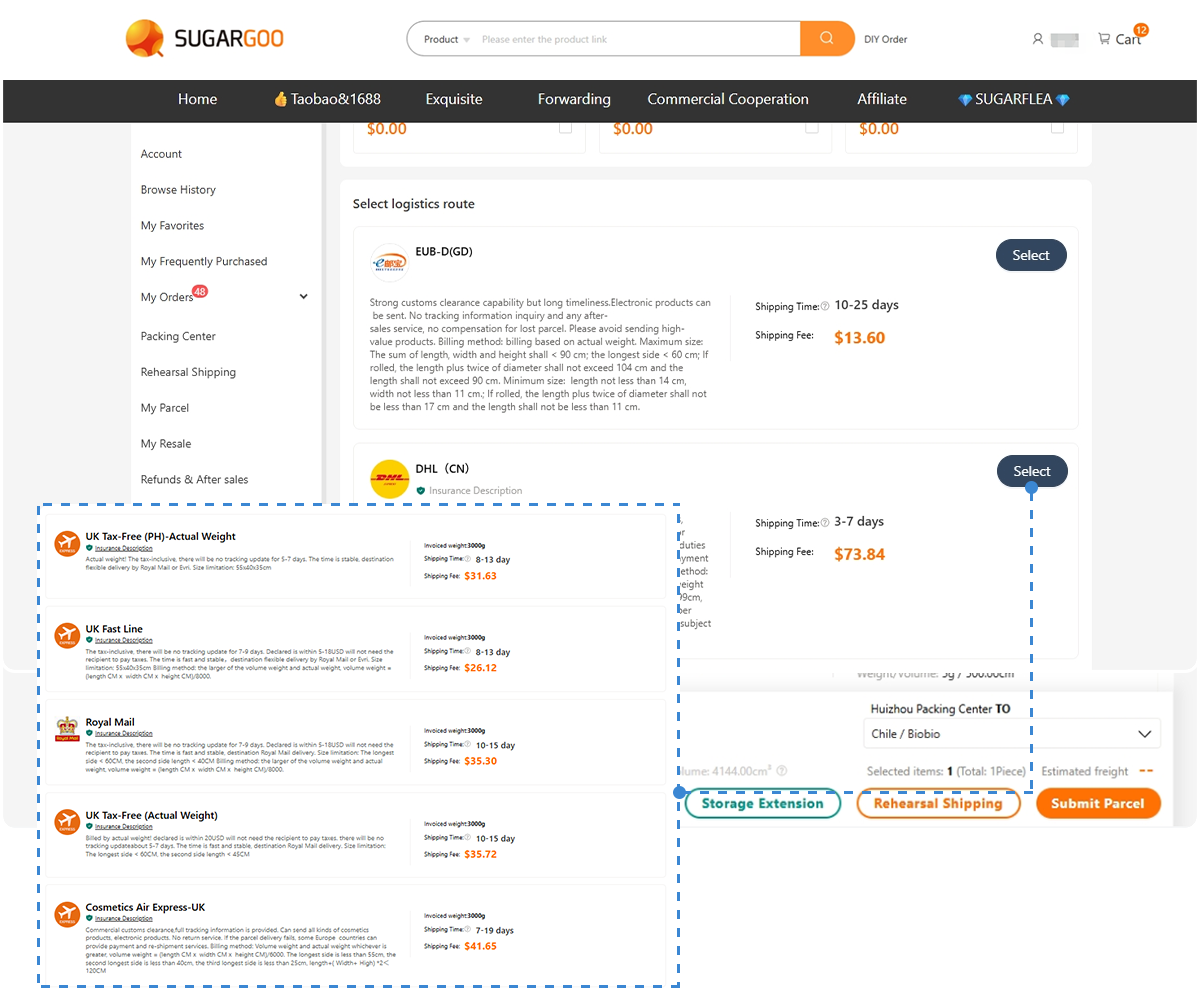

At Sugargoo, we offer a wide range of international shipping routes, including courier, air freight, and sea freight, and collaborate with logistics partners to support customs declaration and clearance. In this guide, we’ll walk you through key considerations when shipping to different countries and provide reference data on customs duties and clearance procedures.

Note: The information in this article is compiled from publicly available sources and is provided for reference purposes only. Customs policies may change and vary by case. If you have specific questions, please contact our official support team.

Why Customs Clearance Matters

All cross-border shipments must go through customs inspection processes in both the origin and destination countries. Whether a package is taxed, held, or rejected depends on a range of factors:

-

The declared value of the shipment

-

The type of goods (e.g., electronics, liquids, batteries)

-

The total weight and volume

-

The recipient country’s customs laws and current policies

Even with proper declarations, there remains a risk of random inspection, especially for high-value, oversized, or sensitive items.

Shipping Route Recommendations by Package Type

Choosing the most suitable shipping method can reduce customs-related risks. Below are general guidelines based on parcel contents and destination sensitivity:

|

Package Type

|

Suggested Shipping Method

|

Notes

|

|

Small, high-value (e.g., electronics, watches)

|

Courier (e.g., DHL, FedEx)

|

Fast but more likely to be inspected

|

|

Medium-sized, mixed goods (clothing, beauty items)

|

Air freight

|

Balanced speed and cost, good for most regions

|

|

Bulk, high-volume items (furniture, wholesale goods)

|

Sea freight

|

Most cost-effective, may face longer clearance time

|

|

Batteries, liquids, and food products

|

Use with caution

|

Restrictions vary by country and route; check before shipping

|

Customs Risk Factors to Keep in Mind

To avoid clearance delays or extra duties, consider the following:

-

Avoid overweight parcels Packages over 10kg may be classified as commercial shipments and taxed accordingly.

-

Limit same-item quantities Sending multiple units of the same item increases the likelihood of being flagged as a commercial import.

-

Choose shipping routes based on country-specific policies For example, Canada and EU countries tend to have stricter inspections and lower tax thresholds than the U.S. or Australia.

-

Use realistic declared values. We assist in declaring parcel values based on destination country thresholds to minimize tax exposure, but we cannot guarantee tax exemption.

Duty-Free Thresholds (For Reference)

Here are estimated de minimis thresholds (the value below which packages are usually tax-exempt) for major countries:

|

Country

|

Duty-Free Value (Approx.)

|

|

United States

|

USD 800

|

|

Japan

|

¥10,000 (~ USD 70)

|

|

South Korea

|

₩150,000 (~ USD 110)

|

|

New Zealand

|

NZD 35

|

|

Singapore

|

$400 SGD (~USD 290)

|

|

Canada

|

CAD 20CAD (~ USD 14)

|

|

United Kingdom

|

£15 GBP (~USD 17)

|

|

European Union

|

€0

|

|

Australia

|

AUD 1,000 (~ USD 650)

|

|

Malaysia

|

RM500 (~ USD 108)

|

Disclaimer: These figures are for reference only. Actual customs decisions are made by the local authorities.

What to Expect During Customs Clearance

-

All parcels are subject to random inspection. This is particularly common if the parcel is large, heavy, or contains sensitive items.

-

If your parcel is flagged, local customs may contact you to provide supporting documents or invoices. For purchasing agent orders, we can provide screenshot-based payment proof, but we do not issue formal invoices or receipts.

-

For non-tax-inclusive shipping routes, all taxes and clearance fees are the responsibility of the recipient.

-

For tax-inclusive routes, we assist in arranging the declaration and payment. If additional fees arise during the process, please retain the official receipt and contact us for assistance.

If customs cannot reach the recipient, or if the recipient does not cooperate with clearance, the parcel may be returned or destroyed. Any resulting losses are the responsibility of the customer.

Summary: Best Practices for Smooth International Delivery

|

Tip

|

Why It Matters

|

|

Choose shipping routes based on item type and destination policy

|

Avoid unnecessary delays or duties

|

|

Declare realistic item values

|

Helps reduce tax risk without triggering an inspection

|

|

Limit same-item quantities and parcel weight

|

Prevents being flagged as a commercial shipment

|

|

Avoid restricted goods

|

Batteries, liquids, and food may require special handling

|

|

Respond to customs quickly if contacted

|

Delays in communication can result in package loss

|

By planning and choosing logistics routes wisely, you can reduce the chance of customs issues and ensure a smoother delivery experience.

Need Help? We're Here to Support You

If you’re unsure which shipping method to choose or need assistance understanding customs procedures in your country, feel free to contact our customer service team.

-

🔗 Visit: Sugargoo.com

-

💁♀️ Visit: Customer Service

-

📦 Start shopping by pasting links from Taobao, JD.com, or 1688 into our platform

We provide end-to-end purchasing, logistics, and customs support for shoppers around the world.

Disclaimer: The content provided in this article is for informational and reference purposes only. While we strive to ensure accuracy and relevance, certain details—such as customs regulations, tax policies, and delivery times—may vary by country and are subject to change without notice. This content may include insights generated with the assistance of AI tools and publicly available data. It does not constitute legal, financial, or professional advice. For specific concerns or the latest updates, please consult with your local customs authority or contact our official customer support team.